Opko Health (OPK +0.00%) is a polarizing stock. Bulls believe the company's growing portfolio of smaller companies will eventually put it on the map as a serious drugmaker. Bears point out that Opko generates very little revenue and that its losses are ever widening.

However, Opko stock has risen more than 140% over the past 12 months, indicating that the bulls are firmly in control. Let's take a closer look at this company to see where it might be headed.

Opko's origins

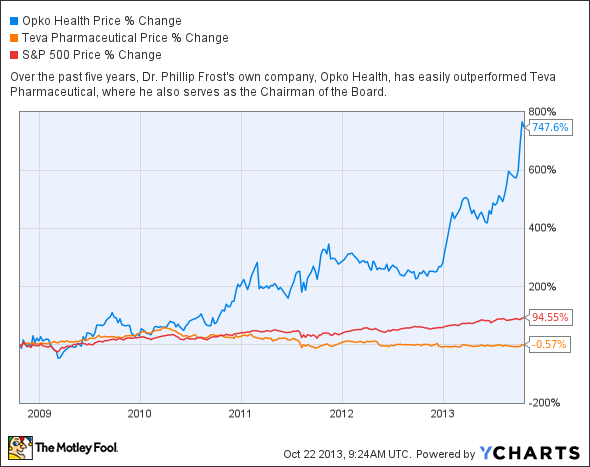

Opko's health chairman and CEO, Dr. Phillip Frost, came from Teva Pharmaceutical (TEVA 1.92%), where he still serves as the chairman of the board of directors. Frost was previously the CEO of IVAX, a manufacturer of generic pharmaceuticals, before it was acquired by Teva for $7.4 billion in 2006.

Source: YCharts.

Frost founded Opko by merging together three smaller companies. In 2009, Opko started acquiring a series of smaller companies, including a Latin American distribution business that would account for the majority of its revenue until 2013. It also acquired the maker of a compact blood analyzer and gained the rights to an Alzheimer's diagnostic test. In 2012, Opko purchased more companies in Latin America, and expanded its reach to Spain, Canada, and Israel, where it acquired a maker of hepatitis B vaccine.

In August, Opko acquired Prolor Biotech, which has drug candidates for growth hormone deficiency, hemophilia, obesity, and diabetes.

Analyzing Opko's revenue streams

Making sense of all those acquisitions can be confusing, so let's dig deeper into Opko's second-quarter earnings report for a clearer understanding of how the company generates revenue.

Opko's revenue comes three main sources -- products (point-of-care products, nutritional products, pharmaceutical products, pharmaceutical ingredients, topical medication, and veterinary products), services (lab diagnostics), and acquisitions. Many of its products are sold in Latin America and the EU.

|

Revenue Source |

Second-Quarter Revenue |

Growth (YOY) |

Percentage of Total Revenue |

|

Products |

$18.6 million |

88% |

78.2% |

|

Services |

$3.2 million |

2,188% |

13.4% |

|

Transfer of intellectual property (acquisitions) |

$2.0 million |

1,252% |

8.4% |

|

Total revenue |

$23.8 million |

133% |

100% |

Sources: Opko quarterly report, author's calculations.

Although Opko's year-over-year revenue growth is impressive, remember that Opko currently has a market cap of $4.3 billion -- and it is trading at a whopping price-to-sales ratio of 47. This means that it needs to generate a lot more revenue to justify its current lofty valuation.

Unfortunately, the company's losses are widening, and its expenses are climbing. Last quarter, Opko's total expenses surged 114% year over year to $41.8 million, causing its net loss to nearly double to $18 million.

Measuring the growth potential of Opko's new projects

To reconcile its current valuation with its stock price, Opko needs much stronger sources of revenue than its existing products and services. The company currently has four leading products, which could generate more top line growth.

|

Product |

Indication(s) |

Status |

|

Citicoline |

memory disorders related to brain injury/stroke/disease |

approved in Spain |

|

Rayaldy/Rayaldi |

secondary hyperparathyroidism, stage 3 or 4 chronic kidney disease, vitamin D insufficiency |

50% enrollment in phase 3 trial |

|

4Kscore |

prostate cancer diagnosis |

preparing for U.S. commercial launch |

|

Rolapitant |

chemotherapy-induced nausea and vomiting |

phase 3 trial by Tesaro |

Sources: Quarterly report, press releases.

To hint at citicoline's growth potential, Opko noted that sales of another citicoline product in Spain, Somazina, generated over $80 million in sales in 2012. The company also points out the citicoline enjoys strong sales across Latin America. However, Citicoline is an off-patent drug that is currently manufactured by 30 different companies, and hardly a breakthrough product that can produce guaranteed revenue.

Rolapitant is another product that should be scrutinized. Opko originally purchased the drug from Schering-Plough (now part of Merck (MRK 1.52%)) in 2009 for $2 million in cash upfront.

Opko could have been required to pay up to $27 million more to Schering if various milestones were achieved. However, Opko held onto the drug for a year without doing any clinical research on it, then flipped the drug to Tesaro (NASDAQ: TSRO) for an upfront payment of $6 million and up to $115 million in royalty payments.

That series of deals has raised some concerns, since Tesaro is now valuing the drug at $121 million -- more than four times Opko's original deal with Schering. Moreover, rolapitant isn't addressing an unmet need -- there are already plenty of medications for chemotherapy-related nausea, such as Kytril, Zofran, Anzemet, and Aloxi. There are currently generic versions of Kytril and Zofran available, whereas Anzemet and Aloxi are manufactured by Sanofi and Helsinn Healthcare, respectively.

Rayaldy is Opko's brightest hope, since current methods of treating vitamin D deficiency in patients with kidney disease can cause severe side effects, such as the accumulation of calcium, which further damages the kidneys. Rayaldy was designed to avoid these side effects. Prolor Biotech President Shai Novik stated that if Rayaldy can capture just half of the market, it could achieve annual peak sales of $6 billion.

The 4KScore prostate cancer test could be another potential winner in the United States, which Opko claims could reduce the number of unnecessary biopsies by 50%. The test launched in Europe last year.

The Foolish takeaway

Despite these possible growth catalysts, the future of Opko Health is too unclear for investors to make an informed decision.

In Frost, Opko has a well-respected and capable leader. Opko's products and services are generating impressive year-over-year revenue growth. The company has at least two new products -- Rayaldy and 4Kscore -- which could become major pillars of growth.

However, Opko is also a Frankenstein's monster of various treatments, services, and products that don't necessarily complement each other. Opko must eventually find a way to reduce its expenses and narrow its losses. Meanwhile, some of Opko's new products, such as Citicoline and Rolapitant, simply aren't impressive considering the available generic alternatives.

Last but not least, the stock trades with a P/S ratio of 47, which suggests that its market valuation might not be sustainable.