Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Manitowoc (MTW 2.46%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Manitowoc's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Manitowoc's key statistics:

MTW Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

37% |

Pass |

|

Improving profit margin |

465.4% |

Pass |

|

Free cash flow growth > Net income growth |

3.2% vs. 600% |

Fail |

|

Improving EPS |

382.3% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

61.2% vs. 382.3% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

MTW Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

551.4% |

Pass |

|

Declining debt to equity |

(35.6%) |

Pass |

|

Dividend growth > 25% |

0% |

Fail |

|

Free cash flow payout ratio < 50% |

12.4% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Manitowoc comes through with flying colors in its second assessment, but it's merely kept pace with the strong performance of the previous year by racking up the same seven out of nine possible passing grades it earned in 2012. The company's annual dividend payment has already been declared, but won't be paid out for another three weeks, and since it won't be increasing over last year's $0.08-per-share payout, we're keeping dividend growth flat and awarding the company a failing grade for that metric. However, in many other ways, Manitowoc appears to be making the right moves for investors, and it could conceivably earn a perfect score next year. Will it? Let's dig a little deeper to find out.

Food-service companies are increasingly investing in research and development to develop innovative products, which could help restaurant operators to cut down on labor and energy costs. Fool contributor Mark Lin notes that Manitowoc, which makes 38% of its revenues from the food service segment, continues to push forward in food-prep products with the Merrychef e4 oven, which can cook food up to 15 times faster than conventional ovens.

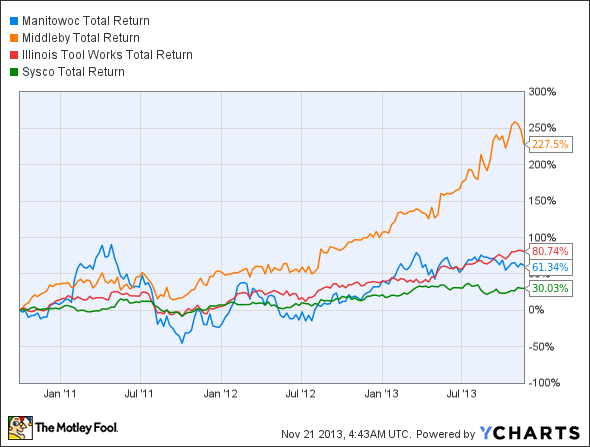

However, food-service competitor Middleby (MIDD +0.42%) has introduced nearly 30 innovative products over the past two years, which has included things like waterless steamers to electric pizza ovens, and Illinois Tool Works (ITW 0.09%) -- which generates roughly a tenth of its earnings from food service -- filed more than 1,200 patent applications in 2012 alone. However, Middleby's strong pricing power and proven track record of innovation have put it well in the lead of both Manitowoc and Illinois Tool Works, as well as food-service products giant Sysco, over out three-year tracking period:

MTW Total Return Price data by YCharts

Turning to Manitowoc's other key segment, Fool contributor Neha Chamaria notes that the company has been able to outperform industry bellwether Caterpillar (CAT 0.74%) for the second straight quarter in the construction equipment segment, thanks to its greater domestic exposure, which has experienced a stronger uptrend in construction because of rebounding housing markets. Manitowoc's crane sales improved 10% during the third quarter, while both Caterpillar and Terex, which generate much their revenues outside the U.S., reported weaker results because of a continuing slowdown in overseas markets, especially in the Asia-Pacific and the Latin American regions.

According to a report by Research and Markets projects, the global crane market is expected to grow at a 7.2% per year through 2016, a lucrative opportunity for crane specialist Manitowoc. However, the company has seen crane backlog and new orders fell by 22% and 23%, respectively, which indicates some looming threats to its construction equipment business. Weak macroeconomic conditions and unpleasant investment policies in China have also forced Chinese construction firm Shantui to end its joint venture with Manitowoc. This isn't quite as bad as Caterpillar's woes -- the equipment giant suffered half a billion dollars in losses because of accounting misconducts at ERA Mining Machinery. However, Caterpillar's order backlog, worth $20.4 billion, puts it in a better position than its industry peers.

Going forward, Manitowoc is poised to rebound with a long-anticipated boom in non-residential construction. The diffusion index of U.S. architecture firms, the ABI, recently jumped to a score of 53.8 in August, signaling a non-residential construction boom over the next few quarters. Fool contributor Mark Holder notes that construction companies have encountered difficulties in obtaining project financing, or are otherwise saddled by a lack of confidence in the U.S. government, which has crimped construction growth.

Putting the pieces together

Today, Manitowoc has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.