For Amazon (AMZN 1.70%), it has always been a revenue story. And after reporting yet another loss yesterday, it doesn't look like that's going to change anytime soon. Even more, no one seems to care; Amazon's stock soared this morning. In stark contrast, if Wal-Mart (WMT +0.08%) reported a loss, the stock would plummet. How did Amazon earn its right to report losses?

Looking back

If anything, it looks like Amazon is doubling down on its revenue-only story.

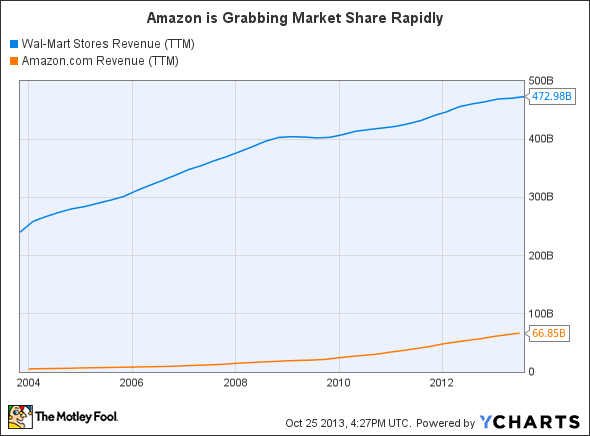

AMZN Revenue (TTM) data by YCharts.

As revenue soars, Amazon's already marginal EPS record has taken a nosedive.

To paint the picture in a different light, let's look at Amazon's total net sales in the last eight quarters compared to its total operating expenses. For deeper insight, Amazon's total operating expenses include cost of sales, fulfillment, marketing, technology and content, and general administrative costs. In other words, Amazon's total operating expenses are the general costs that it takes to run the business plus the cost of its products and services.

Source: Data from SEC filings.

Wal-Mart, on the other hand, delivers a healthy stream of profits for investors.

WMT Revenue (TTM) data by YCharts.

Wal-Mart is a consistent cash cow. Both revenue and EPS are growing fairly consistently. Even more, Wal-Mart is able to pay investors a meaningful 2.5% dividend yield. In fact, the company's cash flow is so consistent that Wal-Mart has been able to deliver 37 consecutive annual dividend increases.

All about market share

So what gives? Investors have driven Amazon's stock price up 630% in the last five years alone -- not on earnings growth, but on revenue growth. Why does Amazon get a free pass from the Street to avoid profits and focus on revenue?

Here's why.

WMT Revenue (TTM) data by YCharts.

To compete effectively with Wal-Mart, Amazon has to break some rules. One of those rules is forgoing profits for the sake of aggressive pricing and spending -- two strategies that have helped Amazon rapidly gain market share. As long as Amazon is gaining significant market share, investors will be happy with the company's strategy.

That's why when Amazon beat net sales expectations this quarter, reporting year-over-year growth of 24% instead of 21%, shares soared despite another EPS loss.

Amazon knows its business is all about scale. One day, way down the road, Amazon can tone down spending and deliver profits for shareholders. But for now (and probably for years to come), revenue will continue to be the focus.

It's in Amazon's DNA

Reviewing "The 20 Smartest Things Jeff Bezos Has Ever Said," it's clear that Amazon probably won't be seeking profits in the immediate future. Just take a look at these two quotes from Amazon's CEO and founder:

"There are two kinds of companies: Those that work to try to charge more and those that work to charge less. We will be the second."

"Your margin is my opportunity."

Don't expect Amazon's spend-everything strategy to change anytime soon.