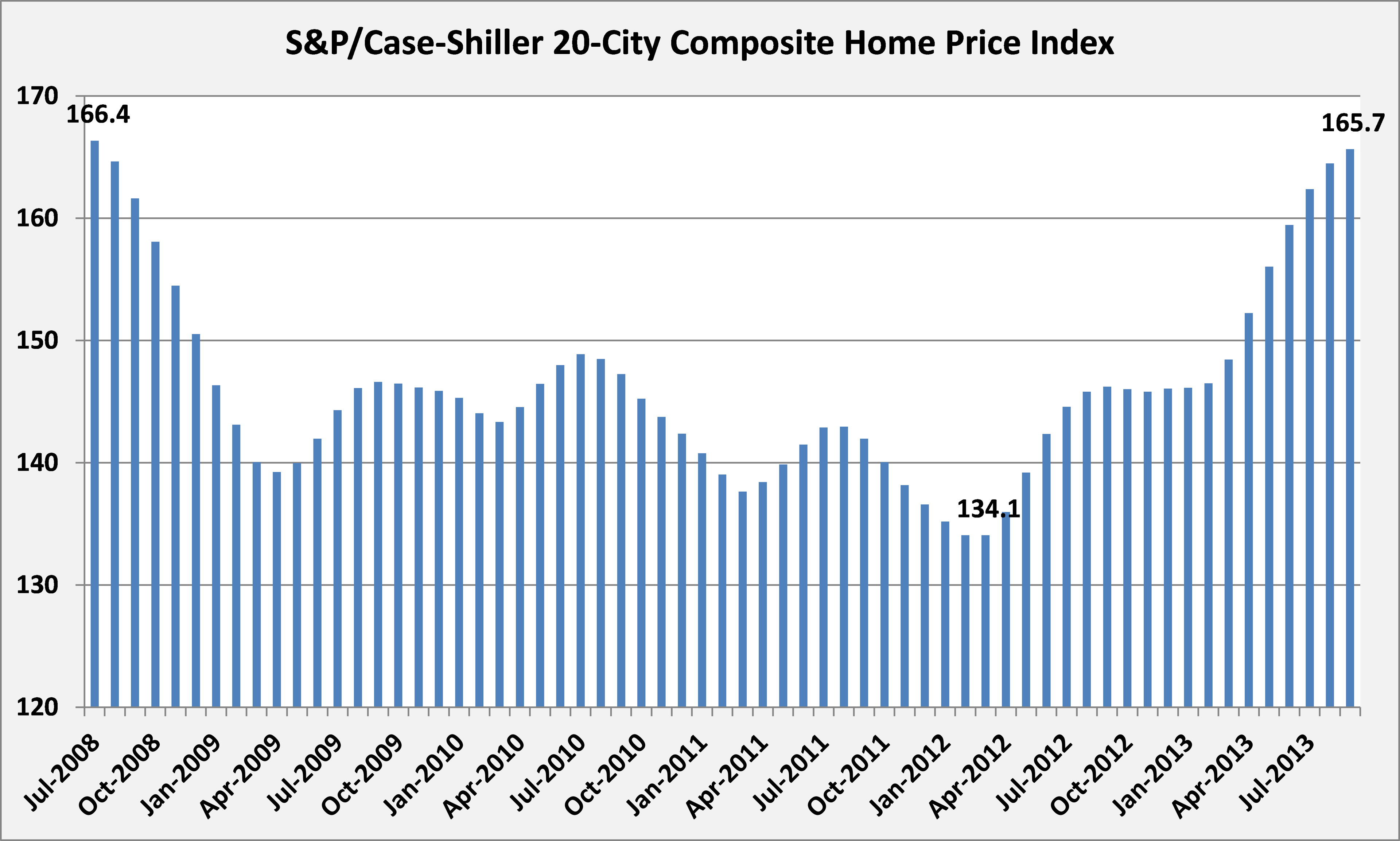

The S&P/Case-Shiller Home Price Index was announced today, and the 20 cities measured in the index saw prices rise by 0.7% from August to September, and 13.3% year over year. On a national level, when housing prices are announced quarterly, home prices were up 3.2% in the third quarter, and up 11.2% year over year.

The 0.7% growth in the 20-city index was the lowest monthly growth rate since the 0.25% growth in housing prices seen from January to February of this year. On average, from February to August, housing prices in the Case-Shiller index grew by 1.95% month over month. However the index continued to climb, and the reading of 165.7 was the highest level since July 2008.

Source: S&P Dow Jones Indices.

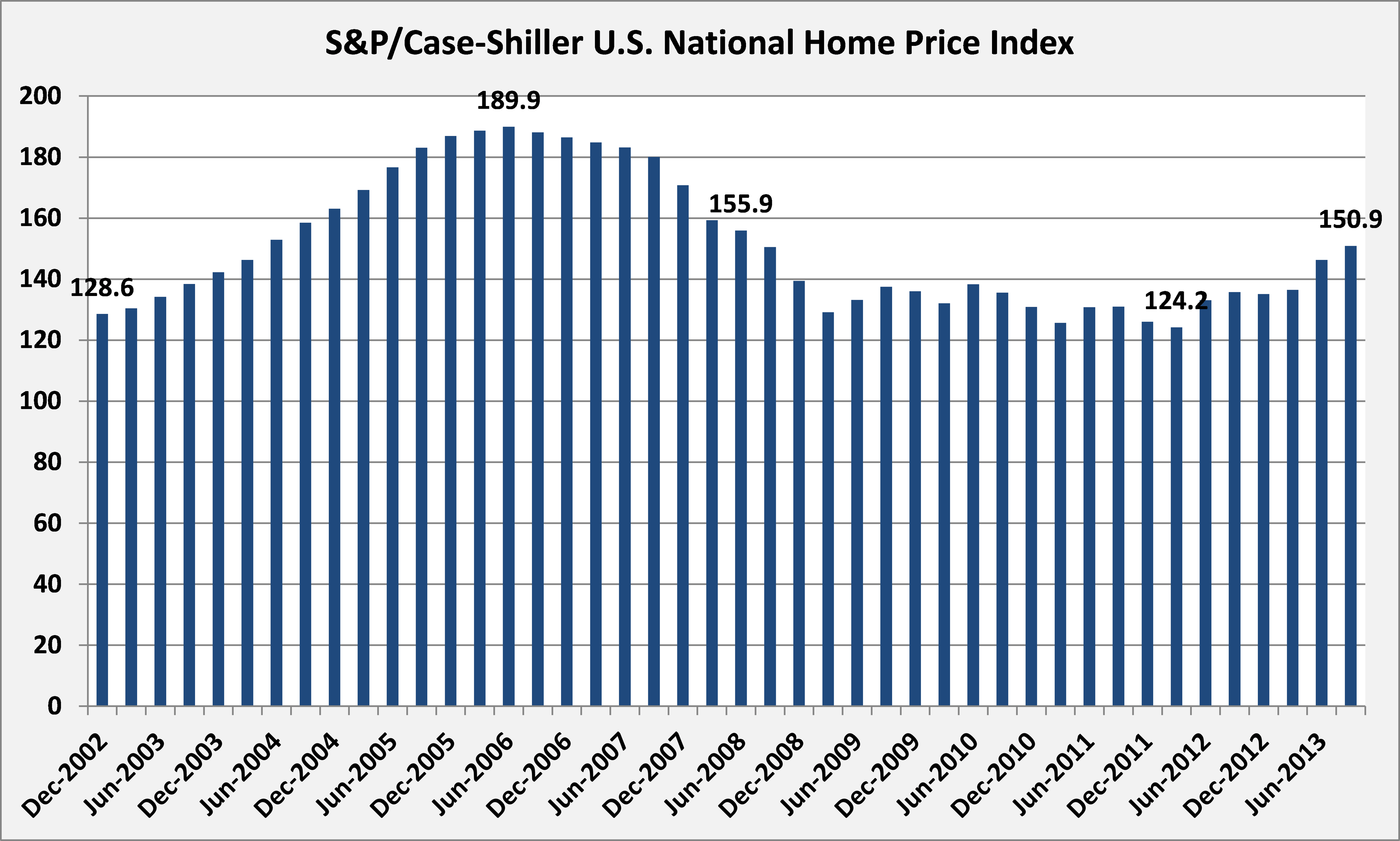

On a national level, the index reading of 150.9 was the highest level since the reading of 155.9 seen in the second quarter of 2008. While prices were up, the growth of 3.2% seen in the second quarter was well below the 7.2% seen from the first quarter to the second. However 3.2% growth is still well above the 0.9% quarterly growth average since national prices were first tracked in 1987. The index from 2002 until the third quarter is available below:

Source: S&P Dow Jones Indices.

The three individual cities that saw the highest growth from August to September were Detroit (1.5%), Las Vegas (1.3%), and Phoenix (1.2%). Charlotte actually saw its home prices fall by 0.2%, and Tampa, Denver, and Dallas all watched their home prices only grow by 0.2%. On an annual basis, Las Vegas, San Francisco, and Los Angeles had the highest home price appreciation, growing at 29.1%, 25.7%, and 21.8%, respectively. Washington, Cleveland, and New York all had the slowest annual growth rates, at 7%, 5%, and 4.3%, respectively.

"Housing continues to emerge from the financial crisis: the proportion of homes in foreclosure is declining and consumers' balance sheets are strengthening," said the chairman of the Index Committee at S&P Dow Jones Indices, David Blitzer. "The longer run question is whether household formation continues to recover and if home ownership will return to the peak levels seen in 2004."