Former Chesapeake Energy (CHK +0.00%) CEO Aubrey McClendon is well known for making some very bold claims about Ohio's Utica Shale. He thought the play would end up being similar to Texas' Eagle Ford Shale, but it would be economically superior to that play. Initial development of the play hasn't shown that to be true. Is that about to change?

It turns out the Utica is just saturated with a vast amount of recoverable natural gas and natural gas liquids. While it doesn't contain the high levels of oil of the Bakken or Eagle Ford, the amount of gas that can be extracted on a barrel of oil equivalent, or BOE, basis per well rivals or exceeds these two oil rich plays. This is one of the reasons why McClendon chose to return to the play with his new venture.

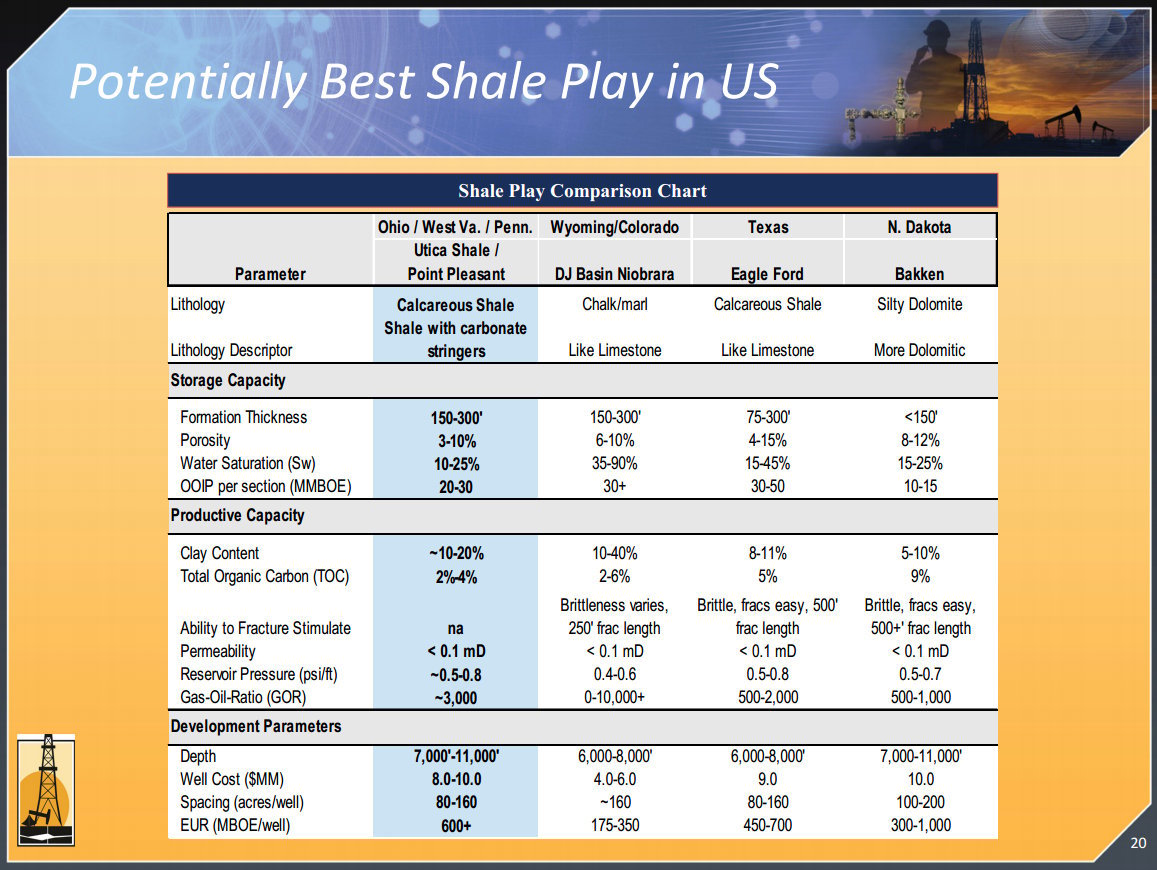

To see what I mean, take a look at the following slide from Magnum Hunter Resources (NYSE: MHR). I want to draw attention to the last line of the slide, which is the estimated ultimate recoveries, or EUR per well.

Source: Magnum Hunter Resources Investor Presentation (link opens a PDF)

The average EUR per well in the Utica is about 600,000 BOE per well, which as the slide shows does rival or exceed other liquids rich plays like Colorado's Denver-Julesburg basin and even the Eagle Ford shale. The fact that each well can recover so much natural gas and liquids, when combined with other factors such as well costs, leads to a higher internal rate of return for companies like Magnum Hunter Resources.

This is one reason why Magnum Hunter actually sold its Eagle Ford acreage earlier this year. The company saw an opportunity to cash out on the small position it had established in that play to develop something that it thought would have even better returns. The company is now able to reinvest those funds to scale up in the Utica, which is really becoming more of an entrepreneurs' play, as evidenced by the fact that Chesapeake Energy's former CEO is also pursuing the play.

Magnum Hunter Resources still hasn't released any Utica well results, however. Though, if they resemble what its peers are seeing from the play, its move to trade the Eagle Ford for the Utica should end up being a solid move. One company that should give Magnum Hunter investors hope is Rex Energy (NASDAQ: REXX), which is moving a portion of its capital from the neighboring Pennsylvania Marcellus shale into Ohio's Utica. To put some numbers behind it, investors need to look no further than Rex's recently completed three well pad in the southern portion of the play. Here, Rex Energy saw all three wells produce an average 30-day sales rate of more than 1,500 BOE per day. Those are very solid results.

These results were even better than what it saw from its last three wells in the northern portion of the play. Those wells averaged just over 1,100 BOE per day. Overall, many producers, including Chesapeake Energy, are seeing initial well results in excess of 1,000 BOE per day in the Utica. High initial results tend to be a strong signal of higher ultimate recoveries that then lead to higher returns for producers.

While the Utica Shale is nowhere near as oily as producers had hoped, its economics could end up being superior to the Eagle Ford because of higher ultimate recoveries of gas and liquids. In the end, that might make it the best play in America for smaller oil and gas producers like Magnum Hunter Resources and Rex Energy.

How to invest in the next energy boom