The Coca-Cola (KO 0.18%) vs. PepsiCo (PEP 0.81%) war is one of the greatest rivalries in corporate history, just like Apple vs. Microsoft or Facebook vs. productive work time. At the same time, these two soda giants are among the most popular and respected dividend growth companies in the market, so let's take a look at the Coke vs. Pepsi debate from an investor's perspective.

Sodas vs. snacks

When it comes to the cola wars, Coca-Cola has already won that competition a long time ago. Regular Coke has long been the market share leader and since 2010 Diet Coke is the second most sold soda brand in the U.S., relegating Pepsi to the third position.

On the other hand, PepsiCo has a leadership position in salty snacks, which provides diversification and growth opportunities for the company. Through its Frito-Lay division, PepsiCo is the world's largest snack food company, controlling almost 40% of the world's salty snack market. The North American snack business is Pepsi's most profitable segment, generating 25% of the firm's total revenue in 2012 and 40% of its operating profits.

Both companies enjoy tremendous brand power differentiating their products from smaller competitors: Coke's portfolio features 16 billion-dollar brands including Coca-Cola, Diet Coke, Fanta, Sprite, Coca-Cola Zero, vitaminwater, Powerade, and Minute Maid, among others. Pepsi owns more than 22 brands generating more than $1 billion in sales, including famous names like Pepsi, 7UP, Gatorade, Lays, Doritos, and Cheetos.

Also, both Coke and Pepsi are facing similar challenges: stagnant volume growth in developed countries due to market saturation and the trend toward healthier nutritional habits. Not surprisingly, both companies are going through parallel roads in finding a solution to their challenges: product innovation and a focus on healthier alternatives in developed countries while at the same time capitalizing on volume growth opportunities in emerging markets

Financial performance

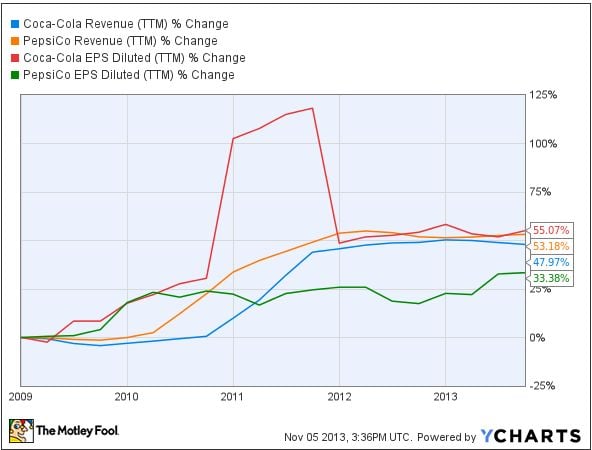

While PepsiCo has outgrown Coca-Cola in terms of revenue over the last five years, Coke is doing better than its rival when it comes to earnings-per-share growth over the same period.

Coke has considerably higher profit margins than Pepsi, in the area of 21.8% at the operating level for the soda giant versus 14.3% for the salty snacks leader. Even if both companies have seen decreasing margins due to bottler acquisitions over the last years, Coke's dominance in drinks seems to provide an advantage when it comes to margins on sales.

Coca-Cola has also done better than PepsiCo in terms of reducing share count via stock buybacks; the company has reduced the amount of shares outstanding by 4.6% over the last five years while Pepsi has not managed to reduce its share count by more than 1.3% over that period.

On the other hand, the trend could be reversing in the middle term as Pepsi's buyback program for 2013 will likely have a bigger impact on shareholder's returns.

As of the third quarter of 2013 Coke had spent $2.8 billion in stock buybacks during the first nine months of the year, and the company is planning to end 2013 with a repurchase of between $3.0 billion and $3.5 billion for the full year. Pepsi is planning to end 2013 with nearly $3 billion in buybacks.

Even if Coke repurchases $3.5 billion during the year, that would represent roughly 2% of the company's $174.8 billion market cap. While Pepsi's buyback would still be smaller in absolute terms, $3 billion would account for a slightly higher 2.3% of the company's market value around $130.1 billion.

Coke's buyback program has been bigger in recent years, but the company may be losing that advantage over PepsiCo in 2013, so it's hard to tell which company will return more capital to shareholders via repurchases in the coming years.

Sparkling dividends

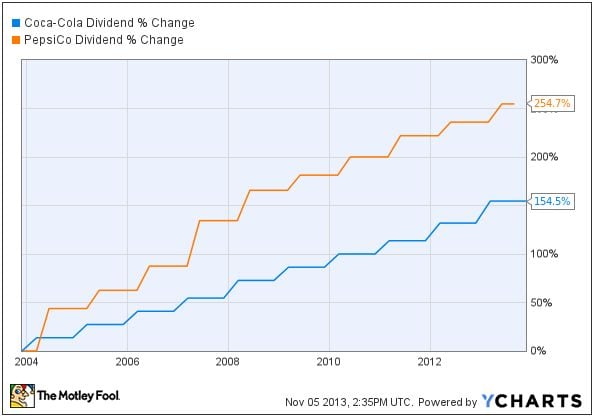

Both Coca-Cola and PepsiCo are Dividend Aristocrats, meaning they have been able to increase dividends over the last 25 consecutive years. Coke has an amazing track record of 51 consecutive dividend increases in a row, while Pepsi has a smaller but still impressive trajectory of 41 consecutive dividend increases.

When it comes to dividend growth, however, Coke has a better trajectory than Pepsi over the long term, and the company also delivered a bigger increase for 2013 with a 10% hike versus Pepsi's 6% dividend rise for the year.

At current prices, Coke yields 2.83% in dividends versus a similar 2.69% for PepsiCo, and both companies have sustainable payout ratios in the area of 56% for Coke and 51.5% for Pepsi.

And the winner is...

Both Coca-Cola and PepsiCo have earned their rights to be among the most popular dividend growth names in the market due to their rock-solid competitive strengths and time-tested dividend growth trajectories.

However, Coke has been able to deliver superior dividend growth over the last few years thanks to its higher profitability and earnings growth rates. Valuations are very similar so, for the same price of a Pepsi, I'm having a Coke.