Yesterday, the Financial Times reported that the Federal Reserve have been querying banks regarding their exposure to mortgage REITs through short-term funding markets out of concern that it poses a systemic risk. With the same Fed having set short-term interest rates at zero and suppressing longer-term rates through quantitative easing, investors have demonstrated a voracious appetite for mREIT shares, attracted by dividend yields that can reach into the high teens. Perhaps it's time those investors asked themselves: What's the nature of my exposure to these leveraged financial institutions?

One thing is certain: that exposure has multiplied over the past several years with the surging popularity of mREIT shares. The three largest, Annaly Capital Management (NLY +1.15%), American Capital Agency (AGNC +1.06%), and Starwood Property Trust (STWD +0.80%) now boast balance sheets with approximately $100 billion in total assets each. The latter two firms did not exist prior to 2008. Incidentally, $100 billion in assets is the informal threshold above which a financial institution earns the label of "too-big-to-fail."

The following figures, which I put together from data from S&P Capital IQ, illustrate the massive growth in the sector:

- During the three-year period between June 30, 2010, and the end of the second quarter, mREITs capitalized on investor appetite for their high-yielding shares, issuing $45 billion worth of common stock.

- Despite that equity issuance, the aggregate leverage ratio of the sector (total assets divided by total equity) rose from 3.7 to 6.9 during the same period. While the latter figure pales compared to the double-digit ratios achieved by investment banks during the height of the credit boom, it represents significant leverage nonetheless.

- Leverage increased because assets have risen faster than equity over the past three years, tripling to $557 billion (see graph below.)

Source: Author's calculations based on data from S&P Capital IQ.

The Fed has had its eye on the mREIT sector for some time now. Federal Reserve board member Jeremy Stein highlighted it in a February speech as a specific area of "overheating in credit markets" (part of the title of the speech):

These agency REITs buy agency mortgage-backed securities (MBS), fund them largely in the short-term repo market in what is essentially a levered carry trade, and are required to pass through at least 90 percent of the net interest to their investors as dividends... One interesting aspect of this business model is that its economic viability is sensitive to conditions in both the MBS market and the repo market. If MBS yields decline, or the repo rate rises, the ability of mortgage REITs to generate current income based on the spread between the two is correspondingly reduced.

It isn't "essentially" a levered carry trade -- it's exactly that: mREITs earn the spread between the rate they pay to borrow short term and the yield on the mortgage-backed securities they purchase, "carry" referring to the net return on the transaction.

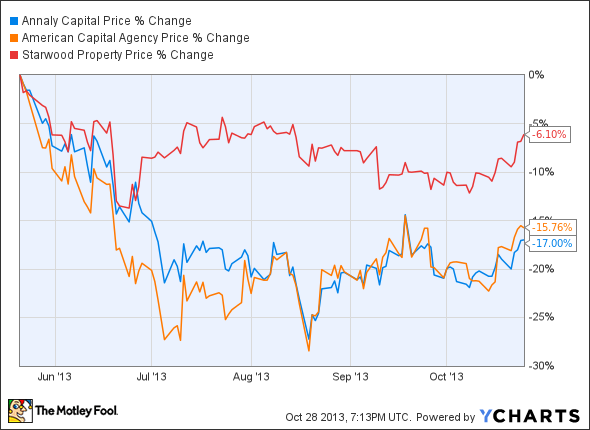

That trade works wonderfully as long as that spread is stable or increasing, but the vulnerability of mREITs' business model to adverse changes in interest rates is obvious when one looks at the price graph of the three institutions I mentioned at the beginning of the article, beginning on May 22, the day when the notion of a Fed "taper" of its bond-buying program first emerged:

When someone tries to sell me on a "free money" proposition -- which is what some mREIT investors appear to believe they are participating in -- my first reaction is to narrow my grip on my pocketbook. Perhaps it's time mREIT investors did the same.