Source: Coolceasar, via Wikimedia Commons.

When most people think of innovation in the food business, they think of lifestyle brands like Starbucks or Whole Foods (WFM +0.00%). These companies have mastered the art of marrying a pleasant customer experience with excellent products and sustainable practices. The result: Their stores are trendy and bustling.

So, if I told you to name a food business whose stock was up 100% over the past year, what are the chances that you'd say Safeway (NYSE: SWY)? Though I follow the company and was aware the stock had been on a roll lately, I'll admit I was shocked when I looked at the stock's chart (I'm not much of a chart-watcher).

Will that trend continue for Safeway, or is the stock priced for perfection? The company's earnings report will be one of the judges of that, and below I'll explain three key variables investors should look at when the company announces earnings on Thursday, Oct. 10.

Canada and interest from other parties

Back in mid-September, Safeway announced it had adopted a shareholder-rights plan to prevent a hostile takeover. Eventually, it became known that activist investing firm Jana Partners had accumulated a 6.2% stake in the company, which prompted Safeway to come up with the plan.

Since then, the company's stock is up almost 13%. There are two different views for why this may be. The first is that with the shareholder-rights plan in place, the company will be able to unload its Canadian subsidiary without a hitch. The move is important for Safeway, as it aims to focus on strengthening its U.S. locations, and raise money when the sale closes.

The other view is that if an activist shareholder like Jana is willing to put so much capital behind the company, it obviously thinks Safeway could be run more efficiently, and if that efficiency is realized, shareholders will be the ones to benefit.

Pay close attention to the question-and-answer session of the company's earnings call, as that's when this subject is likely to be discussed the most.

Sales per square foot

Because the grocery business has razor-thin profit margins, efficiency is key. For a company like Safeway, with more than 1,600 locations and a stock trading for 15 times earnings, a plan to become leaner and more efficient is high priority. Sales per square foot is one of the most important metrics for measuring this efficiency.

Last year, Safeway averaged $573 per square foot. To put it in context, that's near the middle among major nationwide and regional grocers.

Source: SEC filings

As I said above, with its focus on differentiation through customer experience and a focus on healthy living, Whole Foods is the runaway leader in this category. Though Safeway has been successful in creating its O brand of organic offerings, it still doesn't come close to matching Whole Foods' sales.

And while Safeway is focusing on shrinking its overall presence, Kroger (NYSE: KR) -- the nation's largest grocer -- is actually growing after its acquisition of Harris Teeter.

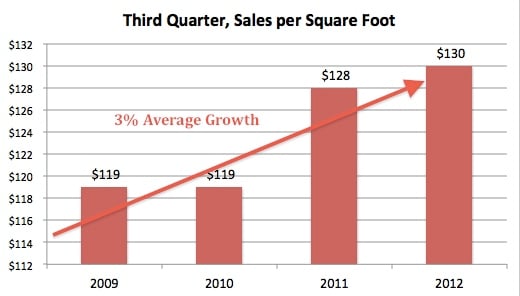

To get an idea for what a good number for this quarter would be, let's look at Safeway's past performance during the third quarter.

Source: SEC filings

If the company is truly going to live up to its valuation, I would hope to see at least $134 in sales per square foot.

Same-store sales

While the previous metric measures efficiency, same-store sales measures how well a grocer is doing at getting more people to frequent and buy from their establishment. In this category as well, Safeway has shown a middling performance when compared to peers over the past two years.

Source: SEC filings, Supervalu's results are from the Retail Foods segment, not including Save-A-Lot stores

What you see here is a shift in the grocery business. While ultra-cheap grocers like Wal-Mart are going after low-end shoppers, players like Whole Foods and others with a focus on healthy living are winning over scores of customers. That leaves the rest of the industry to duke it out for whatever is left.

So far, Kroger is the only traditional grocer that's handled this transition well. Interestingly, SUPERVALU (SVU +0.00%) and Roundy's (NYSE: RNDY) -- by far the two worst performers in this cohort -- have seen their shares triple and double, respectively, in 2012. Investors obviously see value in their focus on consolidating operations and unloading unprofitable business divisions.

It remains to be seen if unloading its Canadian subsidiary will have a similar consequence for Safeway. For the time being, investors should hope for same store sales to at least increase by 1.8%.