Exco Resources' (NYSE: XCO) deal to buy assets from Chesapeake Energy (CHK +0.00%) earlier this year was an extremely complicated one, so don't feel bad if you haven't quite figured it out yet. Based on the oil and natural gas producer's recent conference call, many of the top analysts from financial institutions are still trying to wrap their heads around it as well. As we start to learn the details on the entire project, there is one point that seems clear: The biggest winner in this deal wasn't Exco Resources, but rather partner Kohlberg Kravis Roberts (NYSE: KKR).

A refresher on the buy

The $1 billion deal that Exco did with Chesapeake in the second quarter of this year was actually two separate sales wrapped into one. One was $288 million for Chesapeake's acreage in the Haynesville shale, which either increased Exco's working interest on land it already operated on, or added abutting acreage to its current holdings. This simple deal actually makes a lot of sense for Exco.

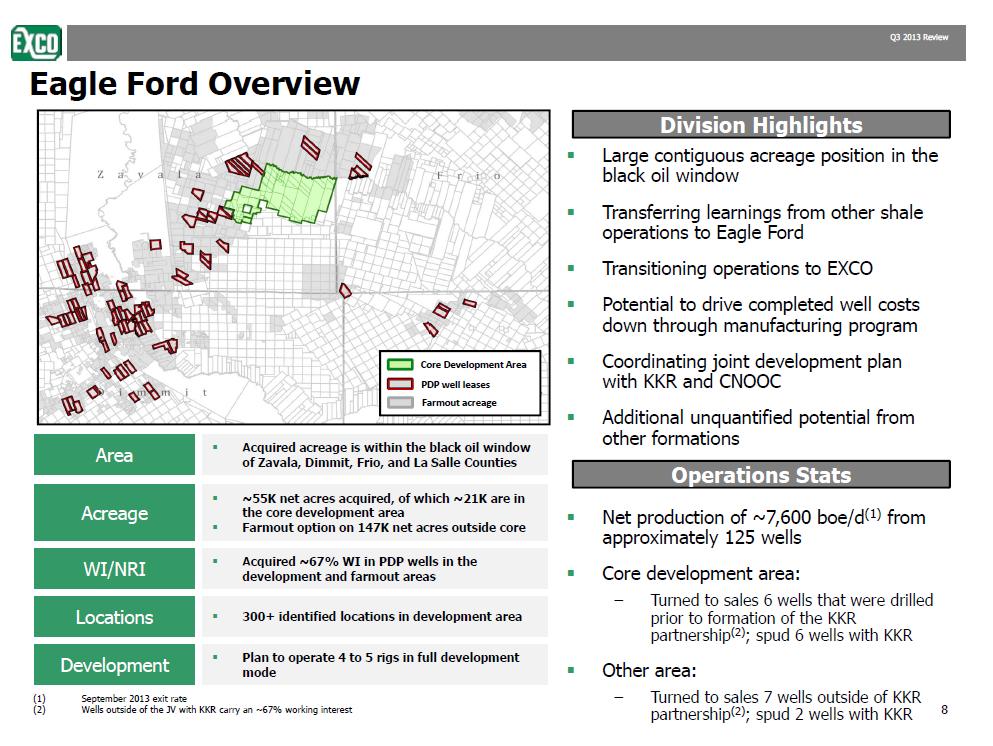

The other side of the deal involves acreage in the Eagle Ford, and that is where things get hairy.

In this deal, Exco netted 55,000 acres on which Chesapeake was the primary operator and CNOOC (CEO +0.00%) had a 33% working interest. Of those acres, 21,000 were undeveloped and the remaining was held by production totaling 7,600 barrels per day of oil equivalent net to Exco.

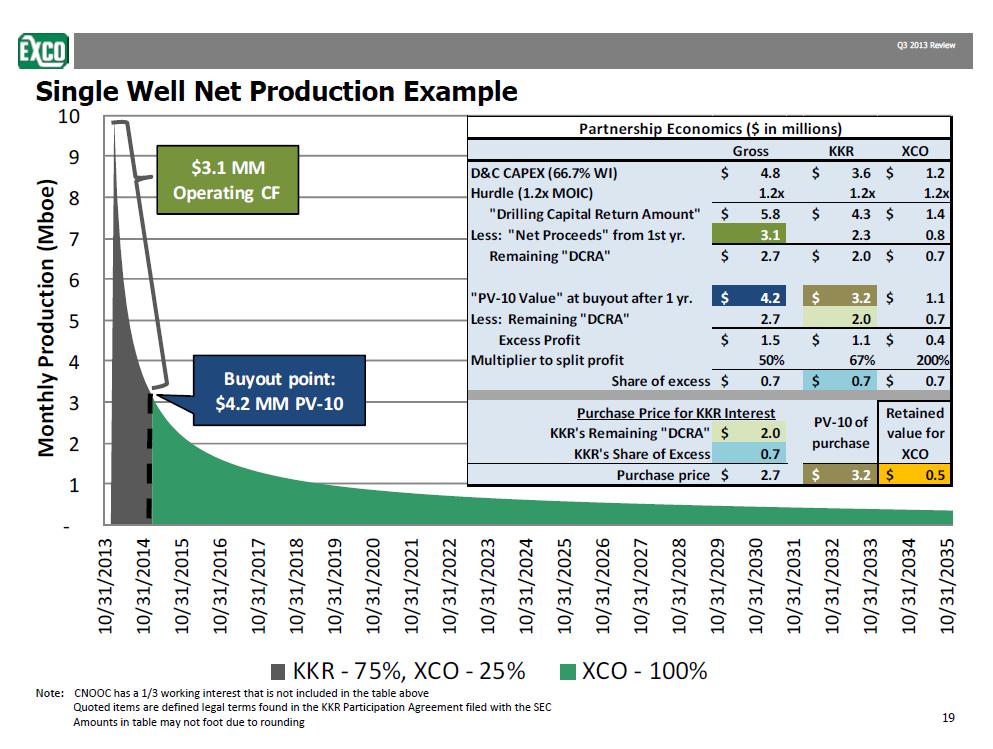

Once this part of the deal was done, Exco immediately turned around and sold half of its stake in the undeveloped area to KKR. That company will pay 75% of the partnership's drilling expenses for the 300 identified well locations in the undeveloped acreage, and KKR will receive 75% of the partnership's oil -- 50% of total production when you consider CNOOC's portion -- for the first year these 300 wells are producing. After one year of production, KKR has the right to sell those wells back to Exco based on their net present value at that time minus the revenue it generated from oil production in that first year. Also, KKR's capital return on those wells is limited to 120% the drilling costs.

If you are scoring from home, that means Exco spent $685 million for assets in the Eagle Ford producing 7,500 barrels oil equivalent per day, sold $269 million of it to KKR, and then promised to buy each well back one at a time for a total of approximately $795 million. For the first year of production -- a shale well's most productive time -- Exco has a 16.7% interest.

Winner, winner, chicken dinner

The only image that comes to mind when I think of KKR's management team involves Kool & the Gang's song "Celebration" playing in the background, because this deal is great for the company. Sure, it has to foot a large share of the drilling costs, and the company's return on invested drilling capital is 20%, but there are two critical things that make this a great deal for KKR:

1) It doesn't have to sell the rights back to Exco if it doesn't want to.

2) It has a "capped" return of 120% on drilling expenses.

The first item is pretty simple, it is basically a protection from oil prices dropping. If the company does not have to return those wells if it prefers to hang on to them. If KKR does wish to sell them back, then Exco is obligated to make an offer. Not only does this give KKR immense upside if the well produces phenomenally, the company is also protected on the downside because the price it gets back is based on how much it spent on the well and not the economic value of the well.

The second part may sound great for Exco to ensure it doesn't pay too much for what will then be a mature, tight oil well, but lets put it in context. EOG Resources (EOG 1.57%) is the top driller in the Eagle Ford today and has been stellar at keeping well costs down while learning how to get more out of each well. Even as the top player, EOG is netting a 12.3% return on capital employed based on $100 a barrel for West Texas Intermediate crude. So basically Exco is offering a deal that pretty much guarantees KKR a return on capital employed that is almost unheard of in the Eagle Ford region, and KKR gets it after only one year.

What a Fool believes

The Eagle Ford shale has been the fastest growing shale play in the U.S., but we have only been drilling in this area for only a couple of years. So there are still questions on how wells will perform two to three years after completion. It is very possible that these wells will have a very long shelf life and will be a cash generator for Exco in the long run. Over the next couple of years, though, KKR will be taking this Eagle Ford deal to the bank.