Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

A government shutdown looks imminent and it doesn't matter to investors? How can I make that assertion in the face of seemingly overwhelming evidence that the market is concerned about the threat of a shutdown? After all, U.S. stocks opened lower this morning, with the S&P 500 (^GSPC 0.06%) and the narrower, price-weighted Dow Jones Industrial Average (^DJI 0.17%) down 0.64% and 0.79%, respectively, as of 10:15 a.m. EDT.

Meanwhile, the yield on 10-year Treasuries fell to its lowest level in seven weeks, suggesting that investors are snapping up government bonds as a hedge against the uncertainty relating to this federal budget standoff (yields fall as bond prices increase).

Finally, the VIX Index (^VIX +0.13%), Wall Street's "fear gauge," is up 11% as of 10 a.m. EDT.

Let me put things in perspective with a couple of remarks.

First, I know financial journalists may describe a 0.95% decline as "stocks are sharply lower," but I hardly think that's appropriate. Sure, it grabs readers' attention more effectively than "stocks are very modestly lower, well within ordinary expectations, given their volatility," but the latter is more accurate.

Second, while I don't wish to minimize the idiocy of our lawmakers, the expression "government shutdown" is too expansive and, by extension, a bit alarmist. "Partial shutdown" is really more accurate. Like a body starved of heat, without a continuing resolution the federal government will suspend "nonessential" functions in order to keep the heart of its operations running.

We can be certain that lawmakers will ultimately find some sort of compromise and, furthermore, that this compromise won't be all that long in coming. The American people won't stand for a shutdown of any significant length, and politicians are elected, after all.

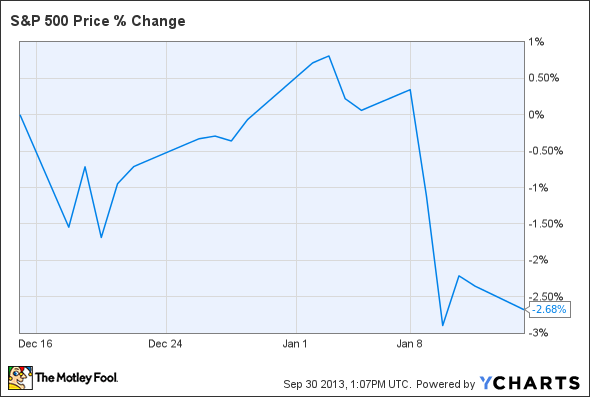

The longest government shutdown in the history of our republic, which occurred in 1995-1996 under the Clinton administration, lasted 21 days. Here's how the stock market performed during the one-month period beginning on Dec. 15, 1995, the day prior to that start of that ignominy:

With a maximum drawdown of 2.7%, it's not exactly terrifying stuff. Now, I won't pretend that the current congressional cohort can't outdo their peers of yesteryear, nor can I predict what the market's reaction will ultimately be, but my point is that there is little cause for panic.

In fact, the most interesting thing about the way lawmakers handle this budget battle is what it may tell us about the odds that they will raise the debt ceiling in time to avoid a sovereign default by the United States -- an issue of genuine concern. While the effects of a government shutdown are limited and relatively well-known, the damage associated with a U.S. sovereign default is unknowable beyond the fact that it would be catastrophic and irreversible. Now that's something worth worrying about.