Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Capstone Turbine (CPST +2.64%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

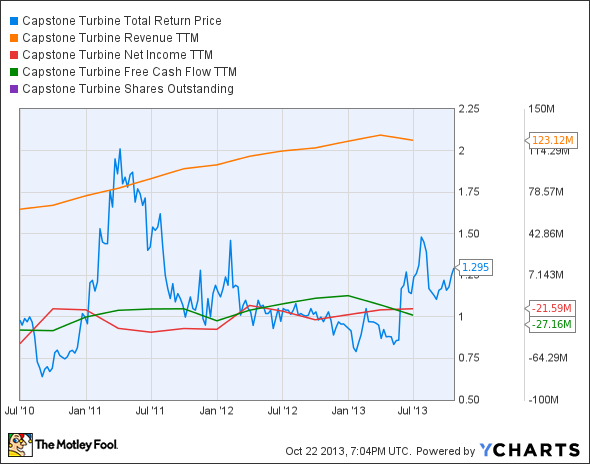

The graphs you're about to see tell Capstone's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Capstone's key statistics:

CPST Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

92.7% |

Pass |

|

Improving profit margin |

78.3% |

Pass |

|

Free cash flow growth > Net income growth |

32% vs. 58.2% |

Fail |

|

Improving EPS |

75.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

32.1% vs. 75.5% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

CPST Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

69.5% |

Pass |

|

Declining debt to equity |

183% |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Capstone puts together a strong performance by earning five out of seven passing grades, but it actually lost two grades since last year's flawless assessment. Capstone's free cash flow, which began at a higher level than net income three years ago, hasn't quite grown at the same pace as its bottom line. The company has also raised significant debt to finance its operations since last year. Is this scrappy industrial upstart on its way to green ink, or is the future still clouded? Let's dig a little deeper to see what Capstone is doing to improve.

Over the past few quarters, Capstone has done a good job identifying and supplying remote areas, such as oil and gas drilling sites, where access to the power grid isn't often available. Longtime Fool contributor Selena Maranjian notes that the company has secured several deals for its low-emission micro-turbines, and there's a healthy backlog of $136.5 million in orders. Capstone recently bagged a $6.4 million contract from BPC Engineering to deliver 100 micro-turbines for a Russian pipeline project, and also gained an order for 34 liquid-fuel C30 micro-turbines from DesginLine for Denver's electric bus fleet. The company has also gained a foothold in China with a contract, valued at more than $1.3 million, from two Chinese energy producers.

Fool contributor Tyler Crowe notes that the company has been diversifying from its traditional oil and gas turbine offerings to other generator applications. Earlier this year, Capstone installed a methane gas-fired micro-turbine, which produces electricity from coal-bed methane gas, at CONSOL Energy's (CNX 1.84%) gas processing plant. Capstone's also signed a major supplier contract to install several "dual mode" microturbines over the next two years, and recently appointed six marine distributors to expand its visibility in the marine market.

Fool contributor Rich Duprey notes that Russia's new regulations now require 95% utilization of natural gas, which is a huge market opportunity for Capstone due to the vast amounts of gas Russia has been (but no longer can) flare off as a waste product during oil drilling. That gas has to go somewhere, and Capstone's natural gas turbines are one way for drillers to meet the requirements while also ensuring their own energy needs are met. Capstone will also benefit from increasing liquids production in the U.S. -- the company secured 4.6 megawatts worth of turbine orders from two northeastern U.S. oil and gas producers this summer.

Putting the pieces together

Today, Capstone Turbine has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.