TECO Energy (NYSE: TE) reported Q3 earnings on Halloween, and its top- and bottom-line misses scared some of its share value away. Let's see whether TECO Energy tricked traders -- and whether there are profitable treats in store for patient investors.

The numbers

TECO's Q3 revenue clocked in at $766 million, 10.8% below 2012's third quarter and a full 6.2% below analyst estimates. But while top lines are important, bottom-line earnings show us how much profit it ultimately pocketed. Q3 operating earnings clocked in at $0.30 per share, $0.03 below analyst estimates and the first earnings fail for the company since Q2 2012.

As earnings reports add up for utilities, there doesn't seem to be much of a sectorwide trend. Cheap and volatile natural gas prices have kept analysts guessing, and utilities have had varied success with adapting to market changes.

Exelon (EXC 0.21%) made news earlier this week when it beat earnings estimates by 18%, its largest beat since the first quarter of 2011. Exelon stock has taken a hit in recent years, but the company's strategic hedges helped it come out ahead of natural gas nightmares. But while Exelon's sales also exceeded expectations, TECO seems to be making more from less. For a peck of perspective, here's how TECO's annual sales and earnings have fared over the past five years:

TE Revenue (Annual) data by YCharts.

Beyond the numbers

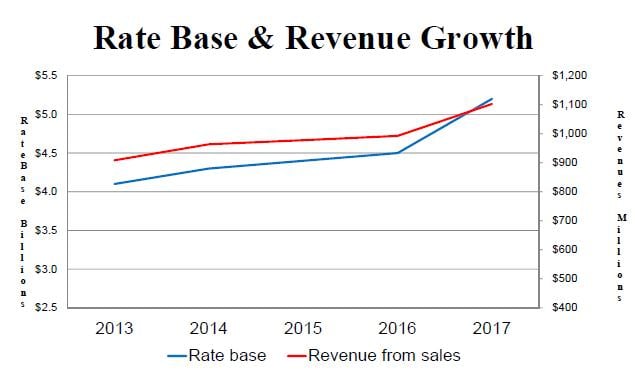

TECO Energy operates three main businesses, with another on the way. Its regulated entities, Tampa Electric and Peoples Gas, enjoyed 1.6% and 1.3% customer growth, respectively, but higher operations and maintenance expenses dulled sales increases. As rate increases go into effect, the company expects sales to head significantly higher in the coming years.

Tampa Electric's base rate has lagged when compared to fellow Florida utility NextEra Energy's (NEE 0.31%) 11% return on equity, but changes are in the works. Tampa Electric is now authorized for a return-on-equity range of 9.25% to 11.25%, putting it at a competitive level with NextEra Energy's returns.

Source: TECO Energy Q3 2013 earnings presentation.

On the unregulated end, TECO Coal sales slumped as global coal prices took a dive. While the average selling price of coal clocked in at $82 per ton, the all-in cost of sales was $84 per ton. You do the math. The division ended up leaking $1.4 million, compared to $68.7 million profit for Tampa Electric and $5.4 million profit for People's Gas.

TECO Energy is also diversifying its energy portfolio with its $950 million New Mexico Natural Gas Company acquisition. The move increases the utility's overall customer base by 50% and loosens the stranglehold that coal has historically had on this company's finances.

Despite the tough quarter, TECO is maintaining its 2013 guidance range of $0.90-$1.00 EPS. The company expects upside from Florida's recovering economy, new rates for its regulated utilities, and a slight recovery from TECO Coal. The company's staying mum on 2014 guidance for the moment, but investors can expect preliminary estimates at the Edison Electric Institute Conference less than two weeks away.

Time for more TECO?

TECO isn't an all-star utility. Investors have historically kept this stock in the dumps, and valuation metrics put it at average levels. But with increasingly regulated and decreasingly coal-centric earnings, there's significant upside for the patient investor. And if next year's growth is as good as TECO hopes it'll be, the utility is overdue for another dividend increase. Like TECO, I'm putting the past in the past and making an outperform call on my Motley Fool CAPS page. I look forward to seeing where TECO takes investors in 2014.