The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

Today, I'm taking a look at one of the most generous dividend yields among the 30 Dow Jones (^DJI 0.09%) blue-chip components. Say hello to pharmaceuticals veteran Merck (MRK +0.81%) and its current 3.6% dividend yield.

That figure places Merck just below the Dow's two telecoms in terms of dividend generosity, virtually tied for third place with Intel (INTC 0.79%). It's certainly a strong payout, but that doesn't make Merck a no-brainer choice for income investors. Merck's dividend policy comes with some serious flaws.

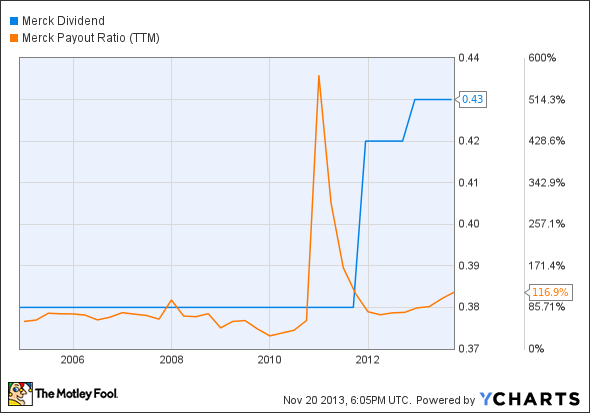

This chart will show you the two most serious red flags that hover over Merck's dividend policies:

MRK Dividend data by YCharts

Infraction No. 1: Merck isn't really into growing its dividends. The size of its quarterly checks flatlined for nearly a decade, and they have only increased by 13% in the last couple years.

Infraction No. 2: Merck really can't afford to raise its dividend payouts. The company already spends more on these distributions than it collects in net earnings. It's the third highest such ratio on the Dow -- behind AT&T and Verizon -- and this is a case of small numbers beating big ones.

The picture changes if you move from non-generally accepted accounting principles earnings to consider the dividends as a fraction of Merck's free cash flow. But it's not a drastic difference: Merck spends 61% of its free cash flow on dividend payments, which is still in the top quarter of all Dow components.

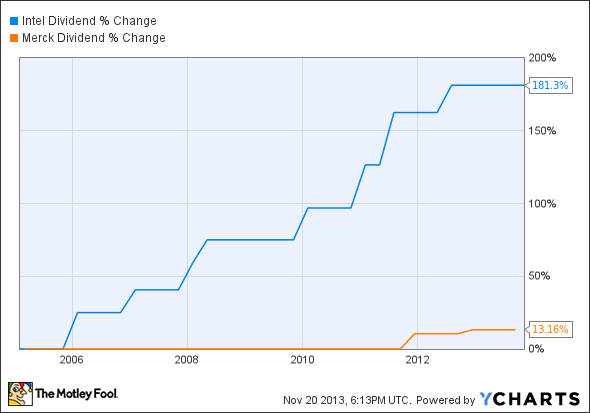

By comparison, Intel's cash-based payout ratio is just 43%, leaving lots additional room for future dividend increases. Not to rub salt in Merck's wounds (the company would prefer a generous layer of Coppertone), but Intel has absolutely crushed Merck's timid dividend increases over the last decade.

INTC Dividend data by YCharts

There may be many good reasons to invest in Merck, but the dividend policy isn't one of them. Look away from the tempting dividend yield to consider these two red flags and Merck's stock starts to look like a poor choice for serious income investors.