One of the keys to being able to enjoy life is income security. Knowing where that next paycheck will come from really takes the weight off. On the other hand, fear of the unknown, in this case income uncertainty, keeps many worrying about retirement. That's why so many Americans have turned to dividend-paying stocks. The income these companies throw off can really help to supplement pensions or Social Security.

That's why it might seem odd that the stock I'm about to buy with an eye toward retirement doesn't pay a dividend ... yet. This is a company that demands a long-term view. It's building something rather remarkable. It is also nearing an inflection point where it will likely start paying a dividend. Add it all up and by the time I retire, this stock should be fueling steady income to support my golden years.

Taking center stage

Without future ado, I'd like to introduce Denbury Resources (DNR +0.00%), which will soon be the newest entry into my retirement portfolio. Denbury is a leader in using carbon dioxide to recover more oil from legacy oil fields. To learn more about the carbon capture and sequestration process click here for a short video by Denbury. It's a proven process and one that Occidental Petroleum (OXY 0.32%), for example, uses to produce 60% of the oil it delivers from the Permian Basin in Texas.

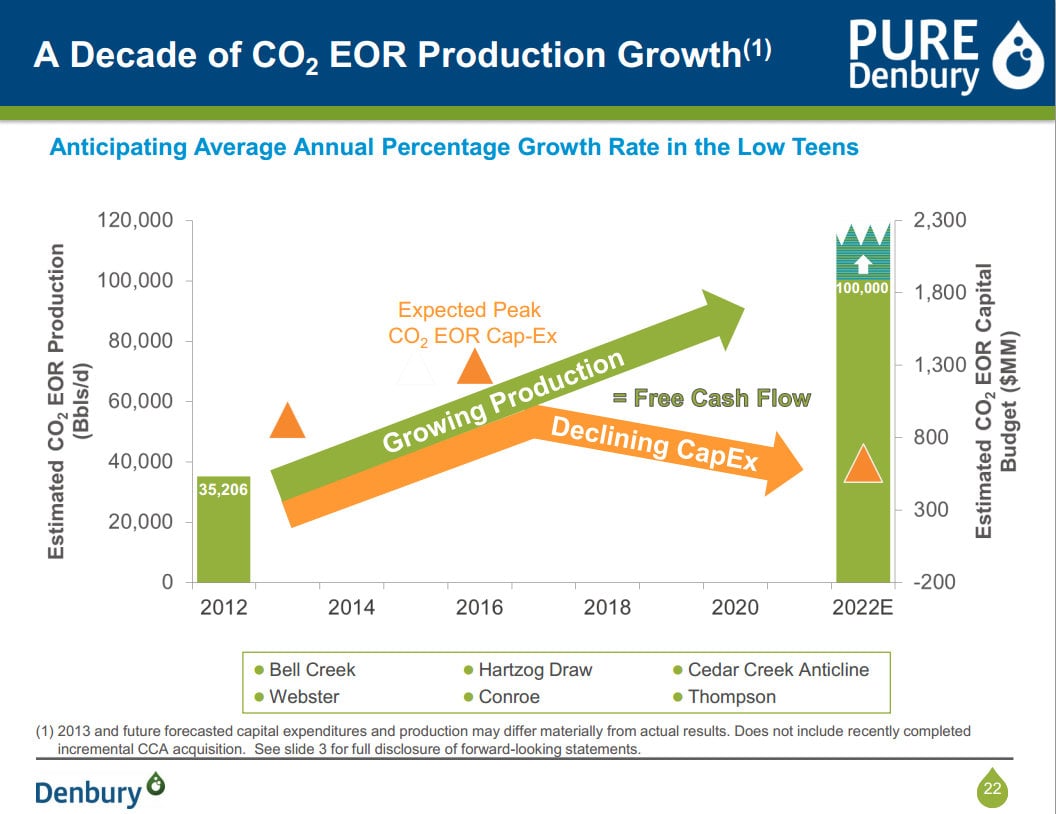

What interests me the most is the income potential from Denbury's process. The following slide shows that by about 2017 this company should hit peak capital spending to build out its enhanced oil recovery system and should then begin to deliver free cash flow.

Source: Denbury Resources Investor Presentation (link opens a PDF)

It's this growing pile of cash flow that I believe will become the foundation for a future dividend. By the time I retire sometime in the next 30 years, the income flowing from Denbury should be substantial.

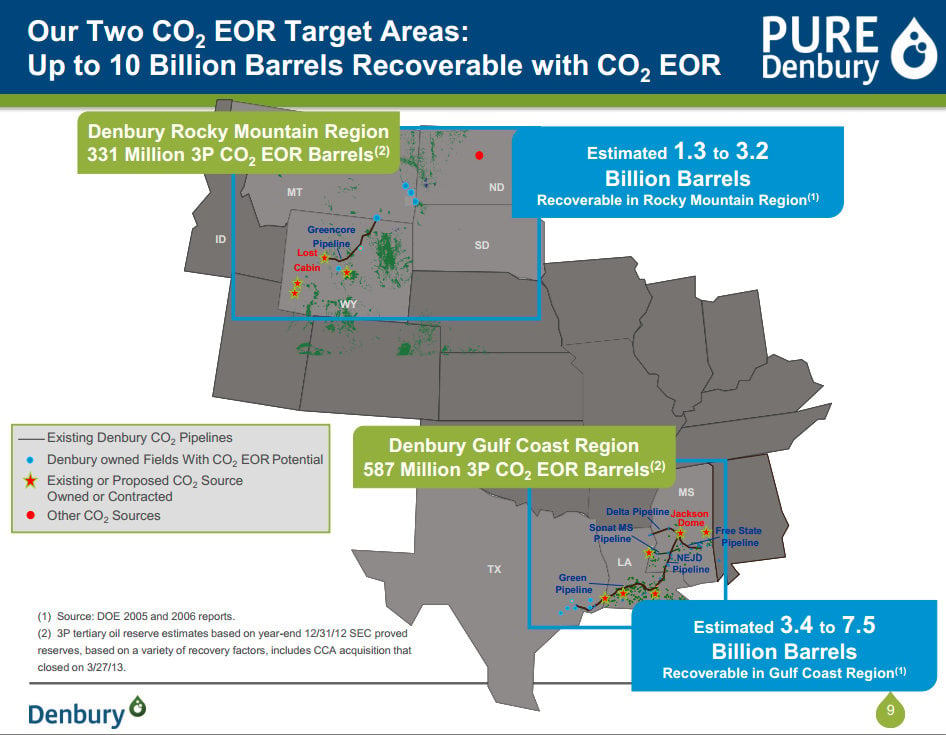

What I like most about Denbury is that it has built a very sustainable and repeatable business model. It can acquire legacy oil fields in and around its existing infrastructure in the Gulf Coast and Rocky Mountains to drive future growth in both production and cash flow. The following map shows the vastness of its growth potential.

Source: Denbury Resources

Denbury Resources has been making that push in recent years. In January, for example, it bought $1.05 billion worth of assets from ConocoPhillips (COP 1.11%) in the Rocky Mountains. ConocoPhillips, which is in the midst of a major restructuring to focus on growing production and margins, feels these assets would be better off in the hands of a company able to develop them to the fullest potential. ConocoPhillips is after growth today, while Denbury Resources is content to wait for that growth to show up in the next few years.

Prior to that Denbury Resources was able to trade its Bakken assets to ExxonMobil (XOM 0.61%) for cash, as well as ExxonMobil's interests in two fields with EOR potential and a portion of ExxonMobils's carbon dioxide reserves in Wyoming. That transaction was a game-changer for Denbury Resources, which was able to use its new cash to fund the deal with ConocoPhillips. Here again Denbury Resources acquired assets that didn't immediately add high growth production for growth that should show up a few years down the road. ExxonMobil, on the other hand, was after increased access to the high-growth Bakken.

The bottom line here is that all the pieces are starting to fit together, and a very compelling future is beginning to develop. It's a future that I want to own a stake in, which is why I'll start building my position in the company as soon as our trading rules allow.

Learn more about Denbury's role in America's energy bonanza