Disney (DIS +1.09%) might be a mature company, but it still finds ways to grow the top line. One such way is international expansion. Its primary target right now is China. This makes sense since China is seeing a rise in the middle class, which leads to more consumer spending. And considering the population of China is four times more than the population of the United States, it's safe to say that the potential is high. Disney opened Hong Kong Disneyland in 2005, but it has much bigger plans going forward.

Artist's rendering of Shanghai Disneyland Resort. Source: Walt Disney.

Shanghai Disneyland Resort

You might already know about this news, but it's possible that you don't know all the details. Plus, this isn't the only move Disney has recently made in China. We'll get to the other one soon. And we'll compare Disney, as a major entertainment company, to Time Warner (NYSE: TWX) and Twenty-First Century Fox (NASDAQ: FOXA) in order to determine which one offers the best investment opportunity at this time.

Shanghai Disneyland Resort is slated to open in December 2015 and is expected to be three times the size of Hong Kong Disneyland Resort, with a cost of $3.7 billion for the theme park and $0.7 billion in associated costs. Like its U.S. counterparts, the resort will have themed "lands," and will include performance venues, theaters, restaurants, retail stores, and two themed hotels. The park will have classic Disney characters as well as new attractions that draw from Chinese folklore and culture. Storybook Castle will be at the heart of the park, and with entertainment and dining offerings, it will be the most interactive Disney castle in the world.

The question is whether or not these attractions will drive Chinese tourists to the park. Nobody outside Disney knows every detail about the park, but in this case you don't need to know. Disney has been around since 1923 and it's the most experienced theme park operator in the world. To think that Disney might fail with its new megapark would be like saying Toyota will suddenly make a car that doesn't run well.

With Disney's brand recognition, it can grow as fast or as slowly as it wants. It's all about selecting the correct locations. Based on China's rising middle class, this location should aid the top line for Disney. Perhaps more important, it will increase brand recognition throughout Mainland China, which will then lead to more demand for Disney products, feature films, and television shows. Disney plays right into this rising demand with one of its more recent moves.

World's largest Disney store

The world's largest Disney store will also open in Shanghai in 2015. Disney sticks to logical strategies, which is just one of many reasons it's so successful. This might be a little subjective, but in my opinion the Disney stores in the United States aren't all that exciting. Disney is looking to raise the bar with this location.

This Disney store will be 53,000 square feet, and it will include advanced-technology opportunities for families to interact with Mickey Mouse, Buzz Lightyear, Luke Skywalker, and more. The plaza outside -- manicured gardens included -- will be used to host outdoor events, which are sure to attract at least some of the 40 million people in the surrounding area.

Disney stock vs. peers

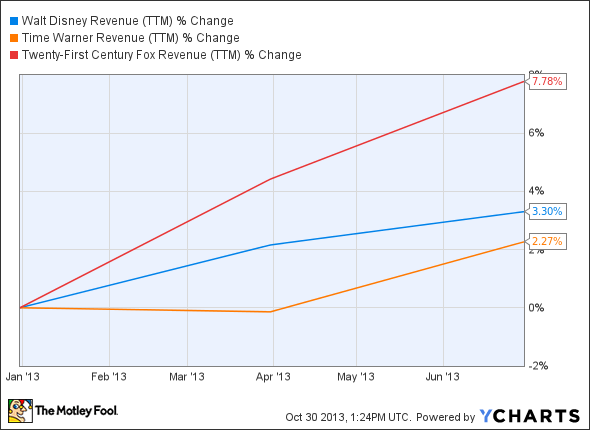

Despite its theme park strength, Disney is looked at as more of a media brand since it operates ABC, ESPN, and consistently pumps out big-name motion pictures. This puts Disney in the same arena as Time Warner and Twenty-First Century Fox. While all three of these companies have driven their top lines over the past year, one has outperformed its peers:

DIS Revenue (TTM) data by YCharts.

Key metric comparisons:

| Company |

Trailing P/E |

Net Margin |

ROE |

Dividend Yield |

|---|---|---|---|---|

|

Disney |

21 |

13.53% |

14.74% |

1.10% |

|

Time Warner |

19 |

12.09% |

12.00% |

1.60% |

|

Twenty-First Century Fox |

11 |

25.64% |

30.33% |

0.70% |

Source: Company financial statements.

If you're only looking at the numbers and top-line trends, Twenty-First Century Fox looks very appealing. Not only is it growing the fastest on the top line, but it offers the best valuation and it has been the most effective at turning revenue and investor dollars into profits. It only lags Disney and Time Warner in yield, where Time Warner is the most impressive at 1.60%. These are all top-tier companies, and it would be difficult to go wrong with any of them.

The bottom line

Disney is one of the most well-established brands in the world, which makes its odds of success for international expansion very high. The company's increasing exposure in China over the next several years will expose the company to a massive amount of consumers. Disney was already one of the best companies in the world. This strategic expansion will only make it stronger.