We know location matters when buying or selling a house. That single factor can outweigh how many bathrooms the house has or the unsightliness of the wallpaper in the den. Location is just as important for an oil and gas company. It can mean the difference between striking oil and drilling another dry hole.

For companies drilling for natural gas there is only one region that matters these days, and that's the Marcellus and Utica shale. Because of the vast resource base, drillers can actually profit from drilling for natural gas even at today's low prices. So while many companies are shying away from drilling for gas, those in these two plays can find growth where others can't.

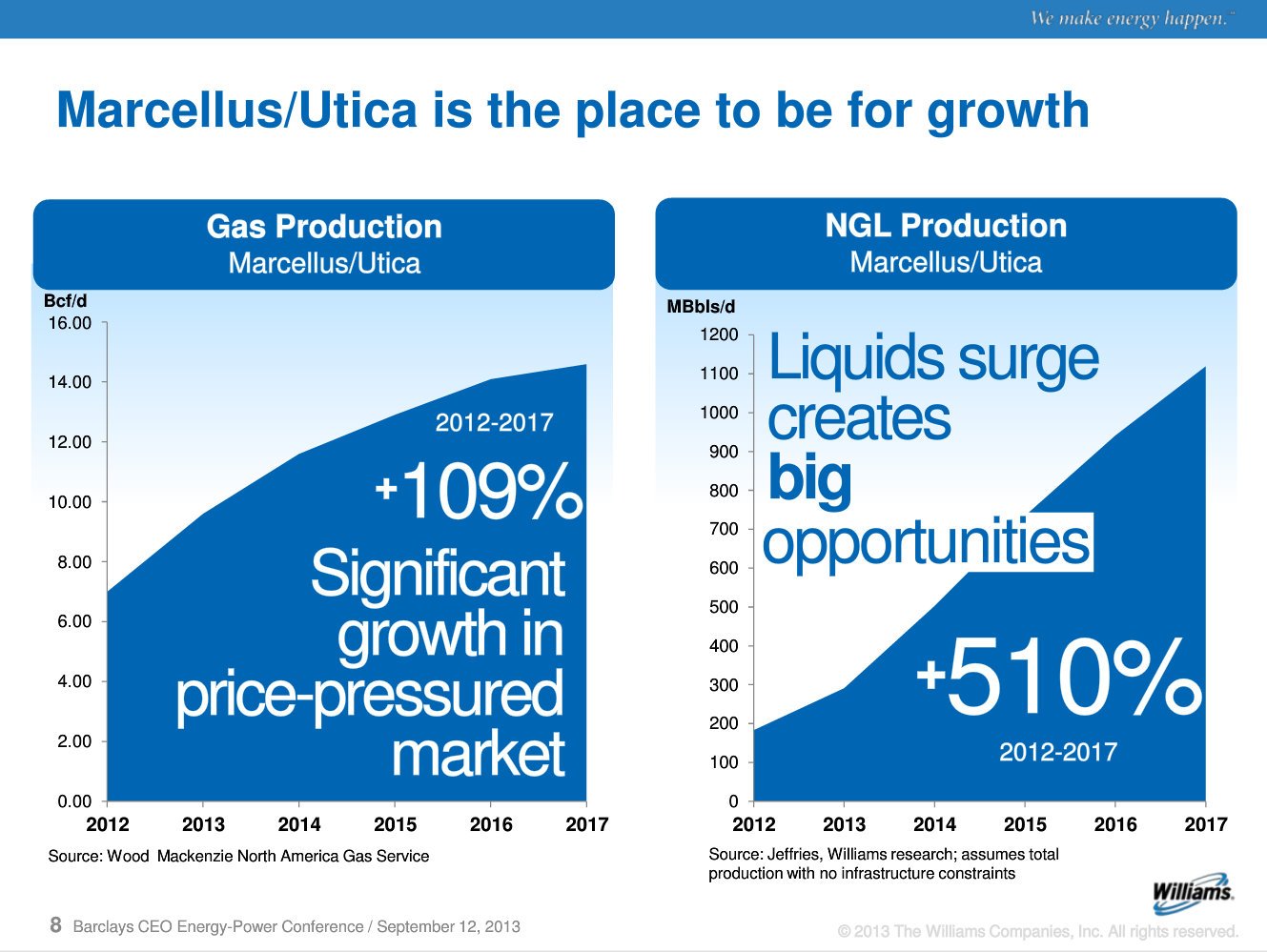

Take a look at the following chart from a recent investor conference. Despite low gas prices, Marcellus and Utica producers are expected to double output by 2017.

Source: Williams Investor Presentation

What's interesting here is the dry gas production growth. In the right locations drilling for natural gas can yield phenomenal returns. For example, Cabot Oil & Gas (COG 0.46%) has noted that the sweet spot of the Marcellus where it drills yields rates of returns that rival or exceed all of the top U.S. liquids plays at current commodity prices. That's a pretty remarkable statement.

Cabot can make that statement because it holds the location where the best gas reserves are found. On the other hand, other heavy natural gas producers like Devon Energy (DVN 0.37%) are completely moving away from dry gas drilling because it isn't enjoying those same returns. In fact, the company has highlighted to investors that it will not drill any dry gas wells this year. Devon has instead turned its attention toward growing its oil production by focusing on the Permian Basin and Canada's oil sands. While the company has a position in the Utica, its initial drilling showed that it wasn't in the best location of the play, which is why Devon is looking to unload its position.

Unlocking the Code

The key is finding the locations with the best gas resource. Cabot has been getting better at drilling wells that are expected to deliver higher estimated ultimate recoveries, or EURs. In 2008, its wells came in at an average of 5 billion cubic feet, but today it can drill a well that will produce an estimated 14.1 billion cubic feet over its lifetime. Better wells yield higher returns along with production growth.

Similarly, Chesapeake Energy (CHK +0.00%) is turning its attention to drilling wells with the highest potential EURs. Its Marcellus operation is focused on drilling the core of its core acreage. These are wells estimated to deliver in excess of 10 billion cubic feet equivalent of natural gas. It's doing the same thing in the Utica where it has honed in on a core position capable of producing 5-10 billion cubic feet equivalent of natural gas. Again, by drilling in the best locations it's able to boost production because the wells will produce so much gas and liquids, which enhances its economics.

All of this natural gas and liquids production growth is creating quite the opportunity for midstream operators like Williams (WMB +1.53%) and Boardwalk Pipeline Partners (BWP +0.00%). The biggest holdup that producers face is the lack of midstream infrastructure to get the gas and liquids to customers. That is one reason why these two companies are working together on the Bluegrass Pipeline. The project would help transport oversupplied Marcellus and Utica liquids to the Gulf Coast.

The upshot here is that the Marcellus and the Utica offer the best locations for producers looking to profit from natural gas. In the right locations, the wells are on par with all of the top liquids sites in the country. However, that production needs an outlet, which is why companies like Williams and Boardwalk are so critical to the growth of the Marcellus. The gas is there and it's profitable to extract, which is why the Marcellus is the place to be for natural gas growth.

Profit from America's Energy Bonanza