Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does 3D Systems (DDD +2.15%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell 3D Systems' story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at 3D Systems' key statistics:

DDD Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

218% |

Pass |

|

Improving profit margin |

0.6% |

Pass |

|

Free cash flow growth > Net income growth |

100.6% vs. 220% |

Fail |

|

Improving EPS |

253.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

1,280% vs. 253.5% |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

DDD Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(44.9%) |

Fail |

|

Declining debt to equity |

(97.6%) |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

We looked at 3D Systems last year, and it has lost one more passing grade in its second assessment, securing only four out of seven possible passing grades for 2013. The company's stock growth has far surpassed any gains in its fundamentals, despite the fact that the fundamentals themselves have grown at a rapid rate. This has been one of the biggest knocks against 3D Systems for some time, but investors haven't cared, as this stock has become one of the market's best performers over the past three years. But can 3D Systems maintain its market-thrashing ways without securing bottom-line gains in line with its share price growth -- or, put another way, can 3D Systems' fundamentals ever catch up to its hype? Let's dig a little deeper to find out.

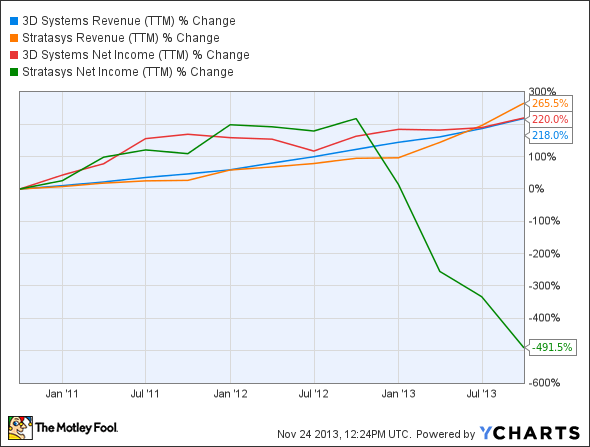

Over the past few years, 3-D printing has emerged out as one of the most-watched technologies in the world, enjoying a level of interest comparable to that given to Internet companies in the late 90s. Part of that is the result of a surge in interest among businesses and consumers: Fool contributor Brian Stoffel points out that the two largest independent 3-D printing companies, 3D Systems and Stratasys (SSYS +0.67%), have both witnessed their soaring revenues at an annualized rate of 47% and 54% respectively. 3D Systems' Cube line, which now accounts for more than 10% of its total revenue, has exploded from sales of only $3.3 million in 2012 to $13.2 million today. But Stratasys' acquisition of MakerBot earlier this year put the two companies neck and neck in the low-end consumer space, as Makerbot now comprises about 9% of Stratasys' total sales. 3D Systems remains far in the lead for three-year gains, however, as its bottom line has grown at a steadier rate:

DDD Revenue (TTM) data by YCharts

Fool analyst Blake Bos notes that the global 3-D printing industry is expected to undergo major consolidation -- moreso than has already occurred -- in the next few years. Serial acquirer 3D Systems recently bought an 81% stake in French-based direct metal 3-D printing specialist, Phenix Systems for $15.1 million in cash, which gives it another foothold in the finished-products segment. Stratasys has also been exploring new acquisition targets in the metal printing business, including ReaLizer, Layerwise, SLM Solutions and Concept Laser. 3D Systems and Stratasys have both been working on developing metal 3-D printing technologies for industrial use, and acquisitions have historically been a way for both companies to gain footholds in new technologies and at new price points.

Brian Stoffel also notes that Hewlett-Packard (HPQ 4.17%) recently announced its intentions to enter into 3-D printing industry. Or, rather, HP wants to reenter the industry, as it earlier paired with Stratasys to market an HP-branded Stratasys-built machine in Europe that was priced too high for consumers but lacked the size and versatility of most professional systems. A proper consumer-focused HP 3-D printer could push 3D Systems and Stratasys into a price war for the home market. 3D Systems has already lowered its earnings guidance for 2013 as it focuses more on increasing its market share, which could point toward reduced profitability as the industry attracts larger players. Patent expirations also loom large for next year, as some of 3D Systems' earliest patents will no longer be defensible in 2014.

Putting the pieces together

Today, 3D Systems has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.