This week, the stock market was dominated by the budget debate going on in Washington. The good news is that investors saw some hope for an agreement late in the week, which led to a 323-point jump in the Dow Jones Industrial Average (^DJI +0.60%) on Thursday, the biggest gain of the year. For the full week, the Dow was up 1.09%, which isn't bad considering that the government is shutdown and the U.S. may default on its debt in just five days.

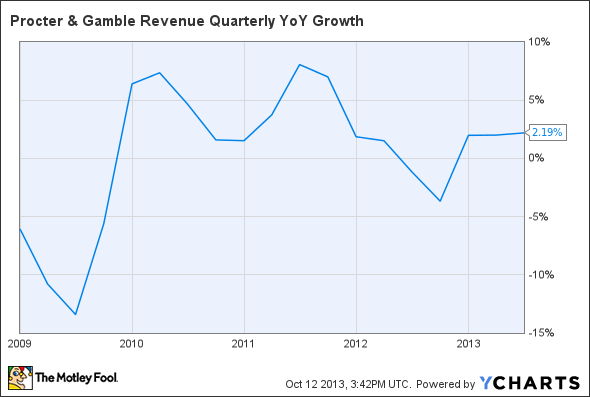

Leading the way for the Dow this week was Procter & Gamble (PG +0.92%), which rose 3.2% for the week. Procter & Gamble held its annual shareowner meeting this week in Cincinnati, and CEO A.G. Lafley said consumer and shareowner value creation is his top priority. This isn't different from most other public companies, but creating value is something Procter & Gamble has struggled with recently. In particular, the company needs to pick up its growth rate, which has nearly evaporated over the past two years.

PG Revenue Quarterly YoY Growth data by YCharts

Wall Street certainly has more confidence in A.G. Lafley as CEO than they did former CEO Robert McDonald, but it'll take time to see if his strategy is markedly better. In the mean time, enjoy the 3.1% dividend yield and just hope P&G makes small strides forward.

Retail giant Wal-Mart (WMT +0.64%) rose 2.8% this week as investors sought out "safe" stocks because of the turmoil in Washington. Wal-Mart was a common safe haven during the financial crisis as well, but I recently questioned just how safe this stock is as the economy recovers from the crisis. Wal-Mart's U.S. sales grew just 10.3% from 2008 to 2012, compared with 17.9% at Target, 26.1% at Costco, and 231.9% at Amazon.com.

Customers used to flock to Wal-Mart when times were bad, but as the economy has recovered, we've seen more affluent customers go to Target and cost-conscious customers move to Amazon. Wal-Mart isn't the safe haven it once was, and while it was a top stock this week, I wouldn't put this among the top stocks on the market today.

Rounding out the top three stocks on the Dow this week is AT&T (T +0.82%), which was up 1.3%. The No. 2 U.S. wireless company announced that it would eliminate older plans in favor of Mobile Share plans beginning Oct. 25. It's not unusual for wireless companies to change their plans and Verizon Wireless and AT&T are both moving to shared plans, which charge more for data, but allow sharing among multiple customers.

Eliminating old plans isn't surprising but investors should keep an eye on the subscriber trends in the third quarter because Sprint and T-Mobile are charging hard for the No. 2 spot. I think, long-term, the sheer size of AT&T will be able to hold off Sprint and T-Mobile, because neither can afford to build to same size network as AT&T. This is still one of the top buys in wireless, and investors get a hefty 5.3% dividend to go along with the stock, which isn't bad even if the stock struggles over the next year or two.