This week, Wal-Mart reported a pretty disappointing quarter and said the holiday season would be even more competitive than we expected. Same-store sales in the U.S. were down 0.3% at Wal-Mart stores last quarter, and Sam's Club experienced just a 0.1% rise. Wal-Mart said it would be fighting for every dollar it could from consumers, but investors should wonder if this is this a precursor to a terrible holiday season.

So far, the market has barely reacted, and the Dow Jones Industrial Average (^DJI +0.16%) was actually up 1.3% for the week. Year to date, the Dow is up 24.5%, but can this continue if consumers aren't spending this holiday season? While Wal-Mart isn't a perfect bellwether for the Dow, it is a measure of how the broader economy is doing. If Wal-Mart is struggling, it's bad for every stock on the market, isn't it?

That may not be the case anymore.

Holes emerge in Wal-Mart's plans

Wal-Mart just reported its third straight quarter of falling same-store sales, usually the first sign a retailer is in trouble. Wal-Mart's plan to fix its problem includes cutting costs, which is part of its problem in the first place.

Image: Wal-Mart.

I highlighted last month that both Target (TGT 0.95%) and Costco are outgrowing Wal-Mart, in part because they have better merchandise and better stores. Cutting costs will only make the problem worse.

There have also been plenty of reports of low inventory at Wal-Mart and not enough staff. If there's a way to make falling same-store sales get worse, it's by having less inventory and fewer staff.

Wal-Mart's problems may be self-inflicted, but that doesn't mean it will be a great holiday for retailers.

The economy isn't helping anyone

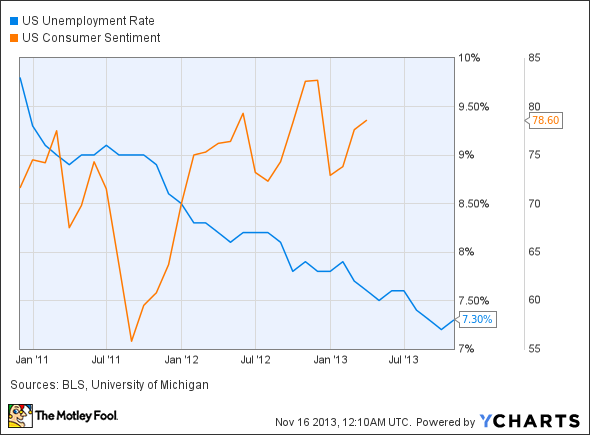

From a macro perspective, the economy is going to hurt retailers. Unemployment is still high, and consumer confidence has been down recently, suggesting that consumers may choose to spend a little less this holiday season. The top end of consumers are still generating an outsized portion of the growth in the economy, which means that discount retailers are going to struggle.

U.S. Unemployment Rate data by YCharts

But the bigger factor affecting retailers such as Wal-Mart and Target will be the growth of online retail. Amazon.com (AMZN +1.63%) isn't expecting a bad holiday season, and that's bad news for traditional retailers.

Something's got to give

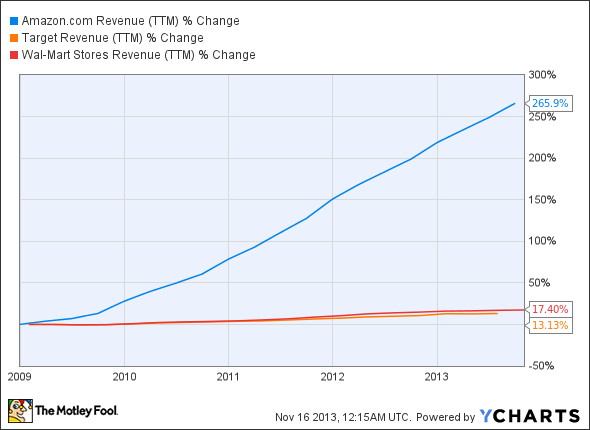

Online sales are growing, and those sales have to come from somewhere. Amazon has vastly outgrown Wal-Mart and Target over the past five years, which wasn't a big deal when Amazon was a $7 billion company -- but it is a big deal now that it has $70 billion in sales.

AMZN Revenue (TTM) data by YCharts

Each percentage point of growth for Amazon is a loss for discount retailers. This is a zero-sum game, and not everyone can grow on the back of limited consumer dollars. If Wal-Mart or any other brick-and-mortar retailer wants to complain about sales growth this holiday season, it may be better to look at online retailers rather than the death of the consumer.

Foolish bottom line

Given weakness in the economy as a whole, I don't think any retailer should expect outstanding numbers this holiday season. But we can't assume that just because Wal-Mart does poorly, the rest of the retailers are having a bad year. They may just be losing sales to online retailers.

When you're reading sales figures this holiday season, keep in mind the growth of online sales. Even flat same-store sales may be a win for brick-and-mortar retailers this year. After all, where are you spending your holiday dollars this year?