Silver Standard Resources (NASDAQ: SSRI) is an outlier even in the beaten down silver mining sector. The company was completely out of investors' favor this year, with its stock down more than 60%. Silver prices have stabilized during the past month, but it has not helped Silver Standard Resources. The stock continued to trend lower over this period. Now the company is trading near its yearly lows, which gives investors a chance to grab it at a cheap price. But is this price really cheap?

Temporarily dependent on one mine

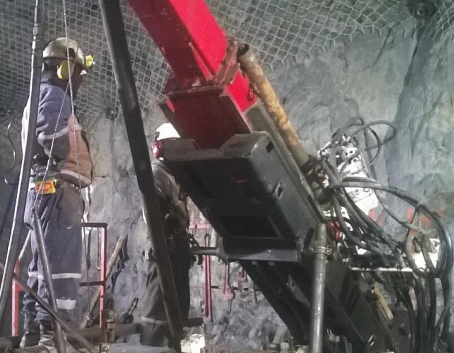

There is one important point that you should know about Silver Standard Resources. This silver miner has only one producing mine, Pirquitas, which is situated in Argentina. All other company's projects are in development or exploration state. It makes Silver Standards' financial fate solely dependent on Pirquitas' mine performance up until its next project, Pitarilla, starts producing silver.

This fact puts Silver Standard in a vulnerable position, especially at a time when silver prices are low. The effect of any possible incident at the mine could be harsh on the stock price. However, a company does not have to be dependent on one mine to get hit in current market conditions.

Hecla Mining (HL +8.77%) and Coeur d'Alene (CDE +4.63%) have lost half of their capitalization this year despite the fact that both companies have a diversified portfolio of producing mines.

Hecla moved to gold this year with the acquisition of Aurizon Mines. The move proved to be a wise one, as gold prices fell less than silver prices. Hecla has a diversified revenue stream, as 72% of revenue comes from gold and silver, while 28% comes from lead and zinc. The company trades at 70% of its book value. This fact, together with Hecla's diversification, makes it a relatively safe bet to consider.

Coeur d'Alene is another victim of the low-price environment. The company, which trades at half its book value, recently announced a 91.5% increase of proven and probable silver reserves at its Rochester mine in Nevada.

Upcoming projects

The Pitarilla mine must interest Silver Standard's shareholders the most. This is the next project in the pipeline, and the company plans to start construction in 2014. A huge mine with an expected 32-year life, it should provide a huge boost to Silver Standards' financial position once it becomes operational.

The question is whether Silver Standard is able to finish the project on time, given the current low-price environment. The company had $435 million of cash on its balance sheet at the end of the second quarter; the market currently values the company at $460 million. Yes, Silver Standard has $182 million of debt, but I still find such valuation ridiculous.

In addition to Pitarilla, there is the San Luis mine in Peru with an estimated construction time of less than two years. This mine holds a high-grade silver ore, with 595.5 grams of silver per ton of ore. In comparison, the only producing mine Pirquitas has an average 180.8 grams of silver per ton of ore.

Bottom line

I think that Silver Standard Resources is undervalued. The company has quality projects in the pipeline. The market could question the company's ability to secure additional financing for those projects, but I believe that the clean balance sheet, as well as the attractiveness of those projects, would make it relatively easy to get reasonable terms for any additional debt.