Boeing's 787 Dreamliner. Photo: Boeing.

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes – just in case they're material to our investing thesis.

What: Shares of Spirit AeroSystems (SPR +0.00%) surged nearly 5% during points of trading before settling down to finish the day up nearly 3% at closing and an additional 1.3% after hours. The trend was likely due to Boeing (BA 0.02%) dominating the aviation show in Dubai and receiving more 787 Dreamliner orders, for which Spirit supplies vital parts.

So what: Spirit AeroSystems manufactures vital airplane parts such as the fuselage, wing, and propulsion systems. Spirit currently has long-term contracts with aviation juggernauts Boeing and Airbus that represent roughly 95% of company revenue. As Boeing continues to ramp up production of its 787 Dreamliner, Spirit will be positioned to have stronger revenue growth.

The real good news for Spirit is that Boeing's 787 Dreamliner keeps pulling in orders, meaning more revenue security and potential for Spirit. Boeing received its 1,000th customer order today when Etihad Airways announced an order for 30 787-10 Dreamliners valued at $8.7 billion.

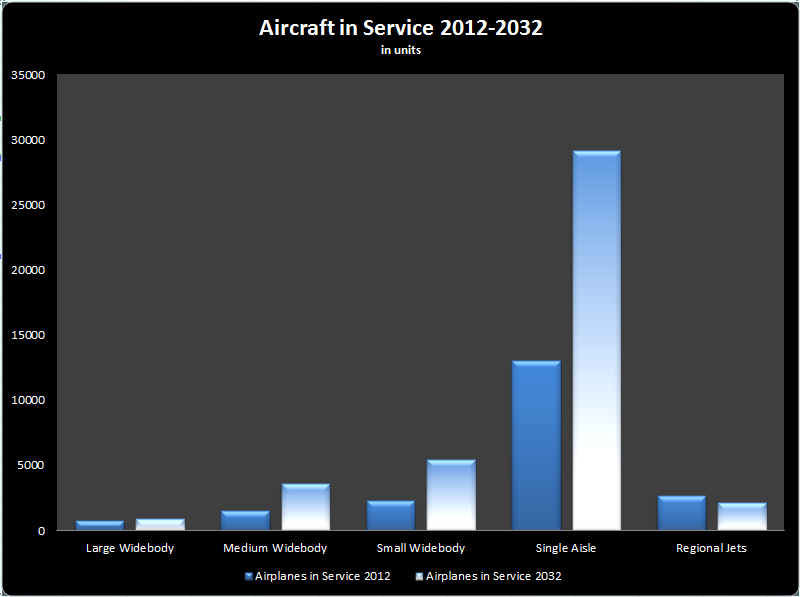

Now what: Aside from today's good news regarding more Dreamliner sales, Spirit AeroSystems is well positioned to drive strong revenue and profits from growing demand for single-aisle airplanes. Spirit AeroSystems delivers better operating margins from its single-aisle operations and that's great news when you see the projected demand in the segment.

Graph by author. Information from Boeing's 20-year forecast.

Spirit AeroSystems is fresh off its third quarter, which handily beat Wall Street estimates. Spirit's revenue came in at $1.5 billion, which was 10% higher than last year and its earnings per share came in a full nickel ahead of estimates at $0.65. That's a night and day improvement from last year's $0.54 net loss.

The company also posted free cash flow of $128 million for the quarter, almost four times the amount of cash it produced in the previous year's third quarter. Going forward, it expects to produce more consistent earnings and cash flow as CEO Larry Lawson is focusing on cutting costs and generating more sales.

What to watch: Despite the bright future amid a commercial aerospace cycle that's in a solid upswing, there are a few things potential investors need to keep an eye on. First, due to delays and design changes among developing programs last year, Spirit took charges that totaled $610 million across six programs. That's just part of the business for Spirit, but it can at times affect bottom-line profits.

Another thing for investors to consider is Spirit's relatively weak negotiating position in its contracts. As Boeing and Airbus combine for 95% of Spirit's revenue, and a majority of it represented by Boeing, it can leave Spirit vulnerable in negotiations as Boeing's business is critical to Spirit's success.