It's really amazing to think about how far we've come over even the past decade in the health-care arena. In that time we've seen heart disease and smoking rates drop dramatically, genome therapy has been brought directly to the patients' bedside, and we have machines that can perform soft-tissue and orthopedic surgeries, as well as pinpoint and irradiate solid tumors. The rate of advancement recently is simply unparalleled.

But, of course, there's still a lot more work to be done. There are far, far more uncured diseases out there than we've cured, and therefore plenty of trial, error, and opportunity still awaits. This is why today I want to look past the current advancements in health-care technologies and focus on the distant horizon -- let's say 20 years from now -- and divvy out four predictions for the health-care industry as a whole.

Source: pop culture geek, Flickr.

Now understand that I have no crystal ball, nor do I have a DeLorean DMC-12 sitting in my garage that'll let the sparks fly when I hit 88 mph and can take me ahead a few decades to see the future. These are merely personal projections that I expect to be held accountable for and for which I'll back up my point of view -- but ultimately, they are just predictions.

Prediction No. 1: Cancer will become the leading cause of death in the United States.

I'm sure that's not the type of prediction you were probably hoping for, but hear me out. Over their lifetimes, men currently have about a 1-in-2 chance of developing some form of invasive cancer, while women have around a 1-in-3 chance. Although we've seen advancements in progression-free survival across many cancer types, and surgery and radiation techniques have become more precise, we are hardly any closer to finding a cure than we were 20 years ago. Take lung cancer and pancreatic cancer as perfect examples. In 1975-1977, the five-year survival rates of these cancer types was 12% and 2%, respectively. Fast-forwarding three decades to 2002-2008's data, and these figures progressed to just 17% and 6%. We're seeing progress, but a vast majority of it has come from better awareness of the risk factors for these cancer types instead of better medication. In essence, we're nowhere near a cure.

The good news is that a lack of cure will offer an incredible opportunity for advancement in personalized patient care through genome analysis. Life Technologies and Illumina (ILMN +1.84%) are two companies that have pioneered smaller genome sequencing technologies, which can process the human genome in 24 hours or less, and for little a fraction of the cost of genome analysis even 10 years ago. By better understanding cancerous genomes and how those cancers interact differently with each person, doctors may be able to use genome analysis to select the optimal therapy for a patient from the start rather than the current diagnosis structure, which involves a lot of trial and error. Illumina's sequencing by synthesis technology is among the most accurate in the industry, and it's certainly the name to keep your eye on here.

Prediction No. 2: U.S. obesity trends will reverse and could fall by as much as 25%.

I know it can be hard to imagine that U.S. obesity trend will actually taper, given the amount of fast-food restaurants in this country, but if history repeats itself, we should see a marked decline in obesity trends starting in about five to 10 years.

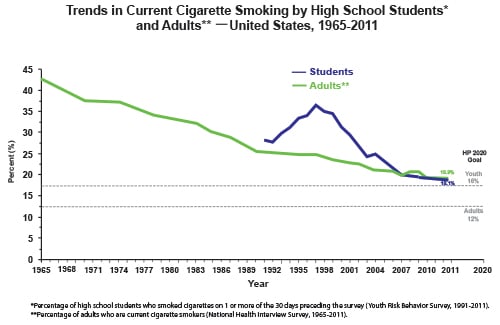

The basis for my prognostication lies with the reduced trends we've seen in smoking. Although smoking rates have been on the decline for decades, it wasn't until the 1990s that U.S. health organizations really cracked down on the dangers of smoking, with their focus on reaching students and young adults.

Source: Center for Disease Control and Prevention.

There was a rapid drop-off in new smokers following these anti-smoking campaigns, but it took a few years for that message to completely resonate with the consumer and with students.

As it relates to obesity, we're beginning to see some lifestyle changes sinking into the restaurant industry: Calories are being displayed on menus, fast-food restaurants are offering salads and other more nutritious selections, and the risk factors of being obese are being regularly highlighted by the Centers for Disease Control and Prevention, as well as other health organizations. Now, we just need to wait for these changes to really hit home with the consumer.

It could also represent a gigantic opportunity for chronic weight-management drugs such as VIVUS' (VVUS +0.00%) Qsymia, Arena Pharmaceuticals' (ARNA +0.00%) Belviq, and Orexigen Therapeutics' experimental drug Contrave. So far, Qsymia and Belviq have been an utter disappointment, but that could change with two factors: time and personalized medicine.

Time is a big factor for these companies, as Qsymia offered better weight percentage statistics, but Belviq has the more favorable safety profile. Over the next five years we should have a better bead on which treatment is superior. Furthermore, personalized medicine via genome analysis may spill over into the fight against obesity and could help researchers determine which anti-obesity medication is a best fit on a case-by-case basis.

Prediction No. 3: Hepatitis-C will be a 100% curable disease.

If there is a widespread disease that's been beaten back with incredible efficacy over the past decade, it's been liver disease hepatitis-C.

Before the emergence of Vertex Pharmaceuticals (VRTX +1.80%) with Incivek and Merck with Victrelis, the overall response rate for peginterferon alfa and ribavirin, the then-current standard of treatment over 48 weeks was less than 50%. When Incivek gained approval in 2011, it was because it delivered a sustained virologic response (SVR) after 24 weeks of 79% (in other words, no traceable levels of the HCV virus was found), which was 20% to 45% higher than every placebo cohort it was tested against.

What's even more interesting is that just two years later, Gilead Sciences (GILD +1.36%) sofosbuvir and AbbVie's direct-acting antiviral combo mopped the floor with Incivek in terms of delivering superior SVR results with far fewer side effects. Sofosbuvir's late-stage study demonstrated an SVR of 90% in the most common genotype of the disease, while AbbVie's combo (which is currently in late-stage studies) delivered a 97% SVR in a mid-stage study of 79 patients.

Simply put, if we've gone from a response rate of less than 50% to averaging 90% or greater on SVR in a matter of a couple of years, I see no reason hep-C can't be eradicated completely over the next 20 years.

Prediction No. 4: Health-care costs as a percentage of U.S. worker income will continue to rise.

Go ahead, blame Obamacare if you'd like, but the truth is that whether or not Obamacare was implemented, health-care costs appeared destined to rise. The way I see it, there are two culprits at work here that the new health reform and previous system failed to address.

Source: Images Money, Flickr.

First, little is being done to address the premium pricing power of health insurers. The ultimate goal of Obamacare's state-run health exchanges is to introduce pricing transparency into the marketplace, which should allow a more educated public to make smart decisions about their health-care choices. The problem is that most states are dominated by just a handful of insurers. California's huge insurance market has 13 different participants, but four in particular -- Kaiser Permanente, Blue Shield of California, Anthem Blue Cross (run by WellPoint) and Health Net -- control a majority of the individual buyer market share. What prevents these insurers from colluding to boost premium pricing? In my eyes, not much.

The other problem is that there aren't really any controls in place to thwart rare-disease pharmaceutical companies from charging an arm and a leg for their treatment. Understandably, pharmaceutical companies need to recoup the costs of their drug from the development process, but they also need to take into consideration the staggering cost their drugs might pose to insurers. In response, all insurers are going to do is pass these higher costs along to members with premium increases. Until there are better pharmaceutical and insurance industry controls, health-care costs as a percentage of income are only going to continue to rise.

It's clear a lot could happen over the next 20 years, and I'm sure I've just touched the tip of the iceberg in terms of where the health-care industry is headed. But one thing is for sure: The industry deserves your full and undivided attention as an investor.