Boeing plans to increase production on its 787 Dreamliner. Photo Credit: Boeing.

Boeing (BA +0.42%) has been flying high this year despite grounded airplanes and doubts regarding its defense segment amid government budget cuts. The good news for Boeing investors is that the company doesn't look to be slowing down anytime soon, as it reported a strong third quarter and raised its guidance going forward. Investors cheered the news and sent Boeing's stock price up 5%, setting another record high. Here are a few highlights from Boeing's third quarter.

By the numbers

Starting from the top, Boeing's revenues jumped 11% compared to the same quarter last year and year-to-date revenues remain 6% higher. Boeing's operating margin jumped 30 basis points to 8.1%; it was strengthened by commercial aircraft operating margins that jumped from 9.5% last year to 11.6%. Investors should keep an eye on operating margins because there could be pressure as the company ramps up 787 production, which is currently a less mature and efficient operation.

That said, its current improved margins helped Boeing increase net earnings 12% from last year's third quarter. One of the biggest highlights was its operating cash flow, which increased 76% to $2.8 billion in the third quarter and remains 104% higher for the year at $6.8 billion. That contributed to Boeing's free cash flow more than doubling to $5.3 billion year to date.

That all equates to earnings per share of $1.51, handily beating estimates. Management is confident enough in its ability to consistently produce profits that it raised EPS guidance to between $6.50 and $6.65 for the year.

"Consistently strong operating performance is driving higher earnings, revenue and cash flow as we deliver on our record backlog and return increased value to shareholders," Boeing Chairman, President, and CEO Jim McNerney said in a press release. "Despite the uncertainty of the U.S. defense market, overall our customer-focused business strategies and disciplined execution on our programs are producing the results we expect, and our strong year-to-date performance and positive outlook allow us to increase our 2013 guidance for earnings and operating cash flow."

Why Boeing will fly higher

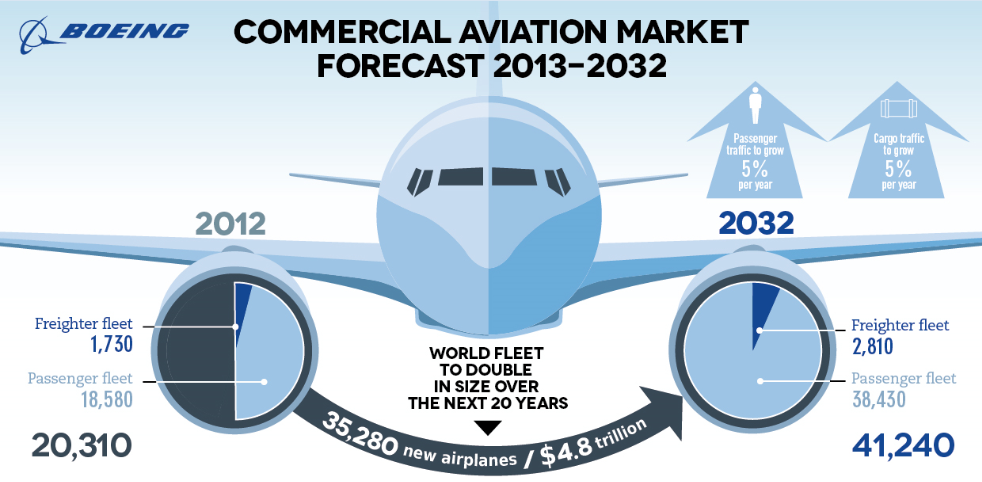

Graphic from Boeing's 20-year forecast presentation.

Boeing recently raised its 20-year forecast, predicting that global commercial aircraft demand would reach 35,280 new airplanes. That equates to a hefty value of $4.8 trillion, and Boeing should have no problem capturing its fair share of that large chunk of change. Investors are also sleeping soundly at night as Boeing's backlog of orders checks in at $415 billion, roughly 4.5 times the amount of sales for 2013. That provides a large safety cushion for revenues if government budget cuts hurts Boeing's defense segment more than anticipated. Boeing's stock is flying high this year, no doubt, and there's no reason it can't continue to produce value for shareholders in the years ahead.