There's no doubt that Amazon.com (NASDAQ: AMZN) is a juggernaut that changed the retail world forever. But the company's valuation has gotten a little bit out of hand. Amazon stock has rallied by more than 10% this month, leaving the company's market cap -- including outstanding stock options -- at $150 billion.

Amazon 1-Month Price Chart, data by YCharts.

$150 billion is a lot of money! As important a company as Amazon is, I do not think its long-term earnings prospects justify a valuation anywhere close to $150 billion.

In order to generate enough free cash flow to justify that valuation, Amazon would need to increase its profit margin dramatically over the next five to 10 years while also maintaining rapid revenue growth. But those two goals are mutually exclusive. Amazon can only keep growing at the pace investors are accustomed to by constantly lowering prices and thereby driving its profit margin into the low single digits.

Where's the cash?

For many years, Amazon delivered consistent, strong growth in free cash flow. Amazon has routinely run a negative cash conversion cycle, which means that (on average) customers pay for their purchases before Amazon has to pay its suppliers. That means that as Amazon grows sales, it simultaneously improves its free cash flow because the gap between inventory and accounts payable (the amount owed to suppliers) increases.

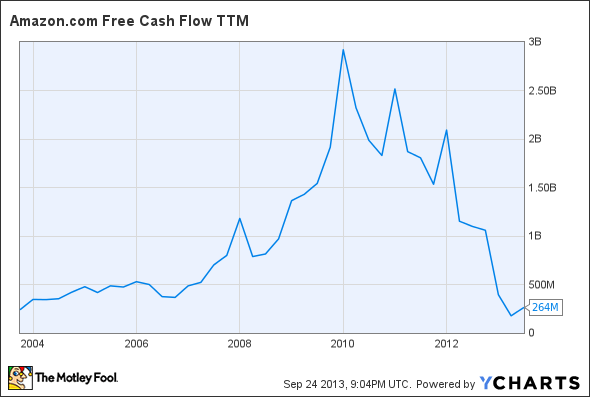

AMZN Free Cash Flow TTM data by YCharts.

But free cash flow peaked at nearly $3 billion in 2009 and has declined significantly since then. Excluding the purchase of corporate office space in Seattle, Amazon's free cash flow for the 12 months ending June 30 was approximately $1.7 billion. Amazon shares are therefore trading for approximately 90 times adjusted free cash flow, despite the fact that free cash flow has been falling for the last several years.

Low margins are here to stay

Amazon bulls routinely argue that the recent dip in Amazon's margins and free cash flow are the result of the heavy investments it is making in long-term growth initiatives. By extension, they expect significant revenue and margin growth going forward, as these investments start to pay off.

From a revenue perspective, it is true that Amazon's investments are producing solid growth. Most analysts expect revenue growth to remain above 20% at least through next year.

However, margin growth has not followed. Considering Amazon's rationale for increasing capital investment was to reduce variable costs and ultimately grow margins, investors should be very concerned.

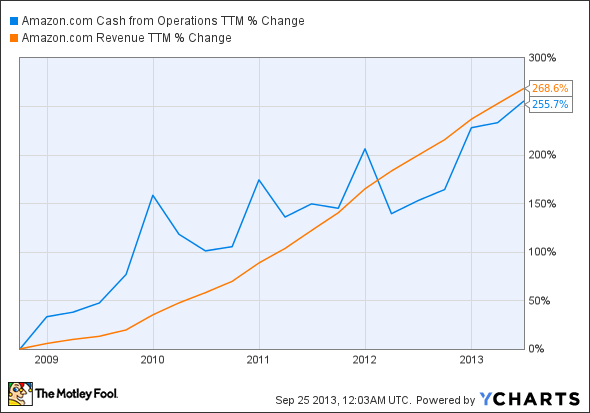

Amazon Revenue vs. Operating Cash Flow, data by YCharts.

The chart above shows revenue and operating cash flow have grown at the same pace over the last five years. Operating cash flow is a good proxy for the amount left over from revenue after accounting for variable costs. In other words, despite Amazon's massive investment in fixed assets like warehouses, servers, and software, variable costs have remained steady as a percentage of revenue.

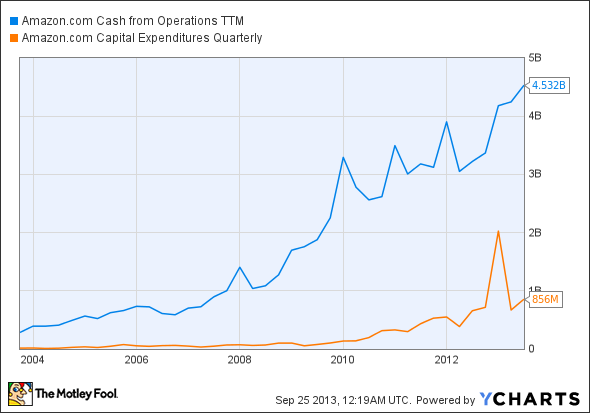

To put it another way, Amazon's massive increase in capex since 2010 should have boosted operating cash flow growth, but instead this growth has been tapering off. (This is clearly visible in the chart below.) This implies Amazon's recent capex binge either has had no discernible benefit in terms of variable costs or any benefits have been fully offset by other unfavorable changes in revenue and costs.

Amazon CapEx vs. Operating Cash Flow, data by YCharts.

The inside scoop

Amazon's $150 billion valuation only makes sense if you believe the company will see its pre-tax margin expand from the low single digits today to double-digit territory over the next five to 10 years. But that is very unlikely to happen. While Amazon is investing heavily today, it is investing for revenue growth and not margin growth.

Amazon's management has periodically dangled the possibility of margins moving higher over time, but this would require a stunning change in the company's philosophy. Amazon CEO Jeff Bezos once said, "There are two kinds of companies: those that work to try to charge more and those that work to charge less. We will be the second."

That quotation provides a lot of insight into what's going on at Amazon today. To the extent that Amazon's investments in fixed assets can reduce variable costs, the company will cut prices in a bid for market share rather than allowing margin expansion.

As a result, Amazon investors should expect very low margins for a very long time. In my opinion, it's hard to justify paying $150 billion for a low-margin business with revenue currently around $70 billion -- even if it's a revenue growth machine.