A recent Seeking Alpha article argued that despite its shrinking sales and net income, General Motors' (NYSE: GM) share price has gotten a boost from cheap, subprime car loans and surging auto sales -- a trend that just can't last. But a deeper look at the situation reveals the flaws in that argument, and paints a much more bullish picture for General Motors, Ford (NYSE: F), and their fellow automakers.

Since the claim about General Motors' declining net income has already been debunked, let's focus now on the idea that auto sales have almost rebounded to their pre-recession peak. According to this theory, new cars will soon "overload" our roads with a supply glut, causing vehicle values and sales to plummet. But there are four good reasons why this argument just doesn't make sense.

Current levels are sustainable

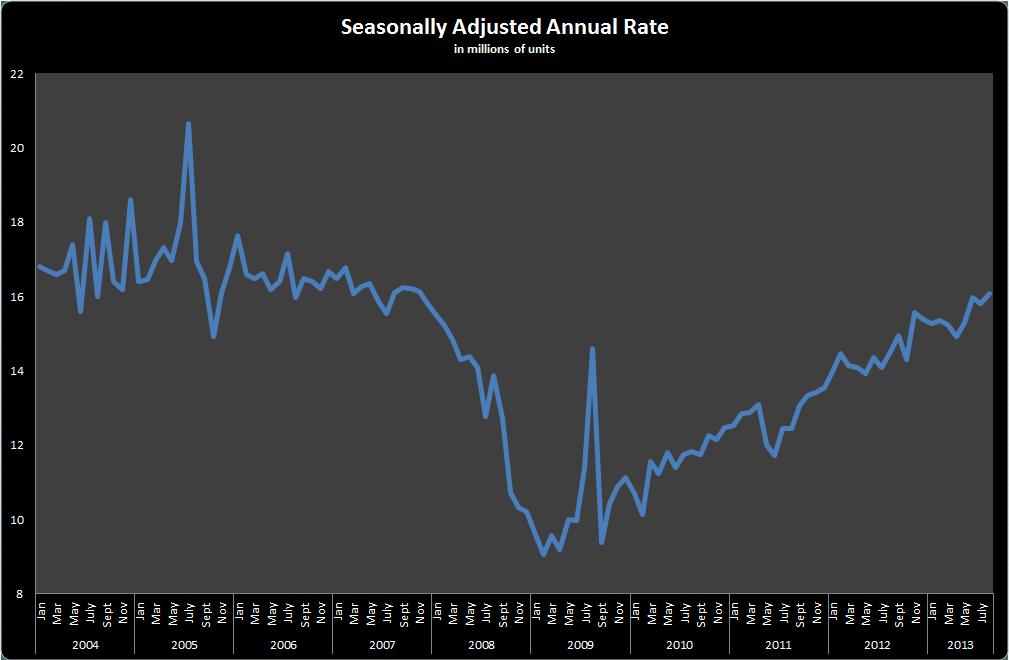

Simply saying we're reaching the pre-recession peak makes automakers' current sales trend sound unsustainable. But look at the chart below:

Graph by Author. Information credit: Automotive News DataCenter.

That doesn't yet look like a bubble in the making. Yes, vehicles are selling at higher rates, but expecting the roads to be swamped with excess supply next year is borderline ridiculous. If that were happening, the average age of America's vehicles would drop drastically, as all those new cars replaced older models.

But the average age of vehicles on the road recently increased, to a record high of 11.4 years.

Eventually, that average age will decline, reaching equilibrium with the seasonally adjusted annual rate of vehicles sold. If sales continue to rise after that point, then you can argue that a bubble is forming.

Average transaction prices are up

Moreover, if supply were beginning to exceed demand, average transaction prices would start flatlining across the industry, similar to what the graph shows from 2005-2009. Right now, that just isn't the case.

Graph by Author. Information credit: Automotive News DataCenter.

That's where the bear argument ends, but it's only half of the story. People often focus solely on the front end of the equation -- sales -- but forget the back end: scrap rates.

Scrap rates

Cars don't last forever. Eventually, their value and usefulness decline to the point where they're scrapped and are removed from the road -- causing demand for new/used vehicles to increase.

Citigroup economist Itay Michaeli found through his research that the rate at which owners completely scrap their cars rises dramatically at 13 years. The average vehicle on the road today is 11.4 years old which means the typical vehicle is roughly 18 months away from an increasingly likely date with the junk yard. As that development unfolds, it will spur demand for new and used vehicles, especially if the U.S. continues at a more stable annual vehicle sales rate.

"No later than 2015, we should see an incredibly strong scrap recovery in this cycle, and it hasn't even begun," Michaeli said the 2013 CAR Management Briefing Seminars, according to Automotive News. "In 2014 and 2015, the rate of vehicle designs and refreshes with tremendous new technology is going to come right at the time when we think the vehicle age will start to hit that ideal range when scrap rates tend to balloon."

Auto sales per houshold still low

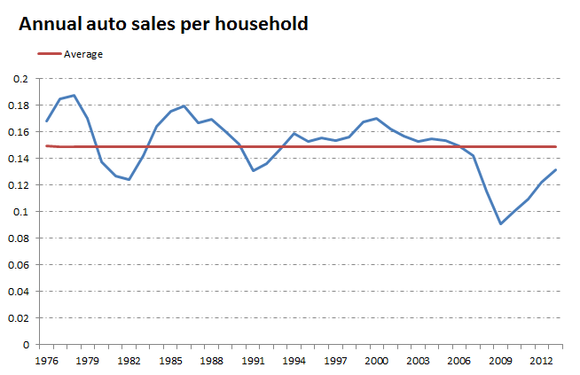

This could be the opposite of the bear thesis at the beginning of this article: a perfect storm that might sustain high auto sales levels for years. Furthermore, my colleague Morgan Housel also noted a very important factor:

Source: Census Bureau, Federal Reserve.

While auto sales are nearly back to pre-recession levels, Morgan noted that there are several million more households today, which leaves auto sales per household below historic norms.

Bottom line

Another thing to consider while viewing automakers as investments is their improved operations. The recession brought on necessary, and drastic, changes to Ford's and General Motors' business models. Costs have been cut from factory closings, vehicle platforms have been consolidated, and operating efficiency has improved. Morningstar analysts now estimate that both Ford and General Motors can break even at SAAR rates of 10.5-11 million vehicles -- or about the same sales rate we saw during the great recession.

I truly believe the bear argument is off base when it concludes that excess supply is imminent, and vehicle values will soon drop. Based ont he numbers above, I believe healthy demand will remain for years. That looks like good news for well-positioned automakers such as General Motors and Ford.