The Dow Jones Industrial Average (INDEX: ^DJI) has climbed another 0.66% late in trading on widespread gains. Jobless claims fell 21,000 last week to 323,000 -- not the lowest we've seen since the recession began, but it's close. The Senate banking committee also approved Fed chair nominee Janet Yellen 14-8, which will not bring her nomination to the Senate floor.

The biggest mover on the Dow today is Intel (INTC +0.05%), which is up 2.6% after the company's executives laid out a long-term strategy. It's well known that Intel intends to get into mobile devices, but outside of the win for the Samsung Galaxy Tab 3, there hasn't been a lot for investors to cheer about.

Intel has been in almost lock step with the Dow over the past five years but if it can get the latest strategy right the stock could be a top performer next year.

Changing the chip strategy

Intel is trying to change it position as a mobile industry laggard and next year plans to quadruple chip volumes. A number of new Atom chips are being rolled out this year, targeting both the tablet and smartphone markets.

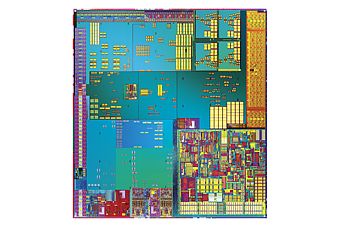

Intel System on a Chip die photo. Image courtesy of Intel.

Intel has lowered power consumption on new chips and is now building chips that can be used by multiple operating systems. Intel used to work hand in hand with Microsoft, but with the growth of Google Android-powered devices it's clear that Intel needed to branch out. With a more flexible chip, Intel hopes to gain traction in non-Windows PCs as well as tablets and smartphones.

Opening up production

The more shocking news of the day is that Intel plans to open up its production facilities to third parties. Intel has long shut off outsiders from using its facilities, but CEO Brian Krzanich sees it as an opportunity to increase revenue and learn something in the process.

Intel has been so in tune to what it's doing that it has lost touch with the outside world -- something it may be able to learn from by being a contract manufacturer.

This is a risky move by Intel, but with the PC slowly dying, it may not have a choice.

Intel is a top Dow stock

Intel is playing from behind in mobile and taking risks by opening up manufacturing, but I think that provides investors with upside potential. Shares trade at just 13.6 times trailing earnings, and a 3.7% dividend yield is one of the top in the Dow Jones Industrial Average. If the company can gain share in mobile and achieve more production capacity, the stock could jump in 2014.