There's good reason for investors' keen interest in the additive manufacturing -- aka 3-D printing -- space. This disruptive sector is projected to grow 20% to 30% annually for the next five years. But like many hot stock sectors, this one harbors a lot of misinformation. Let's put one fairly widely held false belief to rest: Proto Labs (PRLB +0.57%) is not a 3-D printing play..

Proto Labs is a service provider which uses subtractive -- not additive -- manufacturing.to rapidly produce custom metal and plastic components for others. Subtractive manufacturing involves using machinery to whittle away at a sheet or hunk of material. The machinery can be modern and computerized -- as in Proto Labs' case -- or manual. Additive manufacturing (or "3-D printing"), which companies such as 3D Systems (DDD 2.05%) and Stratasys (SSYS 0.33%) use, builds up a part layer by layer.

Even Investors Business Daily, a well-respected publication, has called Proto Labs a 3-D printing company. Additionally, Structured Solutions and STOXX, leading providers of financial market indices, have both included Proto Labs in their 3-D printing industry indices, according to ETF Strategy.

Why the confusion?

It seems a fair number of people equate "prototyping," especially rapid prototyping, to "3-D printing." So the company's name is likely part of the issue. Nonetheless, prototypes were made using subtractive manufacturing long before additive manufacturing entered the scene, and are currently produced using both methods.

Additionally, Proto Labs has only been a public company since Feb. 2012, so lack of familiarity is surely at play.

Proto Labs' niche is the quick-turnaround of smaller production runs, though it also produces prototypes. It uses computer numerical control, or CNC, machines to produce metal components and injection molders to churn out plastic ones. CNC machining is a subtractive manufacturing technology.

Ironically, Proto Labs is using technology that 3-D printing is largely replacing. Though don't let that scare you from considering investing in promising subtractive manufacturing plays, as subtractive manufacturing isn't going to disappear, in my opinion. There are benefits and drawbacks to both types of manufacturing. Subtractive manufacturing will surely contract, as additive manufacturing expands. However, that should just shake out weaker companies.

Proto Labs subtracts, but its business and metrics add up

Proto Labs is in a fragmented industry, largely comprised of smaller, private companies. While there might be a few public companies that have some overlapping operations, there are no comparable competitors. That's often a sign a company has a solid moat around its niche and will sport strong numbers.

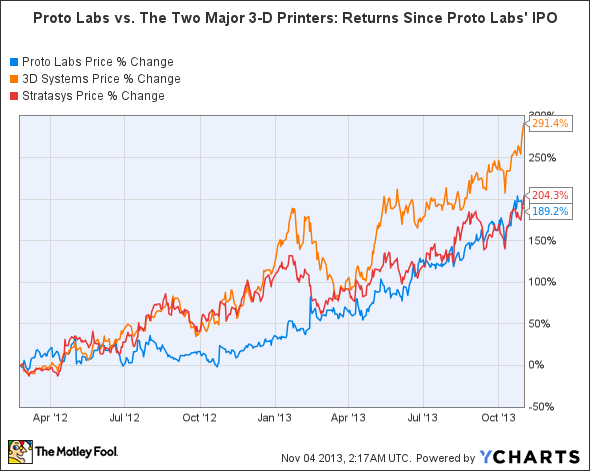

Since its IPO, Proto Labs' stock has given the hot 3-D printers' stocks a run for their money. It's been performing in-line with Stratasys (SSYS 0.33%), the second largest 3-D printing company by market cap, and holding its own against the largest industry player 3D Systems (DDD 2.05%).

Revenue

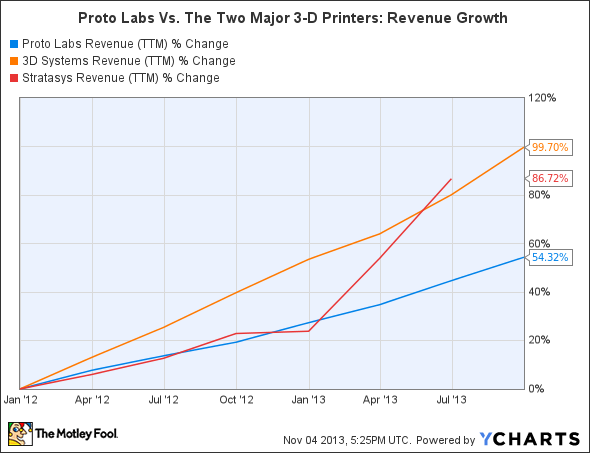

Proto Labs' revenue growth is solid, though not as strong as that of the two major 3-D printers. However, as those following the 3-D printers know, 3D Systems has been gobbling up smaller companies at a frenetic pace.

While it seems to be doing a decent job incorporating acquisitions into its fold, a growth-by-acquisitions strategy can present concerns. Proto Labs' revenue growth was in-line with Stratasys' until Stratasys' merger with Objet in late 2012.

Proto Labs and 3D Systems recently reported third-quarter results, while Stratasys is slated to report on Nov. 7. That's the reason Stratasys' chart is one quarter short of the others.

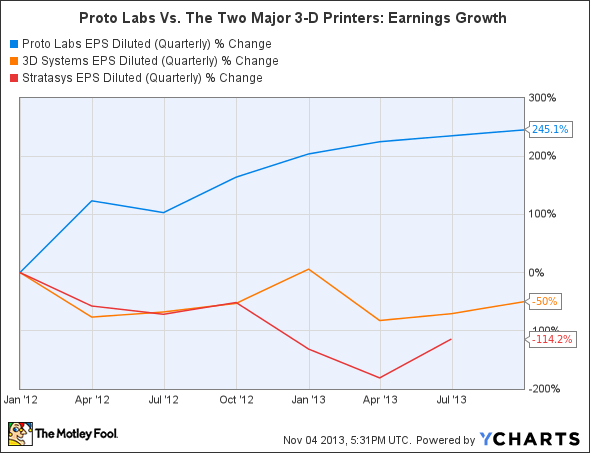

Earnings

Proto Labs' earnings-per-share growth has been stronger than its revenue growth, meaning margins have been expanding. This margin expansion has largely owed to the company's ability to quickly turn around jobs for customers. This competitive advantage provides it with pricing power.

Meanwhile, the two 3-D printer companies have experienced negative earnings growth. Stratasys' profitability was negatively affected by the Objet merger, and the company is currently not profitable, on a GAAP basis. However, analysts expect it to return to profitability in 2014. 3D Systems' earnings growth has suffered due to its frequent small acquisitions. However, it's still solidly profitable, with a trailing-12-month profit margin of 9.5%.

Valuation

Proto Labs' strong growth, a pristine balance sheet (the company has close to no debt and a solid cash position), and fat margins (nearly 22% profit margin on a trailing-12-month basis) don't come cheap.

The stock is valued at a forward P/E of 47.4 and a five-year price-to-earnings-to-growth, or PEG, of 1.9. While that may seem pricey, it's a bargain compared to the 3-D printer stocks. Granted, the 3-D printing sector has more growth potential; however, I think we could see some intense pricing competition on the consumer and, perhaps, professional end of the sector, which will likely result in margin contraction. It's easier for larger companies to enter these markets -- as Hewlett-Packard just did -- than it is for them to enter the industrial end of the 3-D printer market.

Meanwhile, Proto Labs has solid barriers to entry, which extend beyond setup costs. The company is known to be extremely efficient, and a newer entrant would likely not be able to to match its quick-turnaround capabilities for quite some time.

A prototypically potent investment

Remember to be somewhat skeptical of what you read when technically oriented stocks are involved, especially when they're in hot stock spaces.

If your investing goal is to gain exposure to the 3-D printing space, you should "subtract" Proto Labs from your watch list. However, if your goal is to invest in a promising stock, regardless of industry classification, Proto Labs certainly deserves a look.