At one time, people wouldn't hesitate to go to Applebee's after work. It was a great place to enjoy a burger and a beer with some friends. What made Applebee's unique was that its bar was well-separated from its dining area, so families did not hesitate to visit, either. Therefore, Applebee's attracted two different types of customers simultaneously. This approach benefited DineEquity (NYSE: DIN), allowing the company to outperform peers, Brinker International (NYSE: EAT), and Denny's (NASDAQ: DENN).

Today, consumers are constantly looking for bargains. While Applebee's "2 for $20" offer entices many diners, they know they can still do better elsewhere. Due to a lack of wage growth, increased taxes, and other economic challenges, many people choose not to go out at all. Many consumers are now following the Benjamin Franklin approach, with frugality being the best path to wealth.

The declining demand for Applebee's hasn't helped in the real world. The good news for investors is that the stock has still managed to appreciate 59.42% over the past three years. This has a lot to do with the broader market's ascent, which tends to bring almost everything along with it for the ride. To a lesser extent, investors see strong potential for DineEquity's other brand, IHOP.

Comps performance

Over the past nine months, Applebee's saw comps slip 0.1% year-over-year. During the same time frame, comps for IHOP improved 1.7%. For fiscal year 2013, DineEquity now expects 25-30 new franchised Applebee's restaurants to open versus an earlier expectation of 40-50.

DineEquity feels as though continuous menu innovations can help increase sales at Applebee's. However, the comps decline mentioned above is due to softened traffic, and softened traffic indicates reduced demand. Applebee's managed to partially offset the poor comps performance with an increased average check.

IHOP also saw reduced traffic over the first nine months of the year. However, in this case, increased average check greatly offset the reduction in traffic. The increased average check at IHOP had a lot to do with a new menu that was introduced early this past summer. The new menu features a simplified layout and fewer menu items, while still offering new categories and items.

Overall, DineEquity wants to differentiate itself via menu innovation, operational excellence, marketing, and value propositions. That sounds good, but there are a few problems.

A few problems

In April of this year, a franchisee of 33 Applebee's restaurants located in Illinois filed for bankruptcy protection. This could have been due to a lack of demand. If so, it's a negative. If that wasn't the case and the franchisee was incompetent, then it indicates that DineEquity made a mistake in selection. This is also a negative. You might say that this was just one incident and that DineEquity should receive a pass, but earlier this year a franchisee of 19 IHOP locations throughout Illinois, Wisconsin, and Missouri also filed for bankruptcy protection.

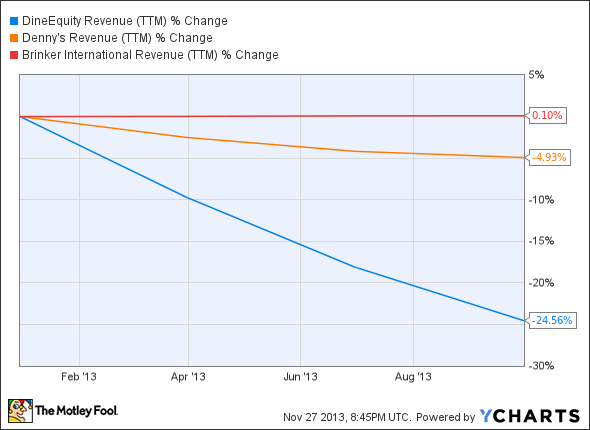

While I don't know the primary reasons for the failures of these franchisees, I do know that demand for DineEquity brands overall has been declining. First consider top-line performance comparisons for DineEquity, Brinker International and Denny's over the past year:

DIN Revenue (TTM) data by YCharts

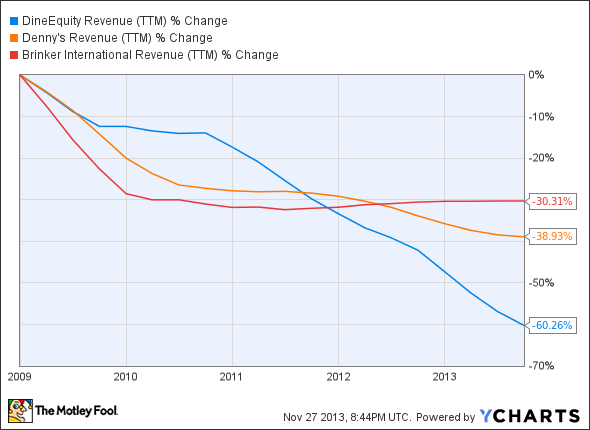

While none of these companies have been impressive on the top line, DineEquity has lagged its peers by a wide margin. If you want to take a look at the bigger picture, consider the hit casual dining has taken over the past five years:

DIN Revenue (TTM) data by YCharts

DineEquity's IHOP brand is more of a family dining establishment, and it's more unique than Applebee's, which gives it more future potential.

Brinker International is relying on new kitchen equipment (faster cooking speeds, higher-quality food, new menu innovations), remodeling most of its Chili's restaurants, opening new Chili's locations in high-potential areas, and acquisitions and mergers for growth. This strategy has potential, but it's going to be very challenging given current consumer trends.

Denny's has seen comps improvements in nine out of its last 10 quarters. The company attributes its recent success (relatively speaking) to new product offerings and everyday value. Nothing unique there, but Denny's is likely to have more potential than DineEquity and Brinker International thanks to its global expansion. Denny's now has 100 international locations, and it recently entered Chile and El Salvador, marketing its "America's Diner" brand. This is likely to be a successful approach since American restaurant brands are seeing high demand in Latin America.

Getting back to DineEquity, one more problem exists. The company has $95.54 million in cash versus $1.39 billion in long-term debt, and it only generated $87.63 million in operating cash flow over the past year. It's going to be difficult for DineEquity to pay off its debt without this effecting top-line growth potential. Currently, DineEquity yields 3.60%. It will be interesting to see if this yield stays intact over the long haul. Everything is rosy right now due to low interest rates, but the long haul might be a different story.

The bottom line

DineEquity should have more potential with IHOP than Applebee's in the current economic environment, but both brands are seeing declining traffic. Raising prices can only work for so long. Top-line performance has been weak, and debt will eventually be a concern. Personally, I hope DineEquity figures out a way to offset current and potential headwinds. I'm a fan of IHOP. Who isn't?

Brinker International is dealing with a similar demand problem with Chili's. Denny's should offer the most top-line potential in the near future thanks to its international expansion into high-demand areas. That said, I wouldn't feel overly confident investing in any of these companies right now.