A traditional master limited partnership has a boss -- and it's not you. MLP investors can be second-class citizens when it comes to distributions, because the partnership must also shell out cash to its general partner in the form of incentive distribution rights. Today, we're going to look at how distributions get doled out at Kinder Morgan Energy Partners (NYSE: KMP), NuStar Energy (NS +0.00%), and Enterprise Products Partners (EPD 1.10%).

IDRs

Before we get into the specific breakdown at these MLPs, let's look at incentive distribution rights, or IDRs. In theory, a general partner will drive growth at an MLP by dropping down assets, issuing debt, or otherwise spurring action in return for an ever-increasing slice of incremental cash flow.

When an MLP is just starting out, the incentive distributions are minimal, but as the fledgling partnership grows, its distribution the percentage of cash headed to the GP jumps. The split between cash owed to the limited partners and cash owed to the general partner typically falls within three or four tiers. Below you'll find a common breakdown:

|

Tier |

LP |

GP |

|---|---|---|

|

1 |

98% |

2% |

|

2 |

85% |

15% |

|

3 |

75% |

25% |

|

4 |

50% |

50% |

In some cases, Tier 2 is omitted. Tier 4 is what's referred to as the "high splits," indicating that the MLPs distributions have reached a previously agreed-upon amount and the general partner is due 50% of incremental cash flow going forward. If you want to quickly check the IDR splits on any MLP, I highly recommend using the DCF Financials research tool at MLPdata.com. You'll want to double-check the site's numbers against an SEC filing before making an investment decision, but it's a handy tool for first looks.

Actual examples

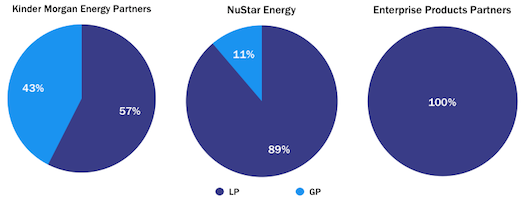

Let's take a look at IDRs using some actual data. Taking data from the third quarter's 10-Q filings, here's how distributions break down at our three MLPs:

Source: Company SEC filings.

Kinder Morgan is clearly in the high splits, handing plenty of cash over to its general partner via IDRs. KMP declared $434 million for Kinder Morgan, Inc (KMI +0.83%) in the third quarter, while paying its limited partners $587 million. As the charts show, that was not the case at NuStar, and certainly not the case at Enterprise Products Partners, which bought out the economic interest of its general partner in 2010 and does not pay incentive distribution rights at all.

So what?

MLPs are complex beasts, and IDRs are not the only factor investors need to consider before buying, but they do matter. IDRs increase an MLPs cost of capital, which can have a big impact on growth, which can ultimately affect distribution growth down the road. Cost of capital can also affect the competitiveness of an MLP, something that will become even more important as the space contracts through mergers and acquisitions in the future.