Smith & Wesson (SWHC +1.51%) has seen stock appreciation of 33% year to date, but momentum has slowed. Investors might be confused about where the stock is headed next. While short to medium-term stock price movements can't be predicted, the key to successful long-term investing is to stock with strong underlying businesses, which then leads to stock appreciation over the long haul.

Center of attention

Smith & Wesson has been at the center of attention over the past few years, which relates to tragic mass shootings and the potential for a ban on gun sales. That ban has proved to be nothing more than a threat, and that threat appears to be fading.

On the surface, this appears positive for Smith & Wesson, but it might actually slow sales. When people feel that they won't have access to something in the future, they run out and buy it before access is denied. Mortgage rates are a good example. While the 30-year fixed is still at historic lows, potential home buyers want to move now before the 30-year moves too high -- they want to lock in good rates now.

Despite the potential for a slowdown, Smith & Wesson has been performing well. For instance, first quarter sales jumped 25.8% year over year. Gross margin expanded to 42.6% versus 37.7% in the year-ago quarter thanks to higher volumes, leveraging of fixed costs, and favorable product mix.

Smith & Wesson is also optimistic about the near future. It raised its fiscal year 2014 revenue guidance to $610 million-$620 million from $605 million-$615 million. Diluted earnings per share is expected to come in at $1.30-$1.35, versus $1.18 in FY 2013.

Furthermore, Smith & Wesson recently agreed to a five-year deal with the Los Angeles County Sheriff's Department -- the second largest policing agency in the United States. The Los Angeles County Sheriff's Department is known for its rigorous testing of firearms. Smith & Wesson passed with flying colors, which is why it earned the firearms contract for its M&P Pistol Series. This contract win is a testament to the quality of Smith & Wesson products. That fact can't be argued. What can be argued is that while Smith & Wesson is an impressive company, one of its peers might offer more potential.

http://ir.smith-wesson.com/phoenix.zhtml?c=90977&p=irol-newsArticle&ID=1849691&highlight

Smith & Wesson vs. peers

Sturm, Ruger & Co. (RGR +2.06%) is a firearms company with 400 variations of more than 30 product lines. The most recent big news for the Sturm, Ruger & Co. is the purchase of a 220,000-square-foot manufacturing facility in Mayodan, North Carolina. Production will begin in the first quarter of next year. This move indicates that Sturm, Ruger & Co. is confident that demand will remain high going forward.

Cabela's (CAB +0.00%) has also benefited from the firearm buying spree. It aims to maintain its current momentum by attracting more people to its stores and website through promotions. For instance, Cabela's is currently offering an "Ultimate Outfitter Sale" that ends on October 27, 2013, and an online only "Gear Up Combo Sale" that ends on October 30, 2013. Additionally, consumers can find as much as 70% off at the "Bargain Cave," which is possible due to overstock and clearance items. The Cabela's Club program offers 0% interest for the first 12 months, then 7.99%-9.99% -- another attractive promotion.

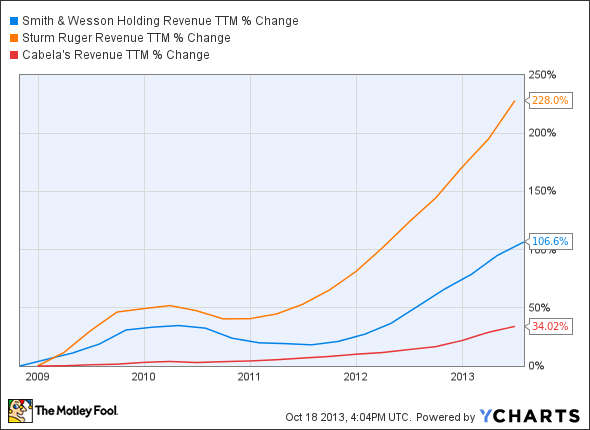

These promotions might lead you to believe that Cabela's will put itself in a precarious situation on the bottom line. You will notice in the performance chart comparisons below that Cabela's has been very strong on the bottom line in recent years while lagging on the top line. Therefore, the promotional angle makes sense. Notice that Sturm, Ruger & Co. has outperformed Smith & Wesson on both the top and bottom lines:

Top line:

SWHC Revenue TTM data by YCharts

Bottom line:

SWHC EPS Diluted TTM data by YCharts

Now consider some key metric comparisons, one of which stands out above all others:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Smith & Wesson |

8 |

14.04% |

54.52% |

N/A |

0.53 |

|

Sturm, Ruger & Co. |

17 |

15.65% |

62.42% |

4.00% |

0.00 |

|

Cabela's |

16 |

6.00% |

15.10% |

N/A |

1.73 |

All three companies offer solid fundamentals. Sturm, Ruger & Co. is the most impressive in almost every category. What really stands out is a 4% yield combined with a perfect debt-to-equity ratio. Sturm, Ruger & Co. is growing the fastest on the top line and it offers a generous yield.

The bottom line

The industry is likely to ebb and flow going forward. External events and headlines will move the stocks in one direction or the other. If you're looking for the best potential long-term investment in the group, then it's likely to be Sturm, Ruger & Co. given its exceptional return on equity, industry topping profit margin, and market beating dividend yield.