Many of the largest biotech companies are getting bigger by the day, and expectations remain high for strong future growth. Companies like Amgen (AMGN +1.24%), Celgene (CELG +0.00%), Biogen Idec (BIIB 0.06%), and Gilead Sciences (GILD 0.10%) have all posted incredible gains over the past decade, and that growth doesn't look like it will slow down any time soon.

Of these four companies, Gilead Sciences is a strong choice thanks to its strong portfolio of HIV and hepatitis treatments, an efficient business strategy, and clear plans for the future.

Would Peter Lynch approve of Gilead?

A look at Gilead's P/E ratios reveals that although investors have high expectations for Gilead, the stock is fundamentally cheaper on a trailing basis than Celgene and Biogen.

| Company |

Trailing P/E |

Forward P/E |

Five-year PEG |

|

Amgen |

18.96 |

18.96 |

1.77 |

|

Celgene |

41.04 |

20.35 |

1.12 |

|

Biogen Idec |

35.99 |

22.15 |

1.50 |

|

Gilead Sciences |

35.11 |

20.84 |

1.29 |

Source: Yahoo! Finance as of Sept. 25.

However, Gilead's five-year PEG ratio indicates that it has stronger long-term growth potential than Amgen and Biogen. The PEG ratio was popularized by legendary investor Peter Lynch, who stated that a fairly valued stock's PEG ratio would be at 1, while anything under 1 is undervalued. Amgen has the lowest P/E ratios and the highest PEG ratio -- indicating that although the stock is considered the cheapest, it also has the lowest growth potential.

Even though Celgene's PEG ratio is slightly lower than Gilead's, its trailing P/E is much higher, indicating that it is slightly pricier at its current price. However, based on forward valuations, Celgene is the slightly cheaper choice.

Yet why are investors expecting high growth from Gilead Sciences? There are two simple answers: a solid strategy and a clear vision for its future.

The solid strategy of using combo drugs

Gilead built its empire on two major treatments -- the flu treatment Tamiflu and the HIV/AIDS treatment Viread. Tamiflu is licensed to Roche, which pays Gilead 10% in royalties on global sales. However, Tamiflu's main patents in the U.S. will expire in 2015 and 2016, and its patents for Viread will start to expire in 2017.

Rather than pursue completely new treatments to offset those eventual losses, Gilead combined Viread with other medications to create new streams of revenue growth.

Let's take a look at Gilead's three top selling HIV drugs in 2012 to better understand how this strategy works.

| Drugs |

Percentage of 2012 Sales |

Active Ingredients |

|

Viread |

9% | |

|

Truvada |

23% |

Viread + Emtriva |

|

Atripla |

37% |

Viread + Emtriva + Merck's Sustiva |

|

Stribild |

N/A: introduced in 9/2012 |

Viread + Emtriva + EVG + cobicistat |

Source: Gilead Sciences 2012 annual report.

Although this strategy of combining drugs into new ones does not protect it from Viread's patent expiration, it helps Gilead maximize sales for as long as it can. Pills like Truvada, Atripla, and Stribild are promoted for their increased convenience and potency. In addition, Gilead's competitors might be able to create generic Viread, but they will also have to produce comparable generic versions of these other combo drugs to remain competitive.

It's a clever strategy that continues fueling Gilead's top line growth. Last quarter, sales of Viread climbed 16% year over year to $250 million. Sales of Truvada and Atripla rose 3% and 4%, respectively. Sales of Stribild, the most expensive HIV treatment on the market at $28,500 per patient annually, rose 8% sequentially to $99 million.

Past sales growth versus competitors

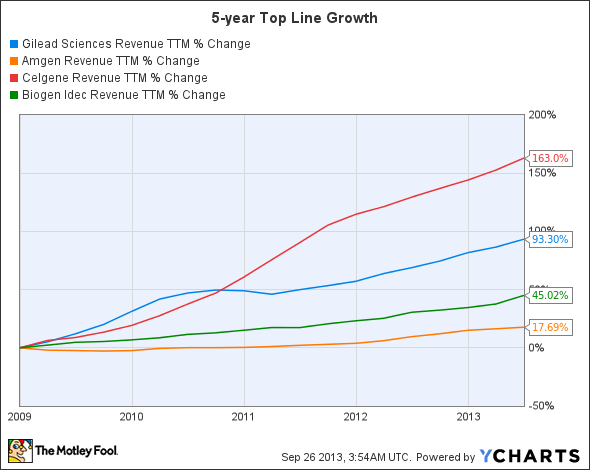

As a result of its combination drug strategy, Gilead's top line growth has remained strong and steady over the past five years. Although Celgene's growth looks remarkable percentage-wise, it is a smaller, growing company, generating $5.5 billion in revenue in 2012 compared to Gilead's $9.7 billion. The majority of Celgene's top line comes from its multiple myeloma treatment Revlimid, which accounted for 66% of its total revenue last quarter.

Source: YCharts.

However, both Biogen and Gilead Sciences' stock prices have outperformed Celgene and Amgen over the same period. Biogen has been riding high on strong hopes for its new multiple sclerosis drug, Tecfidera, but Amgen has been weighed down by generic competition for its former top-selling anemia drug, Epogen. Amgen's top product is now its arthritis medication, Enbrel, which reported 9% year-over-year sales growth last quarter.

Source: YCharts.

Despite Gilead's strong past performance, it is now facing the problem that its industry peers also face -- maintaining future growth.

Even though Celgene's Revlimid doesn't face certain patent expirations until 2019, generic companies challenged its patents abroad last year. Last month, Amgen bought cancer drug maker Onyx Pharmaceuticals for $10.4 billion to boost its drug portfolio.

Biogen, on the other hand, was luckier than its peers, winning a 15-year extension to 2028 for Tecfidera back in March. Tecfidera is expected to eventually generate $3 billion in peak sales for the company.

Replacing Viread with sofosbuvir

To keep pace with its industry peers, Gilead has aggressively expanded its hepatitis treatment portfolio to offset future losses. Its most promising treatment is the hepatitis C, or HCV, drug candidate sofosbuvir, which produced a 95% cure rate after eight weeks of treatment during phase 2 trials.

Based on those promising results, sofosbuvir received a priority marketing review from the Food and Drug Administration in June, meaning that it could be approved by December and start production in 2014. Analysts at Morningstar expect sofosbuvir to hit peak sales of $8 billion by 2022, equivalent to 80% of Gilead's annual sales in 2012.

Just as it did with Viread, Gilead is already combining sofosbuvir with other drugs to make new combo pills. Gilead is testing the combination of sofosbuvir with ledipasvir, another one of its new HCV treatments, in a single pill. It also wants to combine that combination pill with ribavirin, an older HCV treatment.

Therefore, Gilead might be bringing not one, but three HCV treatments to the market soon.

The Foolish bottom line

In closing, it's easy to see why Gilead Sciences trades at a premium compared to its stodgy industry peers. It has a great method of maximizing sales by combining old products together to make new ones, and its promising HCV treatments are on track to arrive well ahead of Viread's patent expiration.

Gilead is a well-organized company with a strong grasp on what it takes to continue growing in an industry where growth usually comes early and becomes increasingly hard to maintain -- making it a lucrative long-term investment.