International exchange-traded funds (ETFs) can be a smart addition to any well-balanced portfolio. An international ETF is a listed fund that holds stocks from countries outside the U.S.

While U.S. stocks have outperformed over the past decade, that hasn’t always been the case. Savvy investors often keep some exposure to international ETFs to hedge against periods when domestic markets fall behind.

You can also look back to the so-called “lost decade” from 1999 to 2009, when international stocks solidly outperformed U.S. equities.

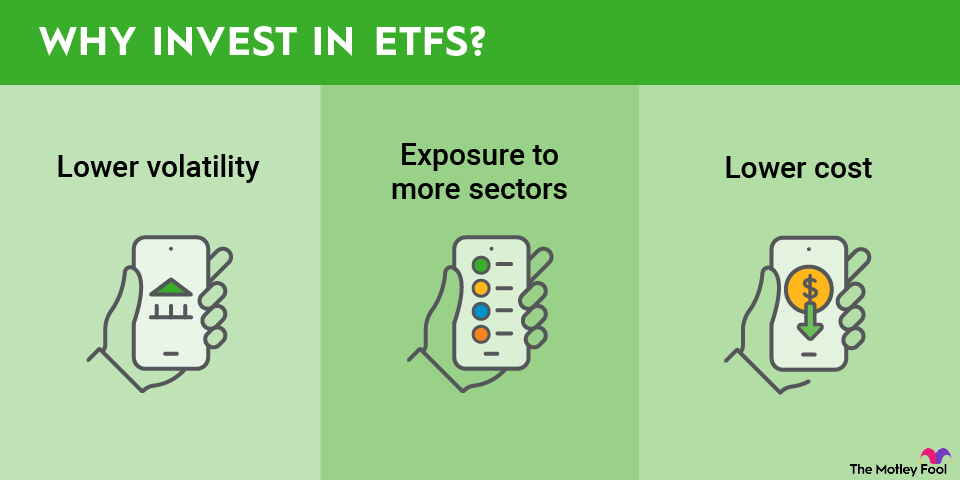

You don’t need to buy individual foreign stocks, American Depositary Receipts (ADRs), or Global Depositary Receipts (GDRs), which can come with complexity and higher costs. International equity ETFs handle the heavy lifting for you and usually come with lower fees than the mutual funds many investors used in the past.

Here’s a look at some of the top international equity ETF picks available today.

The best international ETFs in 2026

What’s best will depend on your risk tolerance, time horizon, and investment goals -- but virtually all investors are well served by broad diversification, low fees, and tax efficiency.

The following international ETFs offer solid exposure, strong liquidity, and reasonable costs, making them smart building blocks for global diversification.

1. Vanguard Total International Stock ETF

NASDAQ: VXUS

Key Data Points

2. Vanguard FTSE All-World ex-US Small-Cap ETF

NYSEMKT: VSS

Key Data Points

Most international ETFs are market-cap-weighted, meaning larger companies make up a bigger portion of the fund. This provides stability but can limit growth potential since small-cap stocks tend to be riskier but offer higher expected returns over time. If you want to tilt toward international small caps, the Vanguard FTSE All-World ex-US Small-Cap ETF (VSS +0.73%) is a solid option.

It tracks the FTSE Global Small Cap ex-US index, holding more than 4,800 global small-cap stocks with a median market cap of $2.1 billion. You can expect more volatility compared to large-cap international ETFs, and performance has reflected that -- it has returned 7.51% annualized over the past 10 years. Still, it’s affordably priced with a 0.08% expense ratio.

3. iShares Core MSCI EAFE ETF

NYSEMKT: IEFA

Key Data Points

You can break international markets down not just by country but also by classification -- developed or emerging. Developed markets typically have more mature economies, stable political systems, and well-regulated financial markets.

The iShares Core MSCI EAFE ETF (IEFA +0.07%) covers this segment by tracking the MSCI EAFE IMI Index, which holds more than 2,600 stocks from developed markets across Europe, Australasia, and the Far East -- hence the EAFE acronym. That includes countries like Japan, the United Kingdom, France, Germany, and Australia. This ETF has delivered a 10-year annualized return of 8.29% and charges a low expense ratio of 0.07%.

4. SPDR Portfolio Emerging Markets ETF

NYSEMKT: SPEM

Key Data Points

5. Schwab International Dividend Equity ETF

NYSEMKT: SCHY

Key Data Points

One thing income investors will appreciate about international equities is their tendency to offer higher dividend yields compared to U.S. stocks. If you’re looking to diversify globally while collecting above-average payouts, The Schwab International Dividend Equity ETF (SCHY +1.17%) is worth a look. It tracks the Dow Jones International Dividend 100 index, which screens for companies with at least 10 consecutive years of dividend payments.

Then, the Schwab International Dividend Equity ETF applies a composite score based on free cash flow to total debt, return on equity, dividend yield, and five-year dividend growth rate. The result is a portfolio with a strong 3.91% 30-day SEC yield. It hasn’t been around long enough to show a 10-year track record, but its 0.08% expense ratio is highly competitive in the international dividend equity space.

Related investing topics

Should I invest in international ETFs?

Investing in international ETFs is about balance, not chasing returns. The biggest reason to include them is diversification. When you hold stocks from outside your home market, you reduce your exposure to a single economy or currency.

If the U.S. stumbles, international equities -- especially from regions like Europe or Asia -- can offset some of that weakness. They also give you access to different sectors, consumer trends, and economic cycles that may not exist domestically.

Another advantage is valuation. Many international markets currently trade at lower price-to-earnings (P/E) ratios than North American equities, meaning investors may be getting more earnings for each dollar invested. Combined with a weaker U.S. dollar, that could support stronger relative returns over time.

However, there are trade-offs. International ETFs add currency risk, since foreign currencies fluctuate against the dollar. Economic and political instability in certain regions can also create volatility, and growth in many developed markets outside North America tends to be slower.

Overall, international ETFs make sense for most long-term investors who want broad, global diversification. A reasonable target is to allocate roughly 30% to 40% of your equity portfolio to international markets. That level keeps your portfolio globally balanced without overexposing you to foreign risks.

How to choose the best international ETF

Start by defining the exposure you want. Some investors prefer a single-country ETF, others target a specific region such as Europe or Asia, and some want broad exposure to everything outside the U.S. Being clear on this upfront helps narrow choices quickly and avoids unintended overlap.

Once exposure is defined, decide between passive indexing and active management. Passive ETFs track an index and tend to offer lower fees, greater transparency, and predictable exposure. Actively managed ETFs aim to outperform by selecting securities, but typically come with higher costs and manager risk.

Liquidity and fees are critical. Look at the expense ratio and the 30-day median bid-ask spread. These together represent the ongoing and transaction costs of owning the ETF. International ETFs, especially those targeting smaller markets, can have wider spreads than U.S. funds.

Finally, determine how the ETF fits into your broader portfolio. Decide how much of your total allocation you want in international equities, what role the ETF plays in diversification, and how often you plan to rebalance. Having a long-term plan reduces reactive decision-making when markets move.