Who says companies are hoarding of all their cash? One company just announced it is raising its dividend by 83% in a staggering maneuver to return more money to its shareholders.

MasterCard will soon be giving shareholders more. Source: Flickr/ Håkan Dahlström

In a press release issued on Monday, MasterCard (MA 1.61%) announced a variety of moves that were all being done with the explicit intention to return more money to its shareholders. Those moves included a 10-for-1 stock split, a $3.5 billion share repurchase program, and the raising of the quarterly dividend from $0.60 per share before the split to $1.10, an increase of 83%.

Narrowing the gap

MasterCard had long trailed Visa (V 1.83%) and American Express (AXP 4.26%) when it came to dividend yield, and this announcement will narrow the gap considerably between it and its peers:

|

Company |

Stock Price |

Dividend |

Yield |

|---|---|---|---|

|

MasterCard (before announcement) |

$763.61 |

$0.60 |

0.3% |

|

MasterCard (after announcement) |

$763.61 |

$1.10 |

0.6% |

|

Visa |

$199.43 |

$0.40 |

0.8% |

|

American Express |

$85.29 |

$0.23 |

1.1% |

Source: Yahoo! Finance.

MasterCard had also trailed both Visa and American Express in payout ratio (the amount of its income paid out in the form of dividends), as it most recently stood at 7%, compared to 17% and almost 20%, for Visa and American Express, respectively. While the exact payout ratio is determined based on the quarter in which the dividend would be paid out, if MasterCard paid out its $1.1 dividend last quarter, its payout ratio would stand at roughly 13%.

Dramatic increase in dividends

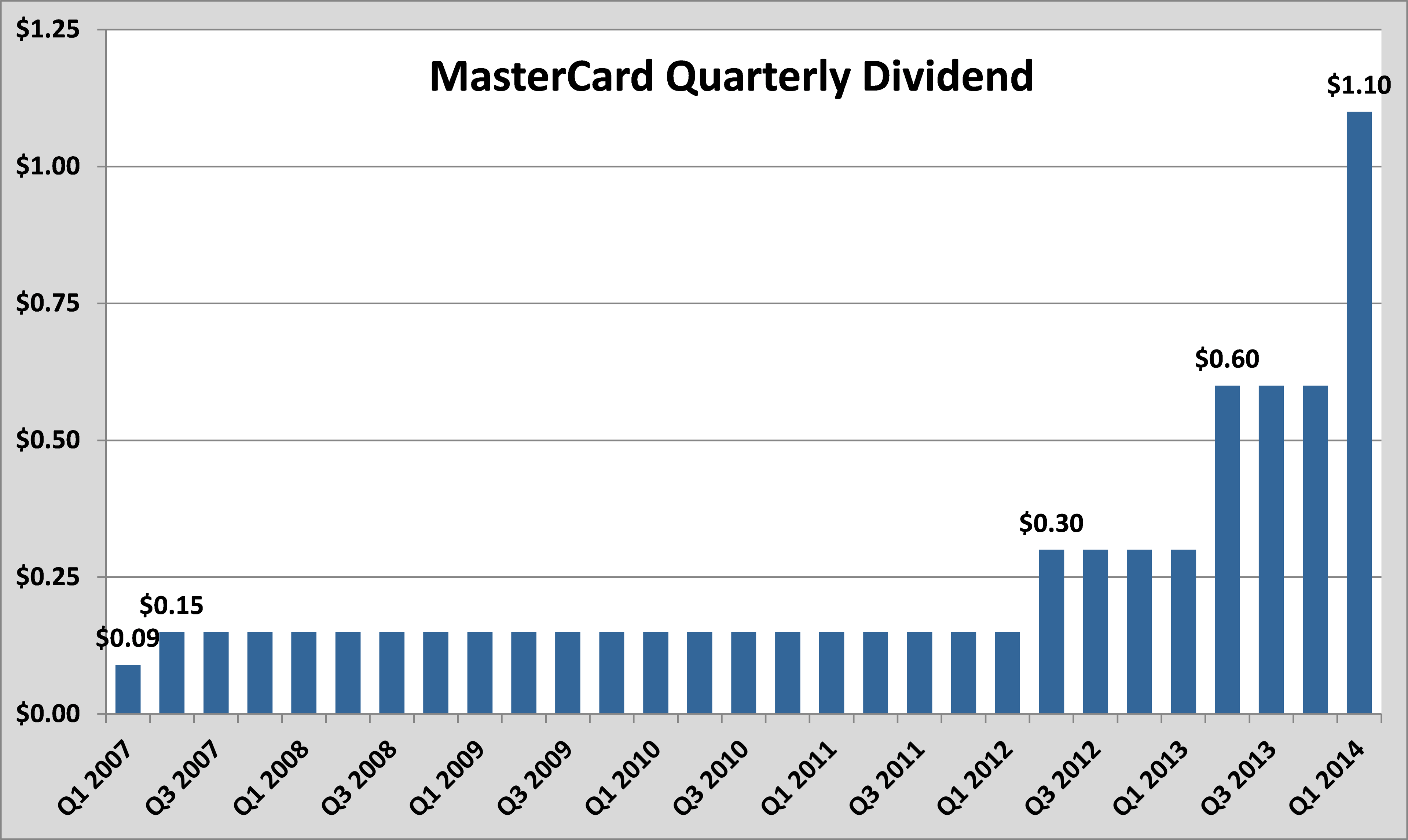

Last year, MasterCard doubled its dividend for the second year in a row, and you can see that after having a steady dividend of just $0.15 per share each quarter, it has dramatically increased its dividend over the course of the last two years. Since February of 2012when the increase from $0.15 per share to $0.30 per share was first announced, MasterCard's dividend has increased by more than 700%.

Source: Yahoo! Finance.

Of the most recent moves CEO Ajay Banga said, "[t]oday's actions reflect our ongoing commitment to deliver shareholder value as well as our confidence in the long-term growth and financial performance of our Company."

Not only divideds

As previously mentioned, in addition to the increased dividend, MasterCard will also be executing a 10-for-1 stock split. The stock split will allow current shareholders to receive nine additional shares for each share that they currently own, and it will effectively reduce the price per share by 90% of its value when shares are distributed on January 21st of next year. In total, current shareholders will have an identical total value of their holdings after the split.

MasterCard will also be repurchasing $3.5 billion in its common stock. The company was previously operating under a $2 billion repurchase plan authorized in Februaryof this year, and had roughly $500 remaining under the previously announced plan.

Through the first nine months of the year MasterCard has watched its earnings per share growby 19% compared to the same period last year. In addition the company's stock is up more than 60% over the past year.

While you should often take the proclamations of CEOs with a grain of salt, it is tough to argue against the both the results and actions of MasterCard, and indeed it has displayed that it is committed to delivering value to shareholders and its supremely capable of delivering outstanding results.