It's been two weeks since the state and federally run health insurance exchanges have been open, and news surrounding their effectiveness has been mixed. Under the Patient Protection and Affordable Care Act, known better as Obamacare, every individual is required by law to have health insurance by Jan. 1, 2014, or face a penalty that's set to increase every year through 2016. This means that whether you're ready to sign up for health insurance or dreading it, it's time to start navigating the exchanges.

Source: White House on Flickr.

That's why, in an effort to get opinions from backgrounds and locations across the country, we three Motley Fool contractors -- Sean Williams (that's me), Steve Symington, and Travis Hoium -- bring you a firsthand account of our experience on exchanges in three different states. Here are the successes and failures we've encountered, so you can see how this might affect you and possibly your portfolio.

Sean's take

I haven't been looking forward to the beginning of October for years now. In a previous Obamacare article, I looked at some reasons why uninsured young adults hadn't purchased health insurance before, and for many it was an objection solely based on price. For me, I'm with the 11% who responded with a feeling of invincibility. However, with the Patient Protection and Affordable Care Act now a law, it was no longer a matter of choice.

Unlike some of my colleagues, I had no trouble accessing my state's (Washington) health exchange. I'd heard about how server overloads and architectural design flaws are holding up the 36 federally run exchanges, but the majority of state-run exchanges are being executed almost flawlessly. The one caveat, though, is that many people are still on the outside looking in rather than being ready to buy insurance, since they have two-and-a-half months to go before their coverage (and the individual mandate) would kick in.

I decided to be brave and enroll completely, knowing that glitches were common and that I'd previously done little research on my state's plans. The result was unbelievable success.

The longest part of the process was identity confirmation, but it worked relatively well. The only potential stumbling block I noticed was that you got into the actual identification application before you were asked if you read and speak English. This seems a bit far into the process for non-English-speaking U.S. citizens to go before being given the option of alternative languages. It also speaks to the delays announced this month from the Department of Health and Human Services, which operates the federally run site, that Spanish-speaking enrollment won't commence for a few weeks.

I had 36 plans to choose from in my county, although surprisingly none were at the platinum level. My price for these plans ranged as low as $191 to as much as $405, putting Washington a bit below the national average compared to estimates issued last month that the average silver-priced plan was $328. For certain people, coverage is key -- for me it was mostly about price because I don't frequent doctors often.

Being 33 years old and qualifying for no subsidies (the perfect high medical cost offsetting candidate that will make Obamacare a success), I decided to go with a bronze level plan from Coordinated Health, a venture created by Centene (CNC 0.26%), which typically deals in lower-priced insurance plans and makes a killing on signing up government-sponsored members under Medicaid. Do I think the plan is fair? I could have purchased a less inclusive plan last year for at least 30% less than I'm paying a month now, but given the beefed-up minimum benefits under the new plans, I understand why the price has moved higher.

So as of Oct. 9, 2013, I am signed up to receive health insurance coverage for the first time in my life. Let's see how well the insurance exchanges held up in a few other states...

Steve's take

The Affordable Care Act is well outside my investing wheelhouse, but in no way does that make its launch any less applicable to my money.

I live in Montana, one of 36 states that chose to default to the new federal health exchange system in lieu of running their own. I'm also a relatively healthy 30-year-old who as a contract writer for Fool.com isn't eligible for health insurance under my employer.

In short, people like me represent the demographic Obamacare absolutely needs to have sign up for its insurance plans to succeed.

Then again, I already have health insurance that meets Obamacare's requirements. But I can't say I'm pleased with the stiff monthly premium and uncomfortably high deductible that comes with my current family plan.

In addition, when I signed up for the coverage in early 2013, I was mildly frustrated with the process of filling out multiple applications and digesting dozens of rate quotes. As a result, I was excited to take advantage of the relative transparency said to come with the new Healthcare.gov web portal.

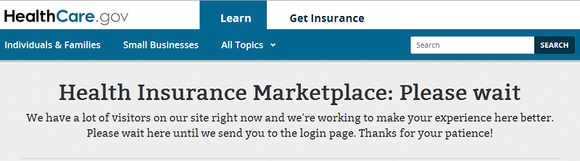

So over to the site I went, only to watch this message continually refresh for a full 32 minutes:

Source: Author's screenshot of Healthcare.gov.

So, for half an hour, I waited until the site finally directed me to the login page, where I began to complete the form to create my account.

That was, at least, until I reached the "Security Questions" page, on which I was greeted with three blank, unusable drop-down fields preventing me from going any further. Naturally, I refreshed the page hoping it would fix the problem, only to be sent right back to the "Please wait" dialog above.

Sigh.

I suppose it's not any particular surprise. After all, nearly everyone expected some glitches in the process of rolling out a universal, one-stop marketplace for tens of millions of legally obliged Americans to shop for health insurance.

Do these issues make the Healthcare.gov efforts look a little silly? Sure.

Does that make Obamacare an automatic failure? Absolutely not.

After all, open enrollment for the new 2014 plans runs for six more months through March 31, 2014. What's more, even if you do opt for new coverage through the site now, it won't kick in until Jan. 1. That gives the government plenty of time to work out the kinks, so you can bet I won't be alone in revisiting the site in the near future to see what it has to offer.

Travis' take

Like Sean and Steve, I'm a prime candidate for Obamacare. As a healthy 31-year-old who doesn't smoke and doesn't qualify for subsidized premiums, I fall into the demographic that will likely see the biggest increase in cost associated with new plans. The good news for me is that I live in Minnesota, which has the lowest-cost plans in the country.

Unlike Steve, I'll be using a state-run exchange and have been getting updates for months from the MNsure.org website about what to expect and even ballpark costs. The process wasn't seamless but worked, and it has a chance to be a huge leap forward from the old process of obtaining insurance.

The first thing investors and consumers need to understand is that buying insurance as an individual is nothing like getting it from an employer. There's no nice pamphlet with five or six plans to choose from or a simple sign-up form that you get reminders about at the end of the year. Buying individual care until the exchanges was a hodgepodge of websites, brokers, difficult-to-understand plans, and no great way to compare plans that were often apples and oranges.

The big leap forward to me for people buying individual plans this year is a standard coverage form called a "Summary of Benefits and Coverage." This single seven- or eight-page document covers what you pay for everything from a regular doctor's visit to what happens when you're pregnant. I tried to find a similar document for my current Medica plan and found a fraction of the information on a plan summary document. If nothing else, this standardized document will make it extremely easy to compare plans and costs in the future.

Getting into MNsure.org was easy enough and getting quotes for plans was pretty much painless (outside of small technical glitches in filtering). In total, I could choose from 66 plans from five insurers for anywhere from $104.58 to $253.37 per month. There were 23 bronze, 24 silver, 14 gold, and five platinum plans with a various networks, deductibles, and levels of coverage.

Compared to my current plan, I found the costs to be higher, but all of the plans are more encompassing, which shouldn't be a surprise since Medica already told me that my current plan doesn't meet Obamacare requirements for 2014.

|

|

Current Plan |

Lowest Cost Silver Plan |

Lowest Cost Gold Plan |

Lowest Cost Platinum Plan |

|---|---|---|---|---|

|

Provider |

Medica |

PreferredOne |

PreferredOne |

PreferredOne |

|

Monthly Premium |

$134.83 |

$139.58 |

$162.95 |

$174.03 |

|

Deductible |

$3,300 |

$3,500 |

$2,000 |

$1,000 |

|

Maximum Coverage |

$5 million |

No limit |

No limit |

No limit |

|

Primary Care |

$30 copay |

0% coinsurance |

$35 copay |

$35 copay |

|

Prescription Generic Drug Cost |

$5 |

0% coinsurance |

$10 copay |

$10 copay |

|

Emergency Room Copay |

$200 copay |

0% coinsurance |

0% coinsurance |

0% coinsurance |

Source: MNSure.org.

The big thing that was lacking early in the process was the ability to search for plans that would cover a certain doctor or hospital. This information was available by going to an insurer's website, but it wasn't easy to find. This is an important function for consumers because networks have gotten smaller and even very regional, which will impact costs as consumers pick plans.

I will note that UnitedHealth Group, a company that has gotten a lot of attention for not participating in many exchanges, was an option for me through its subsidiary Medica. This shouldn't be a shock since Minnesota is where United HealthCare is headquartered, but it shows that the company is available in some states. I'll also note that Medica was often one of the lowest-cost options for me.

The first few days of Minnesota's exchange weren't flawless, but they show a lot of promise for those who have to buy individual coverage. Many insurers are participating, information about plans is readily available, it's easy to access the system, and in my case costs don't appear to be abnormally high. In my opinion, that's an improvement from blindly picking plans from the first website that pops up when I Google "health insurance" even if the system isn't perfect yet.

The takeaway

I (Sean) would say there are some clearly defined takeaways from our experiences. Perhaps none is more apparent than the differences between state and federally run exchanges. Many state exchanges are working well after the first two weeks while the federally run exchanges, which are serving 36 states, are something of a work in progress. That bodes well for architects of state-run exchanges like Xerox, which helped build the groundwork for Nevada's exchange, and poorly for CGI Group, which is the contractor behind the federally run Healthcare.gov build-out; the company has had no comment on the "hiccups" thus far.

Health care access is another differentiating factor I'm seeing across the country -- and even between Steve and myself. In less-populated states, coverage costs are considerably higher because a person's access to health care is more limited. In bigger cities and counties, costs are much lower. Travis and I live relatively close to a major metropolitan city, which helps lower our premium costs. In addition, Travis and I are also seeing more competition among insurers since we're in a more populated county than Steve, helping to further lower our costs.

The final takeaway here would be that insurers are in for some short-term disappointment if they operate in federally run exchange states. Insurers like WellPoint (WLP 1.69%) and CIGNA (CI +0.00%), which spent a fortune to purchase competing insurers Amerigroup and Healthspring, are seeing only a fraction of the sign-ups they expected because of the federal exchange delays. This isn't to say these people won't eventually sign up, but the big boost that insurers were expecting this quarter may get pushed into next quarter.