TransCanada (TRP +0.54%) is a large pipeline and energy company, and the media's hyperactive news cycle has caused the market to miss the firm's deeper value. The Keystone XL pipeline was supposed to bring oil from Alberta down to the Gulf Coast, but significant portions of the project are stuck on the drawing board. The company just filed a statement with the SEC stating that it doesn't expect the pipeline to be approved anytime this year.

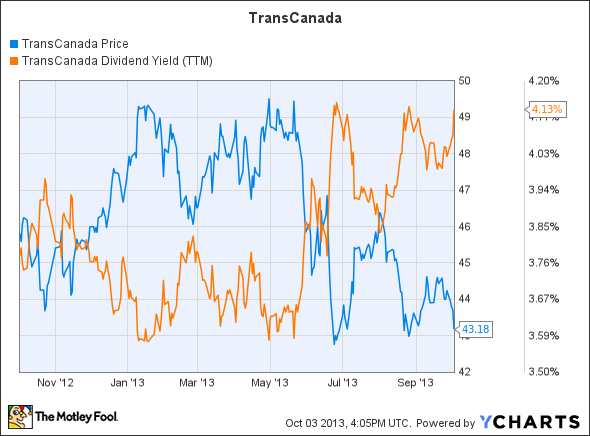

With the recent negative news about Keystone XL, TransCanada has seen its share price fall considerably and its dividend yield spike. TransCanada is losing out on potential income due to Keystone XL's delays, and the company faces the possibility that the project will be canceled altogether.

The other side of the coin

The problem is that TransCanada is much more than the Northern half of Keystone XL. The project is split into two parts and it expects the Southern half from Oklahoma to Texas to be fully operational by the end of this year.

TransCanada's earnings in the second quarter of 2013 tell a deeper story. Only C$149 million in income before interest and income taxes came from oil pipelines, while C$399 million came from natural gas pipelines and C$243 million came from its energy division.

Eastern growth opportunities

Even without Keystone XL TransCanada is growing. In June of this year it acquired the first of nine solar projects that it agreed to purchase in 2011 for C$470 million. The power from these facilities will be sold on 20-year agreements, and it hopes to buy more projects in the coming years.

Its pipeline divisions also have room for growth. Within Canada the company is looking at shipping more oil from Alberta to the East Coast, helping refineries reduce expensive overseas imports. By transforming some existing pipelines and limiting new construction, TransCanada would be able to complete the project without passing into the U.S.

Western growth opportunities

Heading west would offer an even quicker path to the international markets. The company recently proposed the Prince Rupert Gas Transmission project. The pipeline would fuel the Pacific Northwest LNG export facility.

Petronas should not be viewed as an anomaly. The Chinese energy firms PetroChina (PTR +0.00%) and Sinopec (SHI +0.00%) have bought up many Canadian energy assets, and they are keen to get these hydrocarbons to China.

Syncrude is a major oil sands producer and Sinopec owns 9.03% of the company along with oil and natural gas shale assets it acquired from the Canadian firm Daylight Energy. PetroChina has also made significant investments into Canada's upstream assets. It recently bought 20% of Shell's Groundbrich shale gas assets in Northern B.C. . Expanding TransCanada's pipelines westward is a great way for TransCanada to decrease its dependency on the U.S. and take advantage of Asian growth.

The benefits of betting on China

PetroChina and Sinopec are great potential partners. PetroChina has a reasonable total debt to equity ratio of 0.5 and is majority owned by China. Sinopec is another large firm, and as of March 31 it was 55.56% owned by the Chinese government. Beijing needs to expand its energy supplies to keep its economy growing, and it is not afraid of financing huge infrastructure projects to achieve its goals.

In addition to the Prince Rupert Gas Transmission Project, TransCanada's Coastal GasLink Project is a proposed pipeline that will bring natural gas to the proposed Kitimat LNG facility. The Kitimat LNG facility is owned by Apache and Chevron (CVX +0.04%) and would offer more access to the Asian markets. In the event that either of these companies decided to pull out, it would not be difficult to find a state-backed Asian energy firm to take their place and provide financing.

Many companies are leery of big LNG projects after the cost overruns in the Gorgon LNG project, but strong interest from major Asian LNG purchasers is helping to move plans forward. LNG export facilities are expensive, but Chevron has a large market cap around $220 billion, a small total debt to equity ratio around 0.14 and it needs major projects to create earnings growth.

Bottom line

The market is freaking out over the possible denial of the Keystone XL, but TransCanada is more than a single pipeline. The company will still profit from the lower half of the Keystone XL pipeline, and has growth opportunities with its Energy East pipeline. Big Asian firms like PetroChina and Sinopec have already spent millions on Canadian acreage, and the next logical step is the creation of facilities to ship more oil and natural gas westward toward China. With a dividend around 4.1% and a number of growth opportunities, TransCanada is worth a second look.