A lot of investors may be scared of investing in insurance giant AIG (AIG 0.72%) but a number of data points suggest some of their fears should be lessened.

AIG is almost a year removed from when the U.S. government sold its last remaining stake in the insurer. While "bailout" is a word often used to describe what happened to AIG, the reality remains that the government netted a nearly $23 billion gain on the $182 billion it committed to the company, so it's not as though taxpayer dollars were lost on the company.

AIG has emerged from the financial crisis as a leaner operation with less risk, but one of the most compelling things about it is the diversity of its income streams as a corporation though its two major business lines, its Property Casualty and Life and Retirement insurance operations.

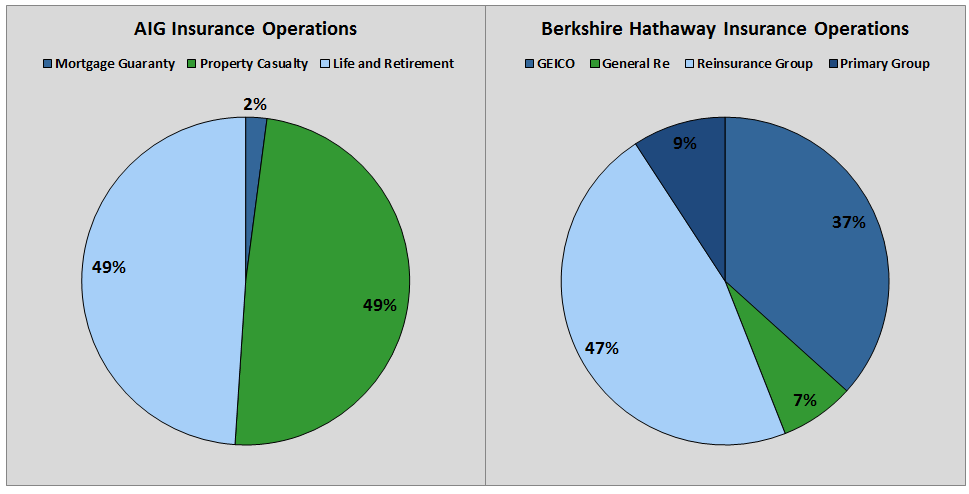

Consider that when you compare AIG to industry stalwart Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B), looking only at the income of insurance operations through the first nine months of 2013, each are extremely well balanced when it comes to their respective segments:

Source: Company Investor Relations.

While Berkshire Hathaway has the more distinct reinsurance operations -- which is essentially insuring insurers -- it has a nice balance between corporate and consumer policies, just like AIG does. And while it's not a direct comparison, a diverse set of insurance functions is essential for success. But it isn't just that the business lines are diverse, but they also have an immense amount of variety when you drill down further.

The beauty of diversity

In 2012, AIG had over $34 billion in net premiums written in its Property Casualty business worldwide. The key there is "world," as AIG truly does have a uniquely global presence. Consider that 51% of its policies were written in the Americas, 30% in the Asia Pacific region, and 19% in were in Europe.

In fact, it not only is diverse, but it is dominant. It was the largest commercial insurance organization in the U.S. and Canada, the largest U.S.-based property casualty insurer in Europe, and the largest foreign property casualty underwriter in both Japan and China.

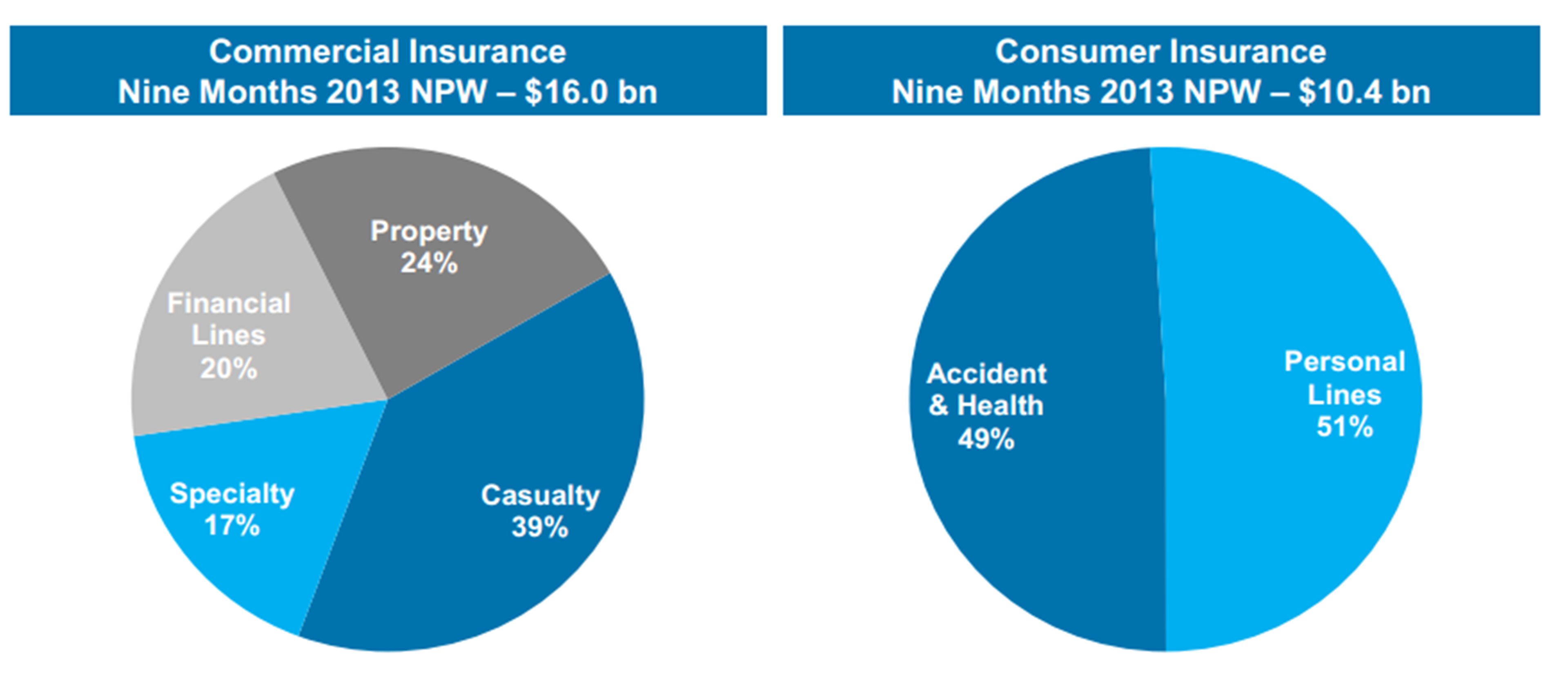

As you can see in the charts below, it also isn't simply underwriting a small scale of policies; its Property Casualty operations are diverse not only in their footprint and reach, but also in their makeup:

Source: Company Investor Relations.

This diversity is compelling for a number of reasons. It helps insulate AIG against risk through its wide-ranging operations, but principally, such diversity allows the company to provide a range of services to its clients, including those seeking both commercial or corporate insurance policies, and personal ones as well.

Banks like Bank of America pronounce their desire to be the one bank where customers can go to rely on all their financial services, and the same can be said of AIG and its insurance operations -- it truly is a full-service provider.

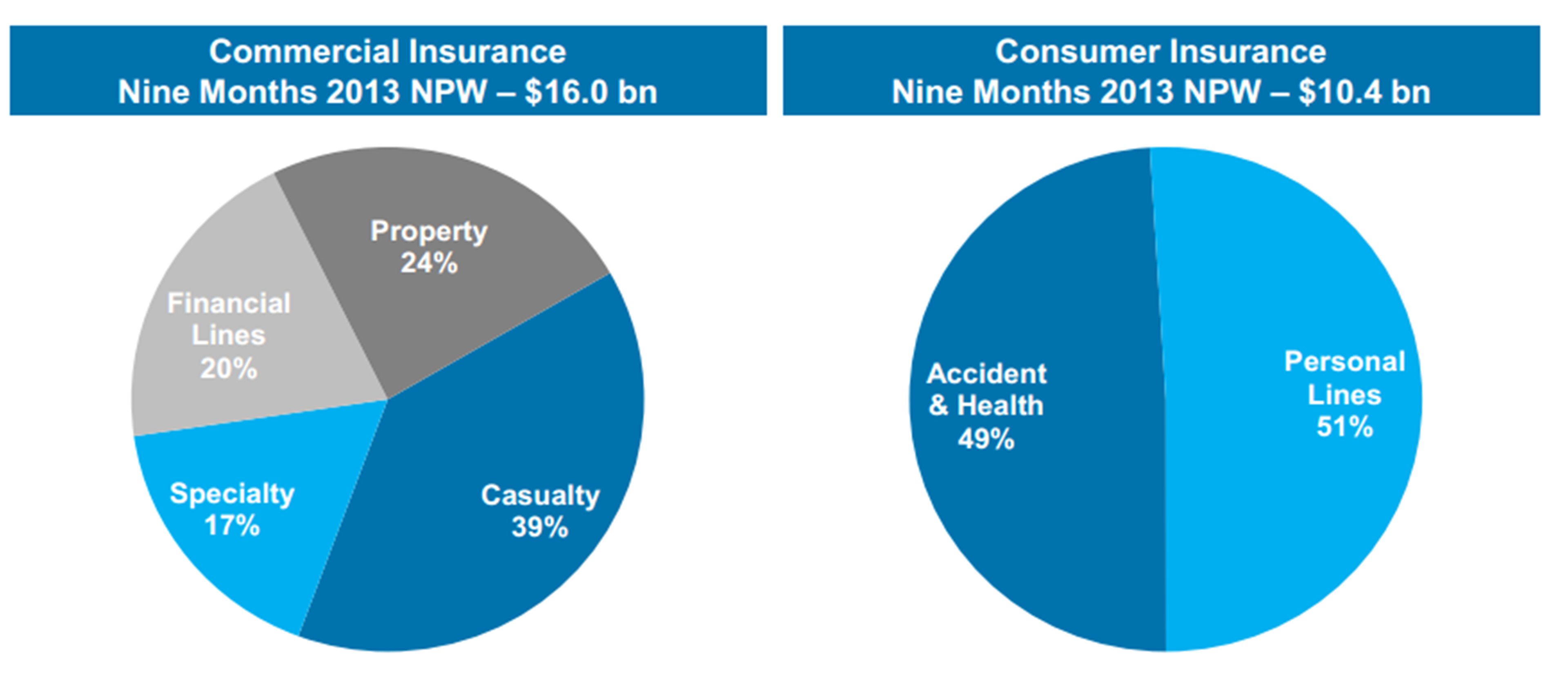

Yet the wide range of income opportunities isn't only available in its Property Casualty operations, but in its seemingly straightforward Life and Retirement business as well:

Source: Company Investor Relations.

As you can see, AIG has done a great job in its second principal operating segment of ensuring that it has a number of different sources of revenue.

The result of the diversity has led to a rather staggering fact that through the first nine months of 2013, its Life and Retirement operations has delivered $3.7 billion in pre-tax income, and its Property Casualty operations has delivered $3.7 billion. Yes, the exact same amount. Its diversity extends beyond the unique products and policies offered by its business lines and into its core makeup.

The bottom line

Insurance can be a wildly profitable business, but being too focused in one particular area can leave both an investor and a company in trouble. A company's diversity isn't the only reason to consider investing in it, but the reality is, in an industry that can be so prone to catastrophic loss like insurance, diversity is essential, and AIG has structured itself in a way that will benefit itself, its clients, and its shareholders.