How to buy REITs

Investors have many ways to invest in REITs. The easiest way is to buy shares of publicly traded REITs through a brokerage account. An investor can purchase a diversified REIT or invest in several different REITs to build a diversified portfolio. REITs are relatively inexpensive to buy, with most trading for less than $100 a share.

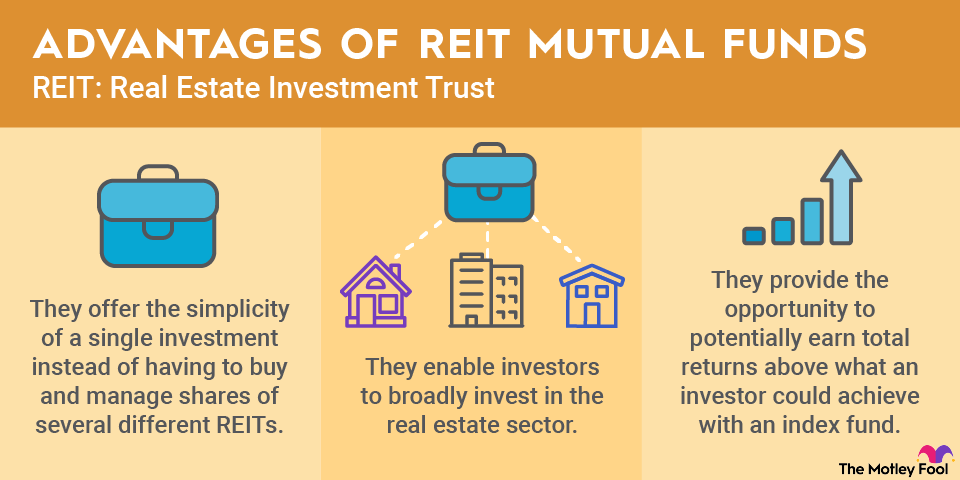

Another way to invest broadly across the REIT sector is to buy a mutual fund or exchange-traded fund (ETF) focused on REITs. REIT ETFs and REIT mutual funds are also easy to buy and relatively inexpensive to purchase.

Finally, you can invest in public non-traded REITs through a financial advisor or a real estate crowdfunding portal, which makes them a little more challenging to purchase. They also often have higher minimum investments, usually $2,500 or more to start.

Essential tips for REIT investment

Here are some practical tips for those looking to start investing in REITs:

- Begin with publicly traded REITs: It's best to start by purchasing shares of a publicly traded REIT in your brokerage account. These companies typically have long operating track records, report their financial results quarterly, and don't charge high management fees.

- Start small and scale up: Investors should begin by allocating a small portion of their portfolio to one REIT. They should consider adding to that position and investing in additional REITs as they grow more comfortable with the sector.

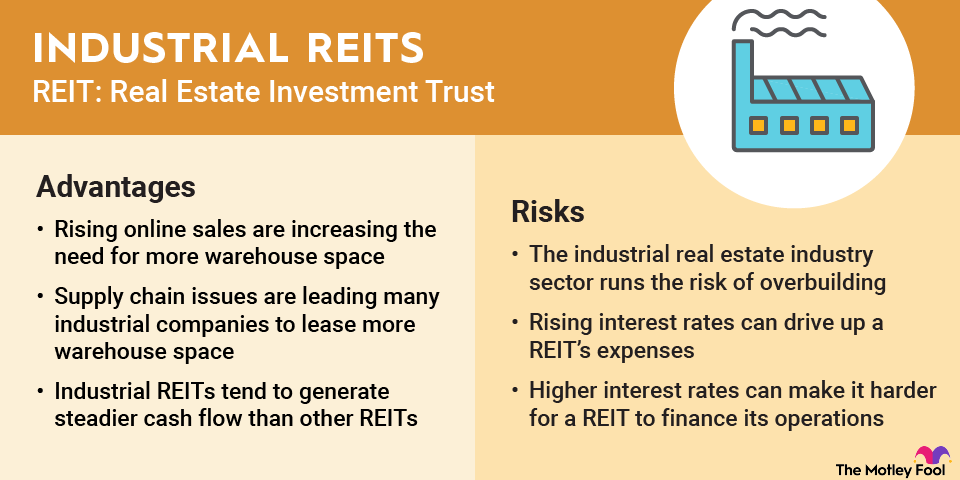

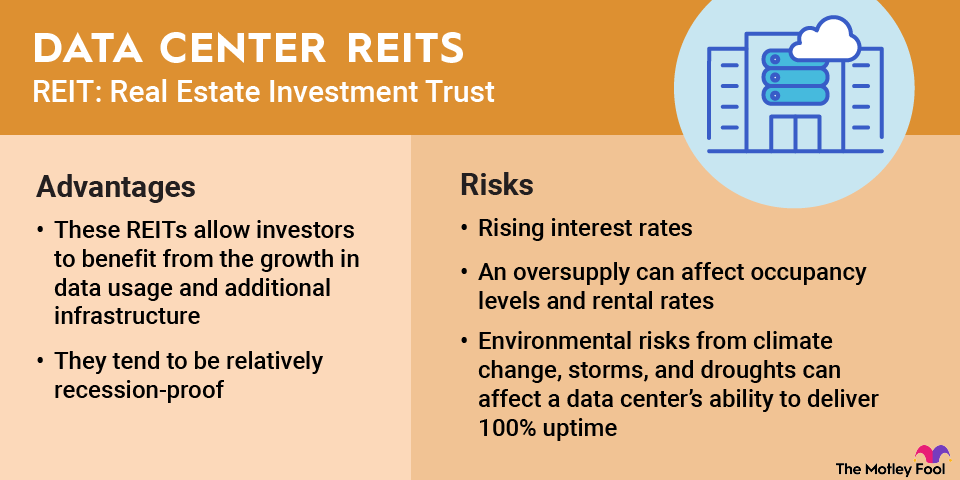

- Diversify across REIT categories: Investors should aim to build a diversified REIT portfolio across multiple property types, including residential, industrial, and retail.

- Focus on dividend sustainability: Many REITs pay high dividend yields. However, investors should focus on companies that can sustain and grow their dividends. They should look for companies that invest in high-quality properties that benefit from durable and growing demand. They should also seek REITs with conservative financial profiles.

How does a company qualify as a REIT?

Companies must meet specific criteria to qualify as a REIT, which receives special tax treatment, so they don't pay corporate income tax. These qualifications include:

- REITs must pay out at least 90% of their taxable income to shareholders as dividends each year. Many REITs will pay out more than 100% of their taxable income because their cash flow, measured by funds from operations (FFO), is often higher than income due to depreciation.

- They must be an entity that would be taxable as a corporation.

- A board of directors or trustees must manage them.

- They must have fully transferable shares.

- They must have a minimum of 100 shareholders after their first year as a REIT.

- REITs can have no more than 50% of their shares held by five or fewer people during the last half of their taxable year.

- They must invest at least 75% of total assets in real estate assets or cash.

- REITs must get at least 75% of their gross income from real estate-related sources, including rents from real property, interest on mortgages, financing real property, and the sale of real estate.

- A REIT must get at least 95% of its overall gross income from those real estate sources and dividends or interest from any source. In other words, 75% of its gross income must come from real estate, and only 5% can come from sources other than real estate, dividends, and interest income.

- They can have no more than 25% of their assets in nonqualifying securities or stock in a taxable REIT subsidiary.

Tax advantages of REITs

REITs have the following tax advantages:

- They do not pay corporate income taxes, enabling investors to avoid double taxation (taxing profits at the corporate level and individual level via dividend payments).

- Return of capital distributions from REITs is tax-deferred.

- REIT investors can deduct 20% of their dividends earned via the qualified business deduction.

However, a portion of a REIT's dividend payment is often a nonqualified dividend, which gets taxed at the higher ordinary rate if held in a regular brokerage account.

Related investing topics