Many biotech investors are interested in antibody-drug conjugates, or ADCs, these days, and for good reason -- if they catch on as a mainstream cancer treatment, they could render traditional chemotherapy obsolete.

An ADC is a "smart bomb" -- a laboratory-created antibody, filled with toxins, which is trained to find a specific cancer cell. Once an ADC locates the target, it attaches to it and unloads its toxic payload into the cell, killing it while sparing nearby healthy cells.

Catching onto Wall Street's interest in this potentially game-changing treatment, many small pre-revenue biotechs have filled their pipelines with ADC candidates. Therefore, investors should better understand this new field and which major players have the most growth potential.

Let's meet the big boys

To date, only two ADCs have been approved by the FDA: Seattle Genetics' (SGEN +0.00%) Adcetris and Roche's (RHHBY 0.23%) Kadcyla. Adcetris is a treatment for lymphoma, while Kadcyla is a breast cancer treatment.

Seattle Genetics is the largest pure ADC play in the market. Last quarter, the company's revenue surged 51% year over year to $73.6 million. $35.7 million (48.5%) of its top line was generated by Adcetris, while the remainder came from collaboration, license agreement, and royalty revenue from major partners like Bayer, Roche, AbbVie, and Pfizer.

Sales of Adcetris rose 3%, collaboration and license agreement revenue climbed 166%, and royalties increased 186%. Moreover, analysts believe that Adcetris could eventually generate $600 million to $900 million in annual peak sales by 2020 -- which means that shares of Seattle Genetics could be grossly undervalued at current prices.

Source: YCharts.

The second major player, Roche, is the largest cancer treatment company in the world. Breast cancer drug Herceptin, which generated $6.5 billion in sales in fiscal 2012, is its top seller.

Herceptin is a laboratory-created antibody that shares the same technological foundation as an ADC. However, instead of being loaded with toxins, Herceptin is trained to seek out breast cancer cells and block their growth signals to starve them. Herceptin can also mark cancer cells so the immune system can "see" and destroy them.

Roche's ADC, Kadcyla, produced with its partner ImmunoGen (IMGN +0.00%), links Herceptin to a toxin. Kadcyla seeks out the cancer cell just as Herceptin does, but as Herceptin blocks the cell's growth signals, the toxin seeps into the cell and kills it. This is a much more potent solution than Herceptin's method of starving and marking cancer cells.

Although Kadcyla was only approved in February, it has already generated $87 million in sales in the first half of the year. Analysts believe the treatment could eventually generate peak sales between $2 billion to $5 billion.

Don't forget the smaller guys

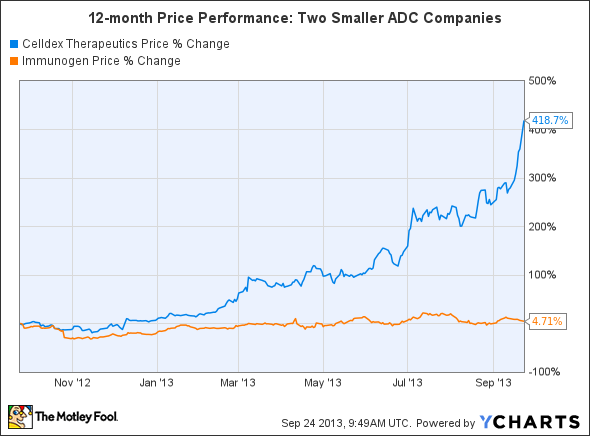

While Seattle Genetics and Roche produce marketed ADCs, there are many other companies vying for a piece of this new market. Two companies to keep an eye on are Celldex Therapeutics (CLDX 0.55%) and ImmunoGen.

Source: YCharts.

Celldex's price performance over the past two years has been incredible, considering that it does not have a marketed product yet. However, Celldex has two major products, which could soon put it on the map: rindopepimut, a treatment for a rare type of brain cancer (gliboblastoma), and CDX-011, an ADC for metastatic breast cancer built on technology licensed from Seattle Genetics.

Celldex reported positive results from its phase 2 study of rindopepimut, which prolonged the patients' average survival rate by 24.6 months, compared to the median survival rate of 15 months. Based on the rarity of gliboblastoma, rindopepimut has been classified as an orphan drug by both the FDA and the European Medicines Agency.

Celldex also finished a phase 2b trial of CDX-011 with positive results, reporting a 32% overall response rate in patients compared to a 13% rate in those administered the placebo.

Considering these two positive factors, analysts at Leerink Swann raised their target price on the stock from $45 to $60 -- causing the stock to rally 12% on Monday.

Not much love for ImmunoGen

ImmunoGen, on the other hand, hasn't attracted as much attention as Celldex, even though it produced Roche's Kadcyla. From its deal with Roche, ImmunoGen received a $10.5 million payment upon Kadcyla's FDA approval in February, and is entitled to royalties on sales up to 5%.

Last quarter, ImmunoGen's revenue -- which are entirely composed of R&D support, license, milestone, and clinical reimbursement fees -- rose 83% year over year to $2.2 million.

ImmunoGen recently announced the market approval of Kadcyla in Japan, which triggers a $5 million milestone payment from Roche. It also reported a positive opinion from the EU's Committee of Medicinal Products for Human Use, which could clear it for market approval in Europe by the end of 2013.

However, investors aren't as excited about ImmunoGen because all of its treatments besides Kadcyla are in phase 2 trials or earlier. However, its pipeline is well diversified with treatment candidates for lung cancer, ovarian cancer, lymphoma, and leukemia. If more ADCs are approved and Kadcyla reaches its peak sales targets, then ImmunoGen could have a lot more upside potential.

The Foolish takeaway

In closing, ADCs are a fascinating group of treatments to follow. If they are successful, chemotherapy and all of its side effects -- hair loss, intestinal problems, and a weakened immune system -- could disappear forever.

Although it won't happen overnight, these four companies could richly reward early investors who have faith in their long-term goals.