With Apple (AAPL +0.52%) apparently set to unveil the next-generation iPhone -- and a lower-cost sibling -- at a launch event on Tuesday, it's only natural for investors to get excited. After all, the last time Apple revealed a new iPhone, it helped drive the stock price above $700.

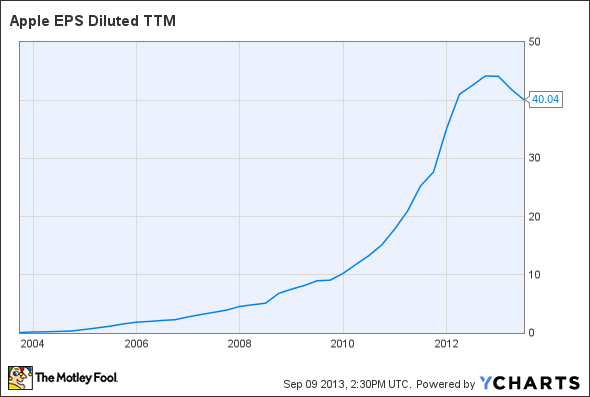

However, investors should also recall that it didn't take long for Apple stock to plummet from $700 to less than $400 after reality didn't live up to the hype of the last iPhone launch. While many factors contributed to Apple's stunning fall, this chart tells the real story:

AAPL EPS Diluted TTM data by YCharts

Simply put, in the past few quarters, Apple reversed a 10-year-old streak of posting high-double-digit earnings increases. Instead, EPS declined by nearly 10%.

There's a clear lesson for investors here. In the short run, Apple's stock may be judged by the "wow" factor it produces at the iPhone launch event. However, in the long run, all that matters is whether the products announced on Tuesday actually help Apple return to profit growth.

Keep it simple, stupid

Most analysts expect the higher-priced model -- probably called the iPhone 5S -- to look very similar to the iPhone 5, but feature a faster processor, a better camera, and a fingerprint scanner. If these rumors are true, it's probably a good thing for Apple.

The iPhone 5. Source: Apple. The more the iPhone 5S looks like this, the better for investors.

While other observers want Apple to offer iPhones with larger screens to compete with Samsung's ever-growing Galaxy S and Galaxy Note series smartphones, simple is better for the bottom line. Back in 2011, some people were concerned that Apple's iPhone 4S was too similar to the iPhone 4 to sell well.

Yet the iPhone 4S sold extremely well. Moreover, by eliminating the complexity involved in ramping production of an all-new design, the introduction of the iPhone 4S drove a significant increase in Apple's gross margin. The result was strong profit growth for Apple in FY12.

If Apple can change things up enough to keep smartphone buyers intrigued without radically redesigning the iPhone this year, the company will probably avoid a repeat of last year's severe gross margin compression.

Moving downmarket, but only a little

The story is similar with Apple's rumored lower-cost phone, the iPhone 5C. There are two important details related to the iPhone 5C that will affect Apple's bottom line. The first is price: The unsubsidized price could plausibly be anywhere between $299 and $399. Some analysts think Apple stock will rally if Apple hits a price point of $299 or below.

Perhaps a shockingly low number would generate enough buzz to drive Apple stock higher in the short term. In the long run, though, Apple is better off erring on the high side with a price around $349 (or even a little higher). That should be enough to gain a nice foothold in the midrange market without sacrificing too much margin.

Factoring in production costs, shipping costs, and retailers' share of the selling price, a $299 iPhone would make little or no contribution to Apple's earnings. In fact, if a $299 iPhone 5C significantly cannibalizes iPhone 5S sales, it could easily have a negative contribution to Apple's earnings.

Expanding distribution

While offering a lower-cost iPhone will give Apple a better chance to compete in emerging markets, it also needs to expand its distribution to capitalize on that opportunity. Thus, another important detail to watch for is whether Apple announces a distribution deal with China Mobile (CHL +0.00%) at its media event on Wednesday in Beijing.

With 700 million subscribers, China Mobile is the single biggest emerging-market opportunity for Apple. Until now, Apple has only partnered with China Mobile's smaller rivals because of technology issues and strategy clashes (China Mobile wants to avoid offering high smartphone subsidies).

Offering a US$349 smartphone in China while simultaneously adding China Mobile as a carrier partner would almost certainly spearhead a return to strong growth for Apple in China. It would also help Apple build its brand in second-tier cities where China Mobile is the dominant wireless carrier. That could create a beneficial "halo effect" for Apple's other products. On the flip side, it would also help China Mobile bolster its competitive position in a big way.

Foolish bottom line

The short-term reaction to Apple's iPhone announcement will probably be overly focused on the "wow" factor, or lack thereof. However, for both phones Apple is expected to launch, a big "wow" effect will not necessarily translate into profit. To put it another way, a really cheap iPhone would be a really unprofitable iPhone.

Investors should focus on the long-game instead. To succeed, Apple needs to include meaningful improvements in the iPhone 5S without completely redesigning the iPhone 5. The iPhone 5C needs to be priced at a level that Apple can still earn a healthy margin, especially because it will cannibalize some sales of the more-profitable 5S. Lastly, Apple needs a distribution deal with China Mobile to reinvigorate its sales in China. If Apple delivers on all three points, the next year is likely to be much better for Apple shareholders than the last one.