Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Penn West Petroleum (NYSE: PWE) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Penn West's story, and we'll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Penn West's key statistics:

PWE Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

18.3% |

Fail |

|

Improving profit margin |

(84.4%) |

Fail |

|

Free cash flow growth > Net income growth |

(146.8%) vs. (81.5%) |

Fail |

|

Improving EPS |

(74.5%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(32.6%) vs. (74.5%) |

Fail |

Source: YCharts. * Period begins at end of Q1 2010.

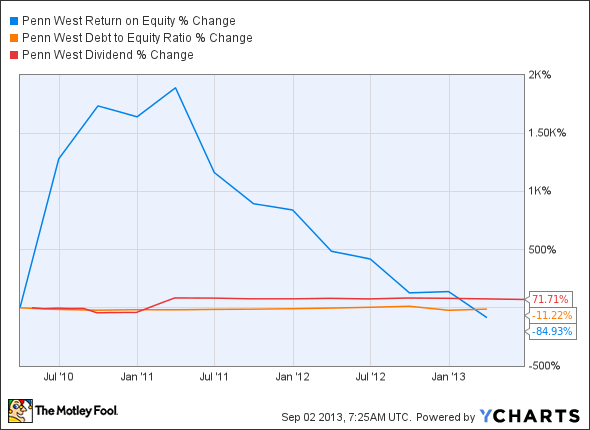

PWE Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(84.9%) |

Fail |

|

Declining debt to equity |

(11.2%) |

Pass |

|

Dividend growth > 25% |

71.7% |

Pass |

|

Free cash flow payout ratio < 50% |

Negative FCF |

Fail |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we're going

Penn West is nearly running on empty today with just two out of nine possible passing grades. Over the past three years, Penn West's free cash flow has fallen significantly, and as a result it can no longer sustain its present dividend payouts without spending its available cash. Penn West's modest revenue growth and falling profit margin have also cost it failing grades on this test. Is there any hope left for Penn West today? Let's dig a little deeper.

Penn West's latest quarterly results were a full third lower than the previous year's quarter, an ugly result regardless of how much is out of the company's hands. Management has said that the company has been struggling to increase revenue, which has cratered largely due to falling natural gas prices, which have resulted in a loss of around $40 million. However, Penn West has been aggressively building its production capabilities, which may be able to boost production levels into the range of 135,000 to 145,000 barrels of oil equivalent per day.

Most recently, the Canadian government announced new safety guidelines for pipeline operators -- my Foolish colleague Arjun Sreekumar notes that Penn West has recently spilled around 5,000 liters of oil in northern Alberta due to some technical problems. Environmental safety is commendable, but in the short run this could further crimp Penn West's free cash flow as it retrofits existing infrastructure. Penn West has also recent appointed David Roberts as new CEO, but this is a rare employee addition for a company that's slashed over 30% of its workforce in the last year.

Penn West has also been selling some of its assets to invest in light oil resources. Taken all together, the company clearly appears to be making every effort to streamline its cost structure, which should be welcomed by beleaguered investors who have long awaited greater profitability. Fool contributor Isac Simon points out that Penn West is currently focusing on its core projects in the Spearfish basin, which largely produces light crude oil, to avoid more substantial losses that may arise out of lingering nat-gas price weakness.

Putting the pieces together

Today, Penn West has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.