Back in 2011, Hewlett-Packard (HPQ +0.43%) CEO Meg Whitman was claiming that 2013 would be the company's time to shine. Now, however, Whitman has backtracked. Investors haven't found answers in 2013, and the company doesn't expect the business to resume growth in 2014, either. Again, investors will just have to wait.

The waiting game

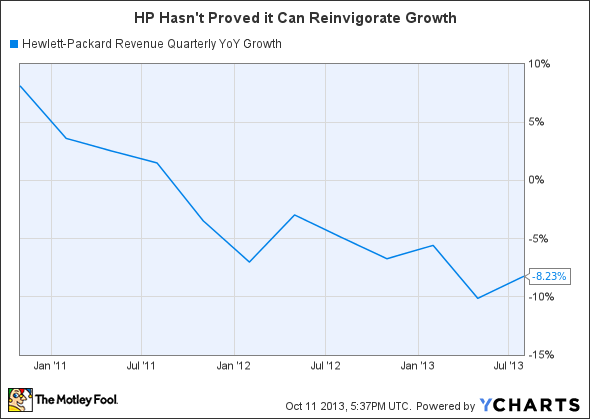

Not only are HP investors waiting for the underlying business, they are waiting on the stock, too. Since Whitman became CEO in September 2011, HP's stock has missed out on a huge market gain. While the S&P 500 gained nearly 50%, HP's stock has recorded a 5% loss during Whitman's tenure as HP's CEO. The stock's underperformance is largely a result of a failure to reinvigorate the company's revenue growth -- or at least stabilize its decline.

HPQ Revenue Quarterly YoY Growth data by YCharts

Though Whitman believes that HP can grow revenues in line with GDP over the long term, investors have very little evidence to latch on to this notion. Even during the company's most recent quarter, only the company's software segment, accounting for just 3.5% of revenue, was up from the same quarter last year. The company's largest segment, personal systems (27.5% of total revenue), saw revenue decline 10.8% from the same quarter last year.

How does Whitman plan to address these declining businesses? In a securities analyst meeting this week, Whitman laid out vague plans which she believes will make 2014 a "pivotal" year and 2015 a year in which there will be revenue "acceleration." While most of her comments indicated a continuation of the company's current plan to organize its units into a successful business that addresses the "new style of IT," there were a few plans that stood out.

One, the company plans to cozy up to customers in order to combat declining sales in its personal systems and printer business. "We have been too insular for too long," Whitman said at the analyst meeting, according to the WSJ. The new Google-colored HP Chromebook with its "Made with Google" marketing slogan may be a prime example.

Two, HP plans to focus on product depth over product breadth. With a focus on fewer products, HP hopes to reconnect with consumers. Easier said than done, of course.

Three, HP is "recommitted to smarter innovation, with research and development," according to HP's press release following the analyst meeting. HP plans to spend over $3 billion in R&D in fiscal 2013. The comment is a bit surprising, considering R&D spending in excess of $3 billion isn't any higher than the company's historical 10-year average. And though it is higher as a percentage of revenue than Apple's (AAPL 0.15%) R&D spending, it's significantly lower than competitor IBM's. Over the last 12 months, HP's R&D spending amounted to 2.9% of revenue and IBM's accounted for 6.2% of revenue.

The thorn in HP's side

The second point above may encapsulate HP's biggest challenge. At 27.5% of total revenue, HP will need its personal systems segment to end its decline in order to stabilize the company's business.

This won't be an easy task. Though HP may be the leader in PC sales in the U.S., and second worldwide, this is just as much a curse as it is a blessing. The PC industry, as a whole, is in decline. The worldwide PC market is projected to see a moderate decline over the next two years, according to Gartner. And in the US, the PC market will be "challenging" in 2013, according to IDC.

In stark contrast, consider Apple. The company is also facing challenges in PCs. PC shipments were down 2.3% in the third quarter of 2013 from the same quarter last year according to Gartner. Fortunately, however, Apple investors have less reason to worry, because Macs account for just about 14% of total revenue. Even more, tablets alone account for 18% of Apple's total sales. Tablets, of course, are one of the many reasons for declining PC sales -- so Apple at least gets the benefit of cannibalization.

Of course, HP's stock reflects its missing answer to its declining PC segment, trading at just six times its earnings estimates for next year. But to make the business a solid long-term investment, HP will need a better answer to its unfortunate situation.

How long will investors have to wait?

That's the important unanswered question. The company says revenue growth should accelerate in 2015, but the path to get to this point remains foggy. Fortunately, HP is generously sharing its free cash flow, with a planto return at least 50% of its estimated $6 to $6.5 billion in free cash flow through dividends and share repurchases during fiscal 2014. But long-term investors continue to wonder: Is there durability to this free cash flow?