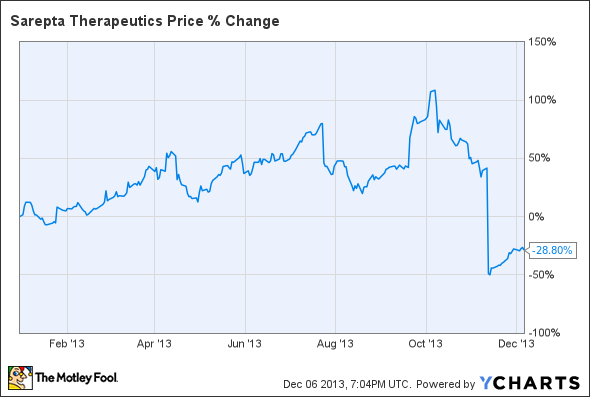

This year was a clash of positive clinical data and regulatory uncertainty for Sarepta Therapeutics (SRPT +1.59%).

Regulatory uncertainty won -- or, rather, became certain in a negative way.

On the plus side

There's little doubt that Duchenne muscular dystrophy drug eteplirsen is working on the patients in the phase 2 trial.

If you weren't convinced in April, when the 74-week data was presented, or in June, when the 84-week data was revealed, the 96-week data in September should certainly be enough to convince you that the lack of a decline in distance patients can walk is real. That's nearly two years without a decline of less than 5% from baseline for those who were able to take the test; it's hard to argue that's a fluke.

Yet ...

Investors couldn't shake the idea that the data wouldn't be enough to persuade the Food and Drug Administration to issue an accelerated approval. The data from the phase 2 trial comes from just 10 patients, after all.

In April, the FDA said it wanted to see the data before advising the company on whether it should apply for accelerated approval. The rather unheard-of move seemed like a good sign; a green light to apply meant the FDA would probably approve the drug.

But the FDA backtracked a little in July, telling Sarepta that it should just apply and the agency would make a decision once it had the full data package. A pre-approval was off the table, but at least there was still the possibility of an accelerated approval.

Without much to go on and a final FDA decision about a year away, Sarepta's valuation was all over the place.

A November to remember

And then the FDA did a 180, telling Sarepta that an accelerated approval was off the table and the biotech needed to run a placebo-controlled phase 3 trial to get the drug approved. The stock dropped substantially as short-term investors jumped ship. A potential approval is now more than two years away, considering the time it'll take to agree with the FDA on a trial design, enrolling and running the trial, crunching the numbers, and for the FDA to review the application.

The agency seems to be spooked by the phase 3 failure of Prosensa (NASDAQ: RNA) and GlaxoSmithKline (GSK +1.03%) Duchenne muscular dystrophy drug drisapersen. It looks bad for the FDA to issue an accelerated approval and then have to pull the drug off the market because the drug doesn't work in a larger population or a side effect is discovered after it's used on more patients.

Of course, it'll look bad if the agency delayed an approval for nothing, denying patients the drug for years, but no one will lose a job over it. It's a culture that keeps the agency conservative.

Biotech investors would be wise to keep that in mind the next time there's regulatory uncertainty with a drug.