Krispy Kreme Doughnuts (KKD +0.00%) recently reported third-quarter revenue growth that was positive but still fell short of analyst estimates. In response, the stock dropped over $4.50, or roughly 18.50%. Is the doughnut company doing as poorly as its share drop suggests, or did the market overreact to Krispy Kreme's most recent earnings report?

The report

The company's most recent quarter saw operating income rise 27% to $11.7 million and earnings per share increase 33% year-over-year to $0.16. Despite these positive numbers, revenue increased 6.7% to $114.2 million, which missed analyst estimates for $115 million.

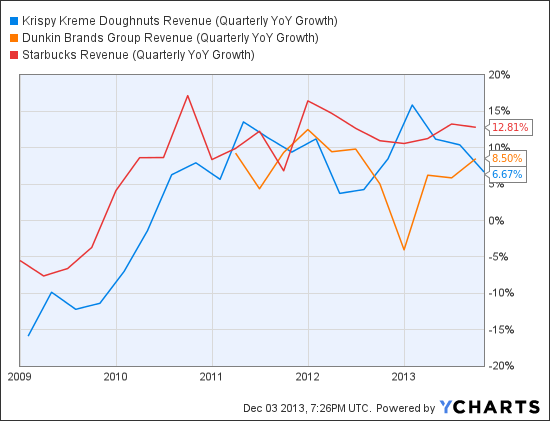

KKD Revenue (Quarterly YoY Growth) data by YCharts

The chart above shows that Krispy Kreme's revenue growth rate has been steadily declining during 2013, and it is now lower than the figures for Dunkin' Donuts (DNKN +0.00%) and Starbucks (SBUX 0.38%). Dunkin' is coming off of negative revenue growth from the beginning of 2013, while Starbucks has been the most consistent of the three.

In addition to revenue, there was some warning with same-store sales. Krispy Kreme's same-store sales growth was 3.7%, which marked the 20th straight quarter of growth in this area. This is a year longer than Dunkin's 16-quarter positive streak. However, Krispy Kreme's same-store sales growth came in slightly lower than Dunkin's 4.2% same-store sales growth and much lower than the 10% same-store growth Krispy Kreme had in its second quarter.

This same-store sales drop can be partially attributed to international franchise shops that reported a 3.1% decline in same-store sales. According to Krispy Kreme, this comes from stores outgrowing the initial opening excitement as well as cannibalization from market development. Because a large portion of the company's growth comes from international expansion, news of cannibalization abroad understandably scared investors.

Moving forward

Despite the revenue miss and international troubles, Krispy Kreme has solid plans for continued expansion.

The company has opened seven "small freestanding shops" that produce doughnuts to sell only to consumers instead of grocery stores or other wholesale chains. These small shops have been opened in South Carolina, Tennessee, Florida, North Carolina, and most recently in Georgia. The oldest shop in South Carolina has had average weekly sales of $31,000 for the past two quarters while the other shops have shown inflated sales of up to $59,000 per week due to initial excitement around their opening. Capital expenditure for a small shop is roughly $3,400 a week and the company has had a 28% cash-on-cash return on investment from its initial shops. These smaller shops show promise for the company's future.

The company continues to expand franchised and company-owned normal, domestic shops. These shops experienced same-store sales growth of 10.7% during Krispy Kreme's most recent quarter. The company has a stretch goal of 400 domestic shops by 2017 which shows its small size compared to Dunkin' and Starbucks who have around 7,015 and 10,924 domestic stores, respectively. Internationally, Krispy Kreme has roughly 350 shops open and it is still on track to achieve its goal of 700 shops by 2017. In fiscal 2015, the company expects to open 10 to 15 company stores, 20 to 25 franchise stores, and 85 international stores.

Final Foolish thoughts

While missing analyst estimates is never good, I think the market's initial reaction to Krispy Kreme's earnings report was extreme. It has a PEG of 1.56, which is comparable to competitors Dunkin' and Starbucks, who have PEG ratios of 2.02 and 1.57, respectively. This metric shows that Krispy Kreme's current price is reasonable for its earnings growth.

Krispy Kreme's guidance predicts earnings per share to be somewhere between $0.60 and $0.63 for 2014, representing 28%-34% growth. The company is making headway in its expansion plans and it has shown positive same-store growth for the past 20 quarters. The stock has been up 150% this year, so any signs of weakness might encourage investors to take their profits. Overall, I think Krispy Kreme will bounce back from this price drop.