After Wells Fargo (WFC +0.37%) announced earnings Friday morning, its stock fell 2.5% in the hour after the market opened -- but despite that fall, its announcement was better than many investors are seemingly giving it credit for.

While the stock went on to rebound following its early morning drop, here are five things in the earnings report that should encourage investors.

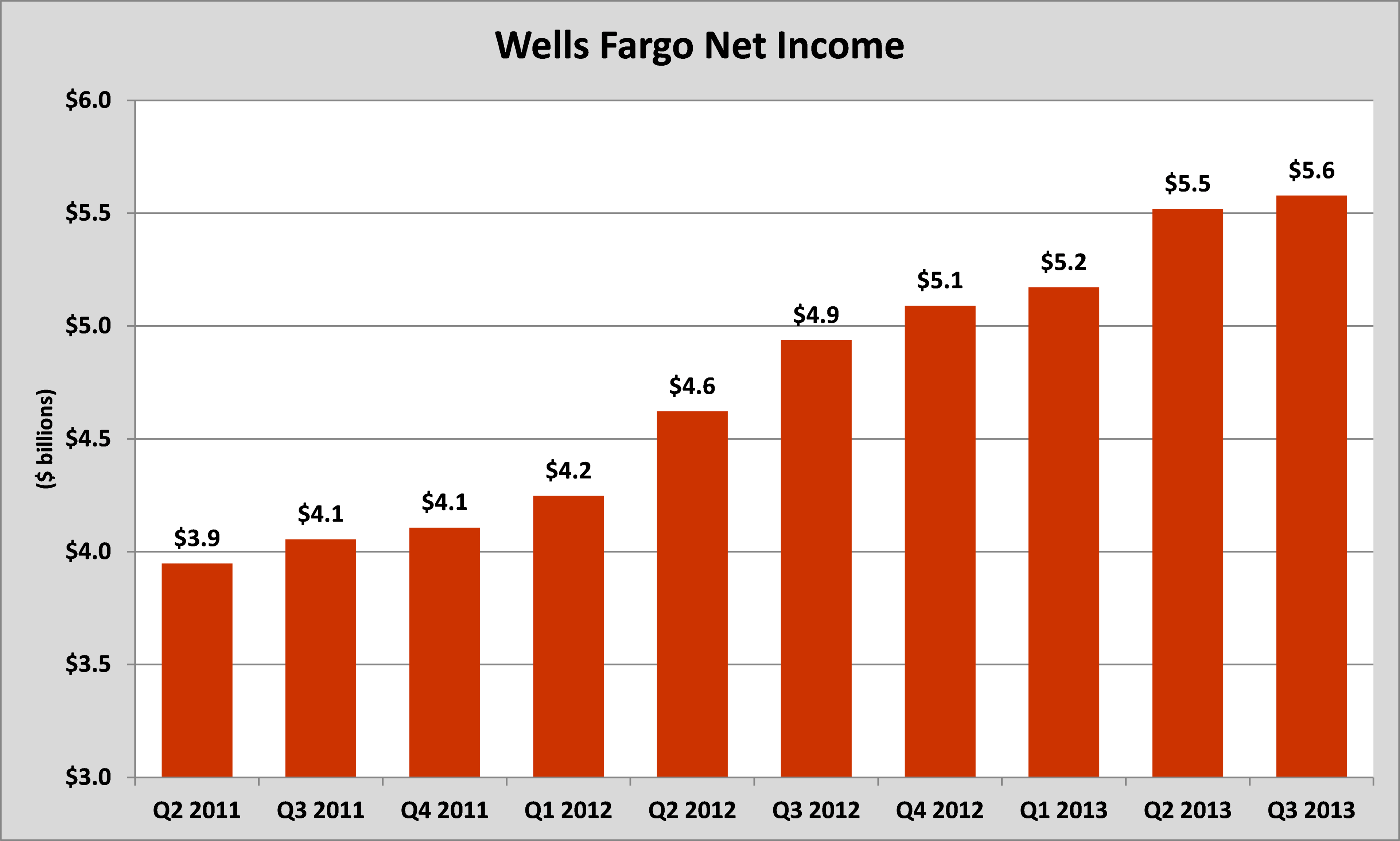

Another record quarter

For the 10th quarter in a row, Wells Fargo reported record net income:

Source: company earnings report.

Compare that performance with JPMorgan Chase (JPM 0.18%) -- once considered the darling of the financial-services industry -- that also announced earnings Friday and posted its first quarterly loss since the second quarter of 2004, thanks to regulatory and legal costs.

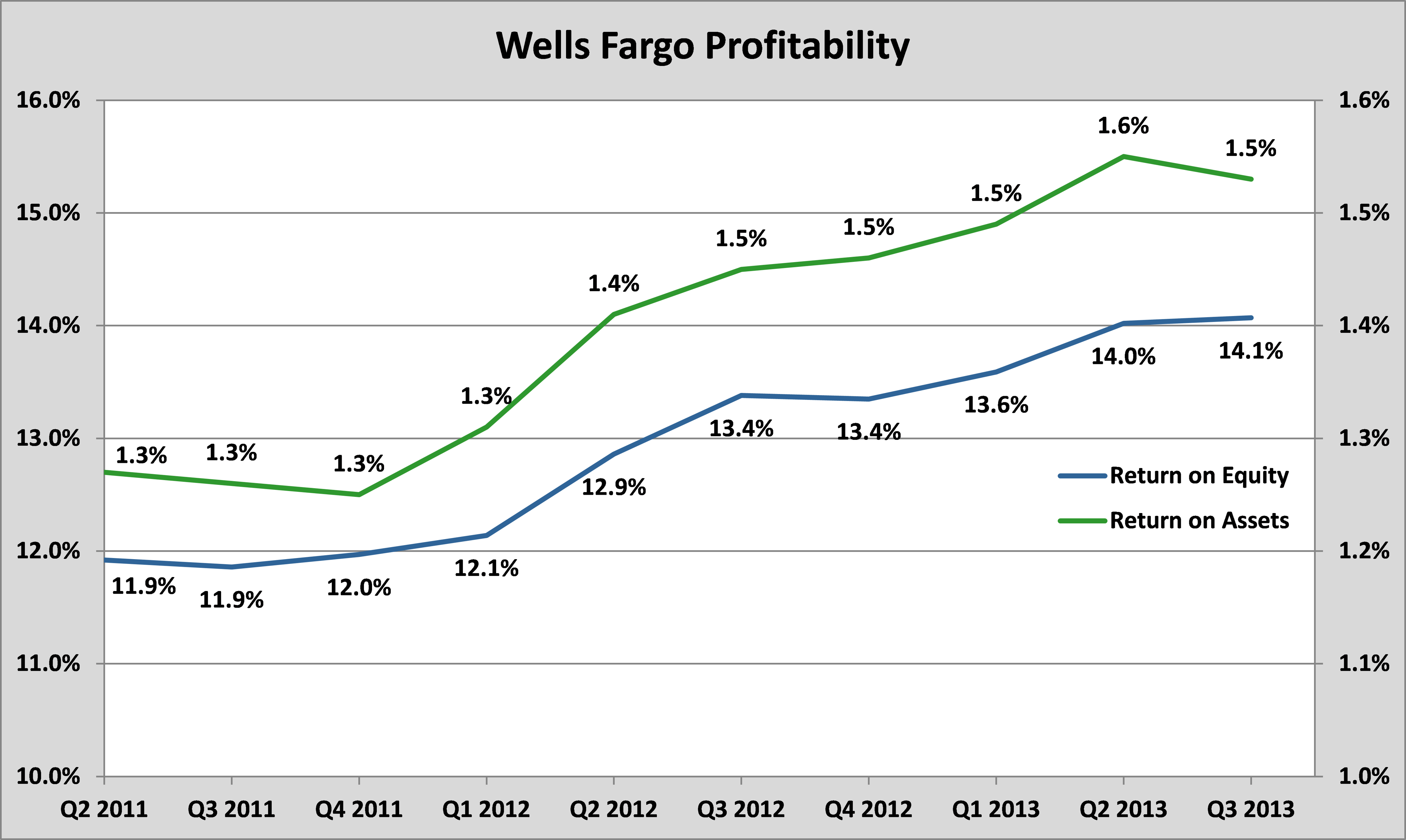

Continuously improving margins

While the bottom-line income number will grab headlines, it's also important to note that Wells Fargo continues to grow a number vitally important to shareholders: its return on equity, which climbed to 14.1% in the third quarter. Its return on assets dropped slightly, and that's something worth monitoring, but what matters to stockholders is return on equity, so to see that figure continuing to grow is encouraging:

Source: company earnings report.

This trend of improving margins coupled with growing net income has allowed Wells Fargo to grow its book value per common share -- the money available to shareholders -- by 7% over the last year.

Mortgages weren't as bad as first look would indicate

At first glance, Wells Fargo's mortgage business looks to be in really rough shape, as its originations fell by 29% compared with the third quarter, as its refinancing volume was almost cut in half. However, the Mortgage Bankers Association predicted that third-quarter origination volume would fall by 25%, which means Wells Fargo's production was in line with the broader industry.

In fact, despite the fall in mortgage originations, Wells Fargo's community-banking business saw its return on average assets grow from 1.43% in the third quarter of last year to 1.60% in the third quarter of this year. This also represented a slight gain over the 1.58% posted in the second quarter of this year.

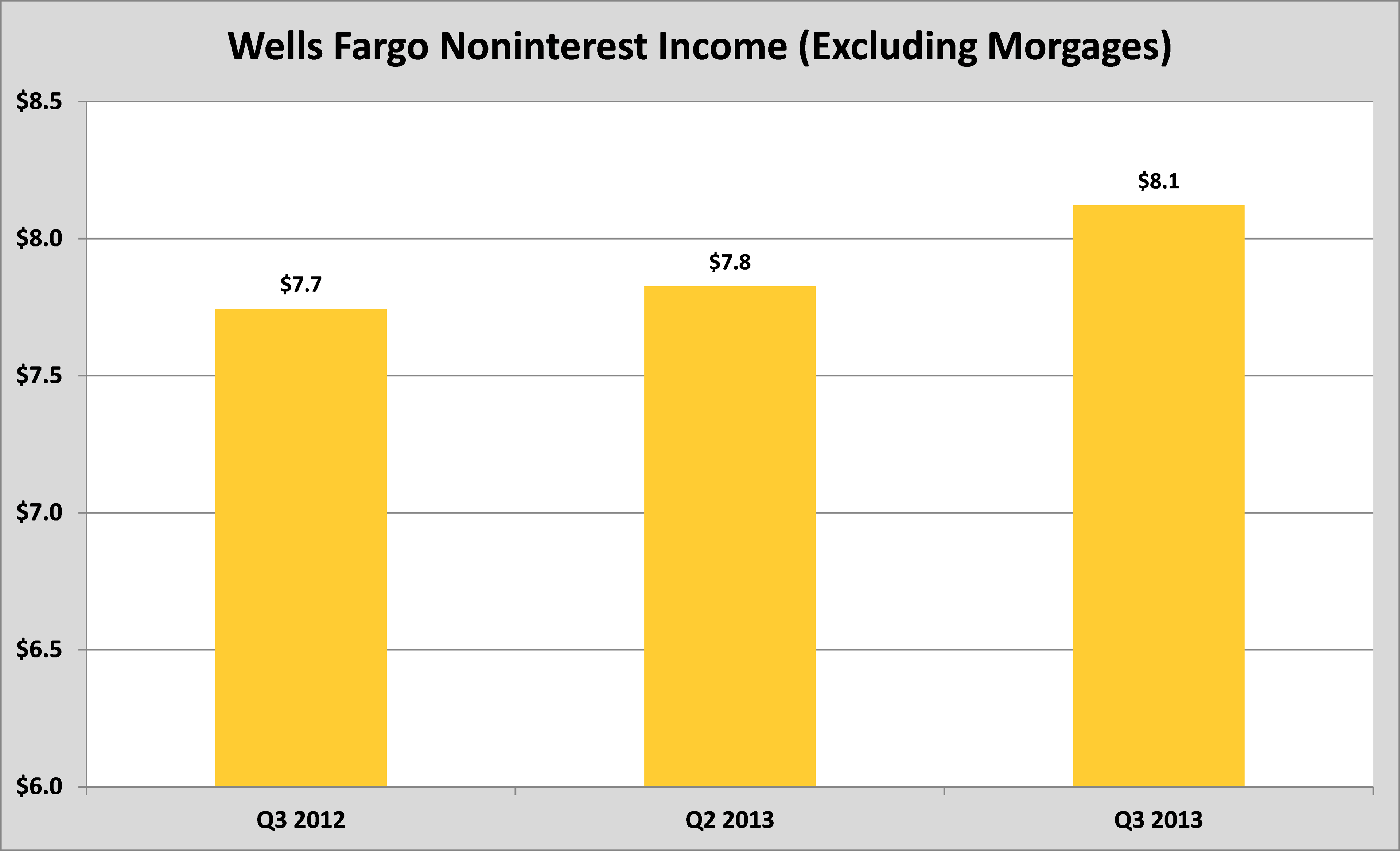

Noninterest income also isn't as bad as it looks

Many banks around the U.S. are seeking to become less dependent on traditional interest income. PNC (PNC 0.50%) CEO Bill Demchak openly stated that he and PNC management was planning to "create a company that is predisposed to increasing fee income." So it's a little concerning to see Wells Fargo's noninterest income fall both 8% quarter over quarter and year over year to $9.7 billion.

Although we shouldn't belabor the mortgage point, Wells Fargo did note that excluding noninterest income related to mortgage banking would instead have shown a gain of 4% compared with last quarter, and a gain of 5% compared with last year.

Source: company earnings report.

Continued improvement in the wealth, brokerage, and retirement business

Wells Fargo as a whole has seen its net income rise by 13% over the past year -- yet its smallest business segment is eclipsing all the others:

|

Business Segment |

Year-Over-Year Earnings Growth |

|---|---|

|

Wealth, brokerage, and retirement |

33% |

|

Community banking |

22% |

|

Wholesale banking |

(1%) |

|

Entire company |

13% |

Although wealth, brokerage, and retirement represents only about 8% of Wells Fargo's total earnings, it's certainly encouraging to see a business segment improve so dramatically over the past year.

While Wells Fargo's stock recovered from its early morning freefall, it still closed the day slightly down. Certainly not everything was good news in this bank's release -- but the early sell-off was unwarranted, as this was yet another quarter of solid results.