The drop in gold price in the past year has taken its toll on gold producers such as Barrick Gold (ABX +0.00%) and Goldcorp (GG +0.00%). Both of these companies' shares have tumbled this year. Looking forward, however, these companies have several factors that could play in their favor. Let's start by reviewing recent developments.

In the second quarter, gold companies adjusted their long-term gold prices. Barrick reduced its long-term gold price on future projects to $1,300 per ounce. Goldcorp isn't any different, and it also revised its assumptions on the price of gold. This is why both companies saw heavy losses in the second quarter. They recorded high impairment of mining interests and goodwill provisions: Barrick's impairment provision was $8.7 billion; Goldcorp's impairment charges were $2.5 billion.

But not all gold producers have recorded these provisions: Yamana Gold (AUY +0.00%) didn't have these make impairment charges in its second quarterly report. According to the company's financial reports, Yamana believes the drop in gold prices would be partially offset by other inputs that would result in lower costs and updated mine plans.

The recent developments in the gold market including the FOMC's decision to keep its asset purchase program unchanged and the strong demand for gold in Asia could keep the price of gold from resuming its downward trend in the near future. If gold prices remain stable, these companies won't have to record additional impairment charges to their mines, and their performance will play a bigger role in their valuation. Let's review some of the reasons why these companies may have cause for cautious optimism.

Decline in costs

Barrick's all-in sustaining costs were lower than last year's by 13.3%. Moreover, the company's guidelines for 2013 are also lower than last year's, which could slightly ease the adverse effect caused by the sharp decline in the price of gold in the past year. One of the reasons for the drop in costs is the company's sale of less profitable mines. For example, the company recently sold three mines in Australia.

Higher gold production

Both companies augmented their gold production, which is likely to result in higher revenues. Goldcorp's gold production grew by 11.6%. Most of the growth came from the Red Lake gold mines and Pueblo Viejo mine, which was opened last August and is one of the largest gold assets worldwide.

Barrick's gold production grew by 3.9% but is likely to rise even faster in the coming years on account of its Pascua-Lama project. Alas, due to the drop in gold prices, the company reduced its capital expenditure on this project by $0.7 billion-$0.8 billion in 2013 and by $0.8 billion-$1.0 billion in 2014. These cuts will impede the completion due date of this project. Nonetheless, these new projects are likely to pull up revenue in the near future.

Valuation

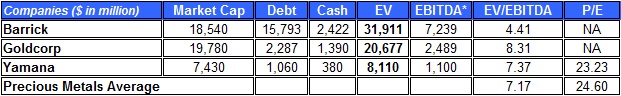

These companies' valuations have tumbled in the past several months, mostly due to the drop in gold prices. The table below shows the enterprise value to EBITDA ratio, after controlling for the goodwill and impairment charges provisions that were recorded in the past quarters. I have controlled for these provisions to consider these companies' current operating profits.

Source of Data: Google Finance, Wikinvest, and Damodaran

The table shows that Barrick's valuation is lower than the precious metals market average; Goldcorp's valuation is slightly higher than the market average but not far off. This makes Barrick the least expensive. In comparison, Yamana is close to the market average with a ratio of 7.37.

Dividend

The sharp rise in operating loss has led Barrick to cut down its dividend to an annual payment of $0.2 per share, which means its yearly dividend yield is 1.03%. But not all miners have reduced their dividends: Goldcorp's dividend hasn't changed, and its yield is much higher at 2.34%. Yamana's annual yield is also similar to Goldcorp's at 2.63%. This may have been the silver lining of the staggering drop in these companies' stock prices – the rise in their dividend yields. It's also one of the advantages of owning gold companies over gold ETF such as the SPDR Gold ETF.

Takeaway

The sharp drop in gold prices during the year has dragged down leading gold producers. Due to these changes, Barrick and Goldcorp have already adjusted their assumptions on gold prices. The projects these companies are developing are also likely to eventually pull up their revenues. Finally, their valuations are modest, making them attractive at current levels.