Recent news for Macy's (M +2.01%) has been disappointing, and the current situation at J.C. Penney (JCP +0.00%) is downright scary. With these two retail behemoths facing difficult times, especially J.C. Penney, it might seem improbable that one of its peers is excelling despite such challenging macroeconomic circumstances. However, such retailer does exist.

Impressive numbers

DSW (DSW 3.23%) might be best known as a shoe retailer, but it also offers handbags, accessories, and more in its 377 stores. DSW targets the fashionable and value-conscious consumer, which fits today's economic environment.

In the second quarter, DSW's earnings per share jumped 47% year over year, primarily due to production inventory management and cost containment. Net sales improved 9.7%, and comps increased 4.4%. If you look at the bigger picture, during the first half of the year net sales improved 8.7% year over year, comps increased 0.8%, and net income jumped 5.9%.

When it comes to retail, the comps number is extremely important because it indicates growth excluding new store openings. Therefore, if the comps number is positive then customers are returning to the company's stores. DSW's impressive comps performance so far this year relates to increases in conversions, average ticket, and units per transaction.

Failure and fiscal-year expectations

If you have shopped at dsw.com, then you might have noticed an expanded luxury assortment. This attempt at luxury proved disappointing, and DSW stated that it won't expand into the luxury market in the future unless it can at least break even.

This failed attempt at the luxury market was also the primary reason for the first-half decline in gross margin of 110 bps year over year. But if you take a deeper look, you will see that excluding this luxury test, gross margin actually increased 30 bps.

So far, the news has been good for DSW and that will continue. Unlike J.C. Penney and Macy's, DSW has upped its fiscal year 2013 expectations. DSW now expects 2013 EPS of $3.60-$3.81, from $3.40-$3.60. Additionally, revenue is expected to increase 5%-7% and comps are expected to be in the low single digits.

Weaker and bigger options

J.C. Penney falls into the "weaker" category. Recent promotions have driven more traffic to J.C. Penney stores. Therefore, at least some form of potential exists. Furthermore, the inclusion of Disney Shops into at least 520 J.C. Penney stores has the potential to drive at least a little more traffic. However, this isn't going to drive a turnaround. Also, J.C. Penney is now going to spend $1 billion more than originally anticipated in 2013 while also offering 96.6 million shares in order to raise more cash. If J.C. Penney pulled off a turnaround, it would present a phenomenal investment opportunity, but the odds are against it. Foolish investors prefer to stick with proven companies like DSW.

Macy's is a much different situation. Macy's is likely to remain a long-term winner thanks to its broad product diversification, ability to attract various types of consumers, and strong management. Macy's is also growing rapidly online. However, Macy's disappointed in the second quarter, citing a cautious consumer. Macy's now expects FY 2013 comps of 2%-2.9% versus an earlier expectation of 3.5%. Furthermore, Macy's expects FY 2013 EPS of $3.80-$3.90 versus an earlier expectation of $3.90-$3.95. Despite reduced guidance, this is still growth. Comps are expected to increase, which is not that easy to find in retail these days, and FY 2012 EPS came in at $3.24. Therefore, even if FY 2013 EPS came in at the low end, it would still be an improvement over 2012.

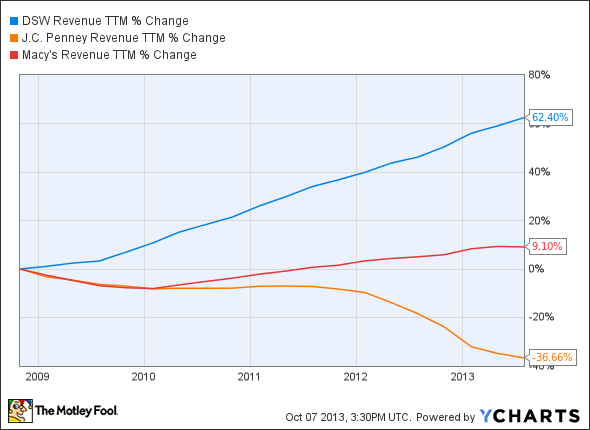

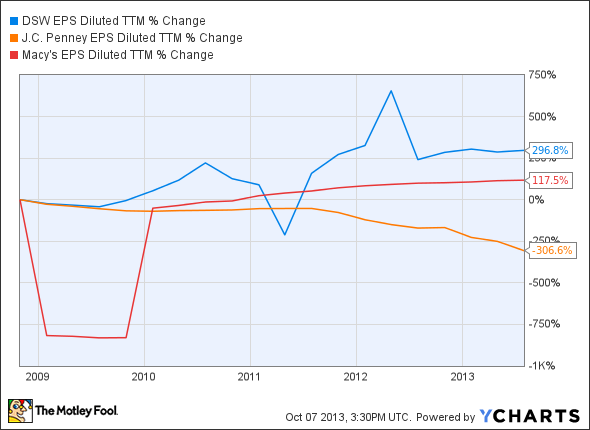

As you will see in the revenue and earnings-per-share charts below, the five-year trends exhibited by these three companies should come as no surprise considering the information above:

Revenue:

DSW Revenue TTM data by YCharts

Earnings-per-share:

DSW EPS Diluted TTM data by YCharts

Now consider some key metric comparisons:

|

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|

|

DSW |

6.19% |

15.88% |

1.20% |

0.00 |

|

J.C. Penney |

(13.29%) |

(53.71%) |

N/A |

2.51 |

|

Macy's |

4.93% |

23.55% |

2.30% |

1.18 |

DSW is solid across the board. The company's small yield adds some extra incentive for investors, and the ideal debt-to-equity ratio should offer peace of mind. Macy's offers a higher yield, but debt management could be better. J.C. Penney needs to improve in every area.

The bottom line

DSW looks to offer the most potential out of the three aforementioned companies. Macy's is a larger company with deeper pockets and marketing power. Also, Macy's should remain a long-term winner despite slower growth than DSW. If you want growth, consider DSW. If you're looking for dividends and a strong and sustainable name, consider Macy's. J.C. Penney would be a gamble.