As investors, we're all looking to get in on good businesses -- businesses that are healthy, growing, and have an edge on the competition. But identifying such businesses isn't as hard as finding a good entry point into those investments. To help you, here are three stocks trading near 52-week lows for your entry point consideration.

Comeback in the oven?

Shares of Panera (PNRA +0.00%) have been trading in the $156 range. For perspective, that's where they were trading 18 months ago. This price is also down about 20% from summer highs.

Shares have been sliding for several months now despite very little bad news. The worst news came in July's conference call when the company announced that comp-sales growth for the 2nd quarter had slowed to 3.8%, and that restaurant traffic had actually decreased 0.5%.

Slowing traffic is concerning, but explosive unit growth -- not comp-sales -- has increased revenue, earnings, and the cash pile significantly over the last five years.

PNRA Revenue TTM data by YCharts

Unit growth is still on track for 115-125 new locations for the year -- 7% yearly growth. That should have a big impact on both the top and bottom lines. Despite this track record and the planned growth, the market is giving Panera a lower P/E ratio than it did 5 years ago, and a forward P/E of just 20. For perspective, Yum! just reported a disastrous quarter in which net income fell 68%, and yet it still trades at a forward P/E of around 18. It seems Panera is entering value territory.

Stuck in 2010 trading?

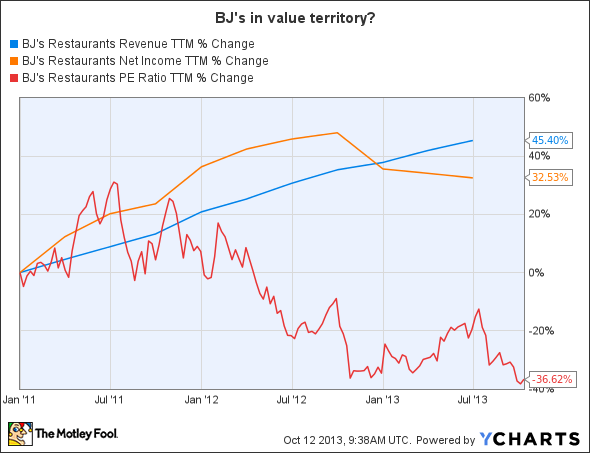

Once a Wall Street darling, BJ's Restaurants (BJRI 0.58%) has sunk over 30% to 52-week lows. Currently trading around $28, you'd have to go all the way back to 2010 for the last time shares traded at this price.

Wall Street is worried about comp-sales for the company. Historically BJ's has performed very well, but comp-sales went negative in May and June. The company has since said that this comp-sales pressure may be attributed to restaurant cannibalization due to its "clustering" opening strategy. In other words, its restaurants are too close to each other.

Yes, comp-sales are always important. No, you don't want your restaurants to cannibalize each other (especially when you're a chain of only 136 locations), but the company's cluster strategy has a benefit: the company saves money by opening new locations this way. The strategy cuts down on shipping costs, advertising, management, etc. Unfortunately, we can't quantify the savings at all. My guess is that the company is saving more money than it's losing to cannibalization.

Investors may have lost sight of the bigger picture here. With a forward P/E of only 23, this is the lowest this company has traded in years.

BJRI Revenue TTM data by YCharts

Granted, it may have been slightly overpriced with a P/E of 60 in 2011. At today's price I think it's a steal. Growth plans for 2014-2015 are already being completed, and management is planning on growth between 11%-13%. Not many companies can give you double digit growth while trading with a P/E in the 20's.

IPO too hot?

Investors like restaurant IPO's these days, and they loved shares of Del Frisco's Restaurant Group (DFRG +0.00%). Currently selling for around $19 per share, it's still up over 40% from its first day of trading, but down over 20% from July highs.

Comp-sales have been hard for the company, declining 0.2% last quarter. Most of this loss was brought on by the Sullivan's brand, where restaurant traffic declined 5%. This has been a trend for Del Frisco's and caused it to miss net income expectations. Net income declined to $2.1 million for the quarter -- 9% lower than the same quarter last year.

The good news is the company's other two brands -- The Double Eagle and Del Frisco's Grille -- have been performing very well. Comp-sales at The Double Eagle were up 4.4%, and revenues increased at the Grille by 59%. The company is performing very well overall; the portfolio is just being dragged down by the Sullivan's brand.

Management is making Sullivan's a top priority. The guest traffic issues are being addressed by things like updating the menu and remodeling the restaurant. There's plenty of reason to believe this issue can be corrected. With the rest of the portfolio already performing well, this could be a good entry point.

Conclusion

One of the most difficult aspects of investing is finding that perfect entry point. Some might see this article as a suggestion to try to catch a falling knife. I like to think of it as a disciplined investment principle of buying up good companies after significant dips. Sure, these could go lower, but I think at today's prices they're already good deals.