When Facebook (FB +0.09%) first went public, investors were worried if it could effectively monetize mobile, which was experiencing rapid user growth, generating no revenue, and threatening to cannibalize Facebook's desktop-based business model. Now that 49% of Facebook's advertising revenue originates from mobile, those worries have been put to rest, and investors have moved onto newer concerns. This time, investors are obsessing over teenage engagement and the role Facebook plays in their lives. Ultimately, I'm confident Facebook will find a way to, once again, ease these concerns.

The $18 billion temper tantrum

By now, I'm sure you've heard that, during Facebook's third-quarter conference call, CFO David Ebersman told investors that, although usage among total U.S. teenagers remained stable on a sequential basis, the company experienced a decline in daily usage within its younger teenage demographic. His comments immediately erased shares' 15% post-earnings gain, translating to an $18 billion loss in market value.

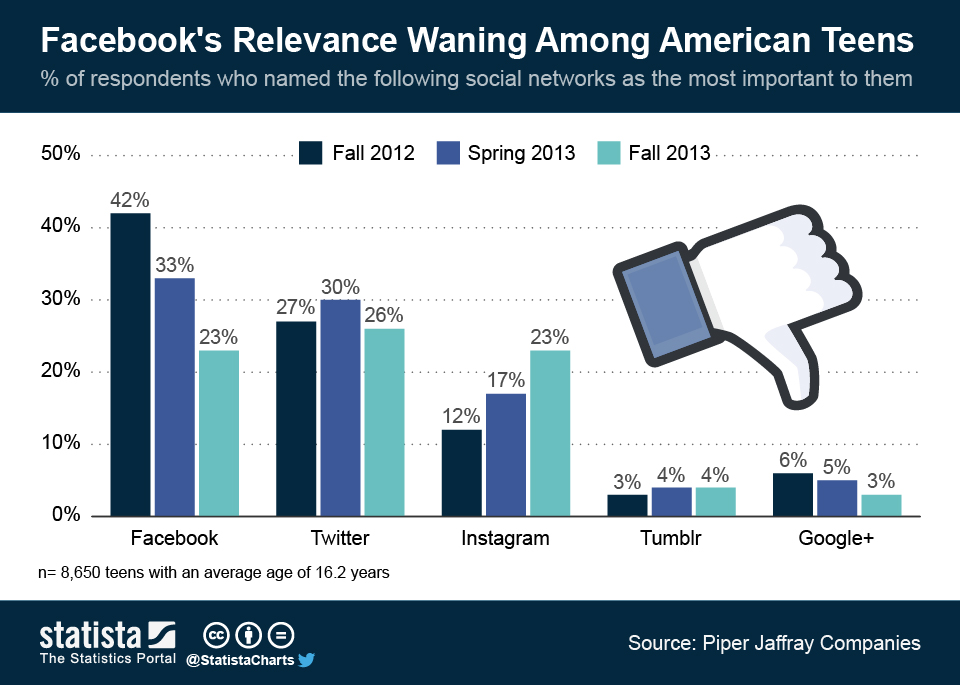

If I had to guess, chances are pretty high that Piper Jaffray's recent survey, which showed that Facebook is decreasing in importance among teenagers, added some fuel to the fire.

Source: Piper Jaffray via Statista.

A little perspective, please!

First of all, we neither know exactly how big this subset of "young teens" is, nor do we have concrete drop-off figures to mull over. Realistically, I don't think it's statistically significant enough to matter at this time, because Facebook's total user engagement level continues to rise.

Sources: Facebook and author's calculations.

By tracking the ratio of daily active users, or DAUs, to monthly active users, or MAUs, an investor can get a good sense if Facebook's platform is converting occasional users into daily users, and whether overall user engagement is on the rise. As long as the ratio of DAUs continues increasing relative to MAUs, there's little for investors to worry about here, because a more-engaged user base provides Facebook with more revenue-generating opportunities.

Getting back to the Piper Jaffray survey, it isn't nearly as bad as the headline reads, considering that Facebook owns Instagram! Combine the two entities, and Facebook's total relevancy among teens only declined by 8% in total, putting it well ahead of the competition. Although this is something to keep an eye on going forward, it reinforces the notion that Facebook likely made the right choice to fork over $1 billion to buy Instagram.

It comes with the territory

No company can fully escape investors' worries, whether they are about earnings, the economy, or teenage engagement. At the end of the day, the greatest businesses are the ones that can adapt to threats, and turn them into new opportunities. Judging by Facebook's ability to take the challenge of mobile and turn it into a massive opportunity, I'm confident that Facebook is one of the greats, and management will find a way to deal with the potential issue of teenage engagement.