Though it can be seen as a matter of opinion, the apparel at Bebe Stores (NASDAQ: BEBE) is certainly unique and eye-catching. On the other hand, if you take a gander at their prices, you will see that they don't exactly fit today's economic environment. This could present a dilemma for prospective consumers.

Recent Results and Future Strategy

While Bebe Stores offers sexy apparel, its numbers are more on the homely side.

In fiscal-year 2013, net sales declined 8.7% to $484.7 million year over year. Comps plummeted 8.8%. This is with the inclusion of online stores boosting comps 1.5%. Gross margin dropped to 32.7% from 39.8% due to higher markdowns and unfavorable occupancy leverage. SG&A expenses increased 9.3% to $209.5 million. As if that's not enough bad news, net loss came in at $77.4 million, versus net income of $11.7 million last year.

These are poor numbers, but Bebe Stores is going through a transformational phase. It hired a new CEO, Steve Birkhold, in January. Birkhold has an impressive track record that includes driving innovation and capturing market share at Lee Jeans, and serving as President and CEO at Lacoste North America prior to its sale to Swiss investors. Since Birkhold's arrival at Bebe Stores, the stock has appreciated 56%. Based on the numbers above, you might be wondering why.

It simply comes down to belief in the company's future potential. For fiscal-year 2014, Bebe Stores' strategic goals include:

- Product distinction (contemporary, accessible, fashionable)

- Refining merchandise and offerings

- Redesigning website

- Aligning marketing campaign

- Identifying store closure opportunities based on profitability

- International expansion

While these strategies have potential, you shouldn't get excited about them until you see actual results. Foolish investors prefer to invest in profitable and proven companies. Bebe Stores has been in the red in three of the last five years, as well as four of the last five quarters. In the first quarter of fiscal-year 2014, Bebe Stores expects negative comps in the low to mid-single digits, and net loss per share in the low to mid-teens per share.

Bebe Stores offers high-quality and eye-catching apparel, but in a competitive and highly promotional environment with a hesitant consumer, Birkhold might be facing his biggest challenge yet.

Despite this challenging environment, one specialty retailer is defying all odds, and it's likely to present a safer long-term investment opportunity than Bebe Stores.

International and Luxurious Tastes

Prior to revealing what that top-notch retail investment might be, let's take a quick look at Guess? (GES +0.00%). Guess? is a specialty retailer and wholesaler focused on American lifestyle and European fashion sensibilities. It recently beat second-quarter earnings expectations thanks to its impressive expense management and cost control. That's what's so exciting about the current economic environment. With so many companies having trouble driving the top line, management teams must perform their absolute best in order to drive the bottom line and please investors.

As far as revenue goes, Guess? saw a 1% improvement in the second quarter year over year. However, if you take away the currency impact revenue actually declined 1.4%. Looking ahead to fiscal-year 2014, Guess? lowered its top-line guidance to $2.56 billion-$2.59 billion from $2.57 billion-$2.61 billion. On the other hand, it upped its earnings-per-share guidance to $1.78-$1.92 from $1.70-$1.90. These conflicting trends are a big reason why investors disagree so much on Guess?

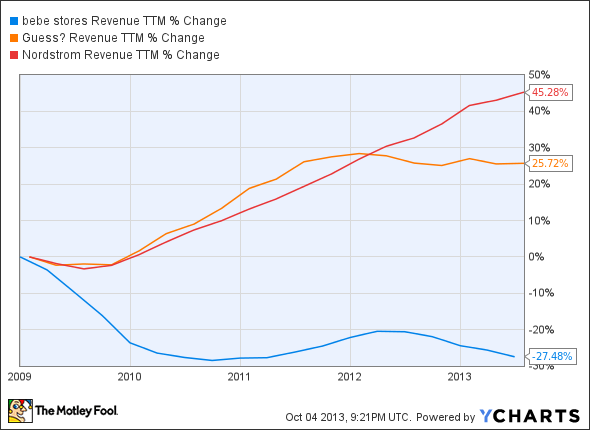

While Guess? lags this so-far mystery peer, Bebe Stores is left in the dust:

BEBE Revenue TTM data by YCharts

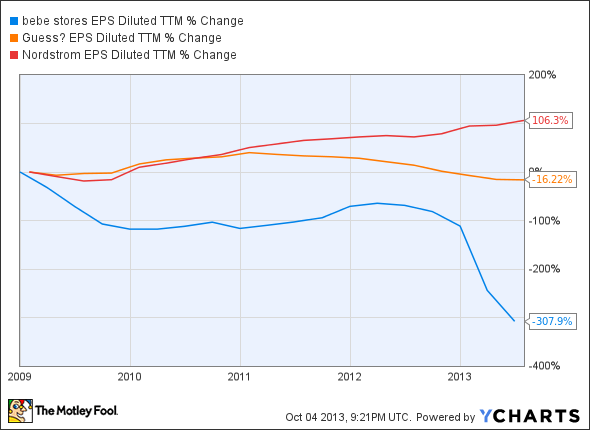

And if you look at the bottom line, you will see a similar result:

BEBE EPS Diluted TTM data by YCharts

It's now evident that Nordstrom (JWN +0.00%) is the consistent performer in this group. Nordstrom's brand is strong at the moment. As simple as it sounds, this helps drive sales. Most people are followers by nature, and they want to shop where everyone else shops. Nordstrom is also good at keeping its customers loyal thanks to its store credit cards. Additionally, Nordstrom is well aware that Nordstrom Rack is showing the most growth at the moment. Therefore, it's focused on growing the Nordstrom Rack brand.

It should also be noted that unlike Bebe Stores, both Guess? and Nordstrom have been profitable over the last five years, as well as the last five quarters.

Not Sexy Enough

Bebe Stores has the potential to turn itself around, but until it delivers improved numbers, Foolish investors might want to shy away. Instead of chasing that attractively dressed woman you spotted at the mall, consider sticking with the girl next door. There might be ups and downs in the relationship, but she will love you to the end, and she goes by the name Nordstrom.