Launched just two years ago, Regeneron Pharmaceuticals' (REGN +1.88%) Eylea achieved U.S. sales of $644 million during the first half of 2013 and the company has raised the drug's US net sales forecast to $1.3 billion for the full year. Passing the $1 billion mark qualifies Eylea for blockbuster status, which is rarely achieved in such a short period of time.

Regeneron started selling Eylea for the treatment of neovascular age-related macular degeneration in November 2011. Age-related macular degeneration, the most common cause of blindness in the elderly, affects more than 2 million Americans over the age of 50 and approximately 150,000 new cases are diagnosed in the US every year.

The vision loss in wet AMD is caused by the growth of abnormal leaky blood vessels that eventually damage the macula, the area of the retina responsible for sharp central vision.

Eylea (aflibercept), is a fusion protein consisting of portions of human Vascular Endothelial Growth Factor, or VEGF, receptors 1 and 2 fused to the Fc portion of human Immunoglobulin G and produced in Chinese hamster ovary cells by recombinant DNA technology.

Eylea is administered through an intravitreal injection by a qualified physician experienced in the procedure. Since there is only 18,300 ophthalmologists in the U.S., Regeneron is targeting its marketing efforts at those specialists.

In September 2012, the FDA granted Eylea extended approval for macular edema secondary to central retinal vein occlusion. Regeneron is also conducting two Phase 3 studies, VIVID and VISTA, for Eylea in the treatment of diabetic macular edema, an indication that could double the number of potential patients eligible to receive Eylea.

Outside the US, Regeneron collaborates with Bayer on the global development and commercialization of Eylea. In countries other than Japan, the two companies share equally the profits and losses from Eylea's sales. In Japan, Regeneron receives royalty on sales. Bayer, which started selling Eylea in the fourth quarter of 2012 in Europe and other international markets, recorded sales of $160 million for the first half of 2013.

Competition

The lead competitor for Eylea is Roche's Lucentis (ranibizumab), which was approved by the FDA in June 2006 for the treatment of wet AMD. Lucentis realized U.S. sales of $1.6 billion in 2012, a decline of 8% from 2011 levels, mainly due to competition from Eylea.

In August 2012, the FDA extended the approval of Lucentis to include diabetic macular edema, and the product resumed growth during the first half of 2013. Novartis, which handles Lucentis' sales outside the U.S., sold $2.4 billion worth of the drug in 2012 and $596 million in the first quarter of 2013.

Eylea's main advantage over Lucentis is that it can be dosed every other month, as opposed to Lucentis which has to be dosed monthly. Less frequent dosing is always a benefit, especially with injections into the eye.

Doctors also use Roche's Avastin (bevacizumab) -- which is approved to treat metastatic colorectal cancer and other late-stage cancers -- off-label to treat wet age-related macular degeneration patients. Since the dose needed to treat wet AMD is very low compared to the dose need to treat colorectal cancer, the cost per injection comes down to about $50 compared to $1,800 for Eylea.

Financial Highlights

Regeneron's total revenues were $1,379 million in 2012, compared to $446 million in 2011, and its net income was $750 million, compared to net loss of $222 million in 2011.

During the first half of the year Regeneron's total revenue, including collaboration revenue from Bayer and Sanofi, rose 67% to $897 million and its net profit rose 110% to $186 million.

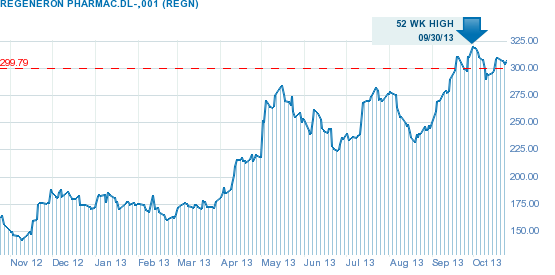

Regeneron shares have gained 76% year to date, and the company is currently valued at more than $30 billion. I like Regeneron, and I think the company has a great future, however, at a valuation of more than 7 times sales, I believe the stock might be in overheated territory right now.